FORMER Media Prima Bhd group managing editor (news and current affairs, television networks) Datuk Seri Mohd Ashraf Abdullah has made a witty suggestion on social media that the implementation of luxury goods tax should start from politicians and senior civil servants.

“If the Government wants to impose luxury tax which may include travel, it should first order ministers, deputy ministers, MPs and civil servants on overseas missions to fly economy (class),” he penned on his Facebook page. “Then Malaysia Airlines can sell first and business class tickets to others for full price.”

A very pertinent question indeed as how the unity government is able to shape up its response to the question will actually determine or offer a hint to the success rate of “the easier said than done” Robin Hood-inspired tax.

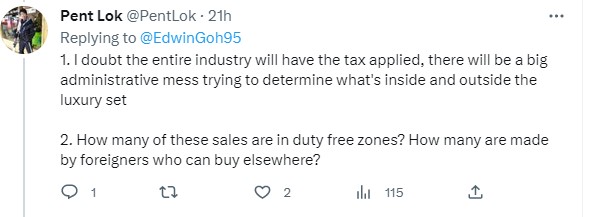

In fact, knowledgeable netizen Pent Lok (@PentLok) doubted that the entire luxury product industry will have the tax applied given “there will be a big administrative mess trying to determine what’s inside and outside the luxury set”.

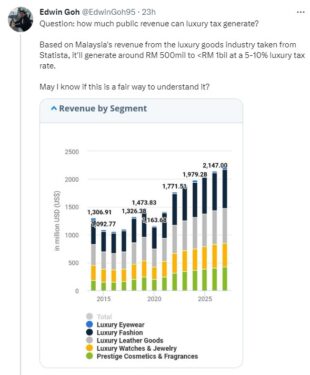

“How many of these sales are in duty free zones? How many are made by foreigners who can buy (from) elsewhere?” he opined in a reply to an original tweet by Edwin Goh (@EdwinGoh95) who wished to know how much public revenue the luxury tax can generate.

Goh has earlier shared that based on Malaysia’s revenue from the luxury goods industry from Statista Market Forecast, the government can expect to generate “around RM500 mil to RM1 bil (per annum) at a 5%-10% luxury tax rate”.

While putting to rest speculation on the implementation of the Goods and Services Tax (GST), Prime Minister-cum-Finance Minister Datuk Seri Anwar Ibrahim had in his re-tabling of Budget 2023 laid down a slew of measures ‘to leech’ higher-income earners by raising the tax rate on the T20 group to the introduction of a luxury goods tax.

Tax experts have deemed the act of taxing luxury goods such as high-end cars, yachts, private aircraft, watches and fashion products as a clear-cut approach to let high net-worth individuals offset the downward income tax adjustment on the working middle class or M40 group.

This practice is in line with other countries with Singapore known to impose such tax on luxury cars while China imposed 60% import tariff on luxury goods.

According to Deloitte Malaysia, measures such as taxing the T20 group, luxury goods tax and the voluntary disclosure programme should boost Malaysia’s tax collection by 4% in 2023 from the prior year.

Currently, tax collection remains the largest contributor to the government’s revenue, representing 74.9% of total revenue or 15.4% of GDP (gross domestic product).

While it remains to be seen how the luxury goods tax will pan out (pending details from the Inland Revenue Board, the Royal Royal Malaysian Customs Department or Finance Ministry), Centre for Market Education (CME) CEO Dr Carmelo Ferlito is aghast that Budget 2023 “shifts the burden of fiscal responsibility on firms and individuals”.

“It seems to us that it (Budget 2023) lacks a comprehensive strategy for a holistic tax reform; it does not introduce any attempt to rationalise government expenditures while the burden of reducing debt is shifted on firms and individuals with new and questionable taxes»,” observed Ferlito.

“Slogans like ‘tax the rich’ or ‘tax luxury goods’ may be good to gain political consensus but are unlikely to produce any real benefit for the country, quite the contrary. The taxing of luxury goods is demagogic and violate the principle of horizontal equity, essential to a truly equitable tax system.” – Feb 26, 2023

Main photo credit: Hollywood Photo Archive