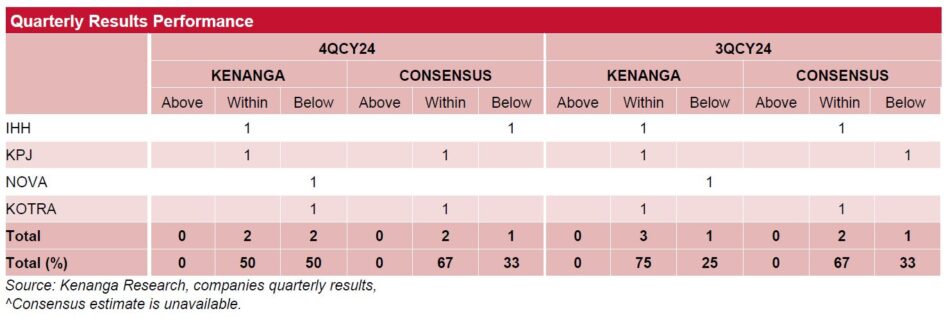

GENERALLY, private healthcare players recorded mixed results in quarter four calendar year 2024 (4QCY24).

“For IHH, due to seasonality in various markets they operate in, 4QCY24 is typically a slow quarter,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

On the other hand, KPJ registered quarter-on-quarter (QoQ) double-digit bottomline growth underpinned by better overhead absorption as well as reduced losses from its new hospitals, despite a seasonally slow quarter.

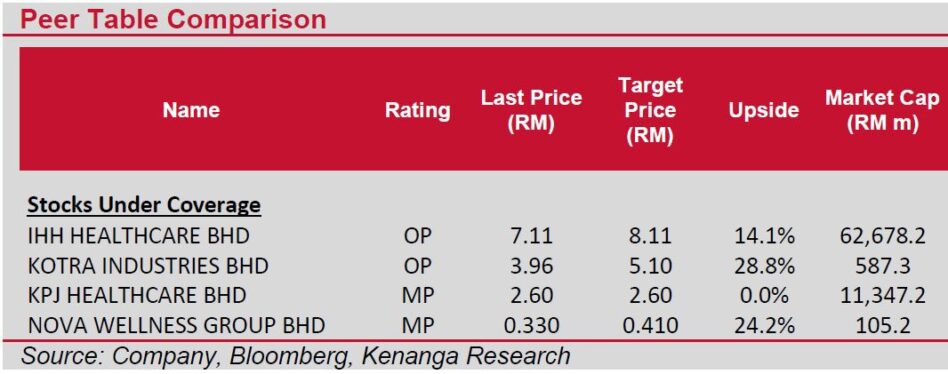

Overall, IHH’s FY24 results met expectations with core net profit rising 35% year-on-year (YoY) driven by revenue intensity, better yields and a lower tax.

IHH expects its earnings momentum to accelerate, underpinned by revenue intensity and rising demand in 4QCY24.

This would be supported by higher yield services both in Singapore, return of medical tourists in Acibadem, and post-election effect in India.

Separately, KPJ’s financial year 2024 (FY24) results met expectations driven by higher inpatient throughput (+7%), outpatient (+2%), bed capacity (+6%), surgeries (+5%) and average revenue per inpatient (+5%) and outpatient (+6%).

Citing incremental revenue from higher patient throughput and improving operational efficiency, KPJ highlighted that FY24 losses at its new hospitals under gestation declined by 30%-35%.

KPJ’s fundamentals have been priced-in after the recent run-up in its share price, as investors gravitate towards secular growth businesses amid a more risk-off environment.

“It is optimistic of a total 4,400 beds by end-CY25. Beyond CY25, it will add 800 beds bringing total beds to 5,200 over the next five years, largely via brownfield expansion which we have already factored into our forecasts,” said Kenanga.

“In terms of bottom-line profitability, we expect earnings to gain momentum moving into FY25 on better operational efficiencies from its cost optimisation effort and overhead absorption rate as a result of a gradual ramp-up in opening new beds,” said Kenanga.

However, the opening of KPJ Kuala Selangor (60-bed) slated to commence operation by mid-April CY25 is expected to incur start-up costs. Typically, new hospitals go through a gestation period of 3-5 years.

With a guided capital expenditure of RM300 mil-RM400 mil in FY25, the group is looking at M&A opportunities for future growth including looking at acquiring yield accretive hospitals or assets which are complementary to its core business for future growth.

Separately, in an effort to differentiate itself from other hospitals, KPJ has identified five areas of sub-specialities establishing them within its existing hospitals, in the discipline of heart and lung, neurology and stroke, oncology, orthopaedics as well as robotics for advanced surgery which is expected to raise revenue intensity due to its acute case of complex cases.

“KOTRA’s first half financial year 2025 (1HFY25) margin shows marked improvement on sales of higher margin products though its earnings missed our expectation,” said Kenanga.

Independent market researcher The Statista Consumer Market Outlook projects the OTC pharmaceuticals market in Malaysia to grow at a compounded annual growth rate of 6% to an estimated USD715 mil by 2027 as consumers take a more proactive stance towards their health and well-being, especially in the aftermath of the Covid-19 pandemic.

The trend augurs well for KOTRA which manufactures and sells OTC supplements and nutritional and pharmaceutical products under key flagship household brands such as Appeton, Axcel and Vaxcel.

Meanwhile, NOVA is ramping up production at its new plant during the year.

There is also earnings impact from the introduction of 15-20 new SKUs in FY23 including skincare products, health supplements, and Activmax and Sustinex range of functional food products such as plant-based protein including specialty Activmax for hospitals. —Mar 14, 2025

Main image: Health Care Today