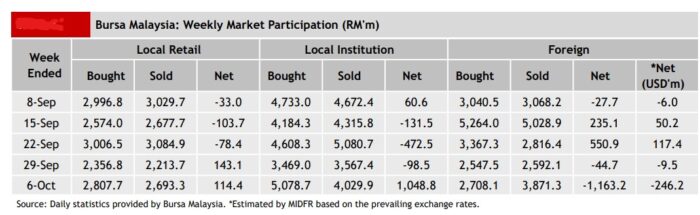

FOREIGN investors continued to net sell again on Bursa Malaysia last week – this time massively with -RM1.16 billion of net outflow which is an amount not seen in the last three years (during the week ended March 20, 2020 when they net sold –US$1.79 bil).

Foreign investors net bought RM20.6 mil on Monday (Oct 2) but net sold for the rest of the week: -RM39.3 mil on Tuesday (Oct 3), -RM397.6 mil on Wednesday (Oct 4), -RM410.6 mil on Thursday (Oct 5) and -RM336.3 mil on Friday (Oct 6).

“The top three sectors that recorded net foreign outflows were financial services (-RM770.3 mil), consumer products & services (-RM246.5 mil) and healthcare (-RM159.8 mil),” MIDF Research pointed out in its weekly fund flow report.

“The top three sectors with net foreign inflows for the week were utilities (RM86.2 mil), construction (RM41.8 mil) and property (RM21.9 mil).”

Year-to-date (YRD), foreign investors have net sold -RM3.13 bil on Bursa Malaysia.

On the contrary, local institutions broke their three-week net selling streak with a heavy net buy of RM1.05 bil, the highest net buying amount seen in three years since the week ended June 5, 2020 when they net bought RM1.18 bil.

YTD, local institutions have net bought RM3.63 bil of equities on Bursa Malaysia. They net bought sectors such as financial services (RM678.5 mil), healthcare (RM138.6 mil) and consumer products & services (RM127.2 mil).

Joining suit were local retailers who continued to net buy domestic equities for the second consecutive week at RM114.4 mil. They net bought every day of the week except Thursday (Oct 5) when they net sold -RM22.6 mil. YTD, retailers have recorded net selling amounting to -RM508.2 mil

In terms of participation, there was an increase in average daily trading volume (ADTV) among foreign investors by +2.4% and local institutions (+3.6%) but local retailers posted a decline of -3.7%.

In comparison with another four Southeast Asian markets tracked by MIDF Research last week, Malaysia posted highest net outflow from foreign funds with -US$246.2 mil followed by Thailand (-US$239.1 mil), the Philippines (-US$45.4 mil), Vietnam (-US$15.9 mil) and Indonesia (-US$600,000).

The top three stocks with the highest net money inflow from foreign investors last week were YTL Corp Bhd (RM66.4 mil), YTL Power International Bhd (RM58.7 mil) and Boustead Plantations Bhd (RM31.6 mil). – Oct 9, 2023