HEINEKEN and Carlsberg’s 9M24 results significantly exceeded our initial forecasts, driven by price hikes implemented in April 2024, which led to margin expansion for the brewers.

Given the historically stronger sales performance in the fourth quarter amid festive season, both companies are on track for a record earnings year in FY24.

However, despite the robust earnings growth trajectory, the share prices of both brewers remain under pressure, with returns (Carlsberg +7.1%; Heineken +0.0%) lagging behind the KLCI (2024: +12.9 %).

A key factor dampening market sentiment is the perception that the earnings growth may be one-off nature rather than stemming from sustainable volume growth.

Carlsberg’s 2Q24 results briefing revealed that it’s sales volume remain below pre-pandemic levels, despite strong tourist arrival numbers and improved labour market in Malaysia.

This lack of a clear, sustainable volume growth outlook has contributed to tepid sentiment towards the sector, further compounded by a general de-rating of the sector, largely driven by concerns over ESG factors.

Despite the sector’s underperformance in 2024, we see several catalysts that could bring the sector back into the limelight in 2025. These include:

We believe the stronger disposable income outlook in 2025 will be a key catalyst driving beer sales growth for brewers.

Beer’s extensive distribution network — from bars to convenience stores — combined with its position as the most affordable alcoholic beverage in the market, positions brewers to benefit from the minimum wage revision from RM1.5k to RM1.7k, effective February 2025.

Additionally, the anticipated steady growth in the labour market, driven by lower unemployment rate and resilient domestic demand, will further boost beer sales.

While domestic factors are expected to drive the majority of this growth, external factors such as tourism could provide additional upside.

To recap, Tourism Malaysia aims for 27.3m tourist arrivals in 2024 (with 75% of the target achieved by 10M24) and has set a target of 31.5m for 2026 under the Visit Malaysia Year campaign.

Linearly extrapolating these figures suggests a target of 31.5m for 2025, which would not only mark a recovery to pre-pandemic levels but also set a new record if achieved, providing an additional boost to beer sales.

Major raw materials, such as aluminium and barley, have corrected from their peaks and are now trading near post-correction lows.

In addition, the anticipated strength of the ringgit in 2025 presents an opportunity for margin expansion for brewers.

Our economics team forecasts the ringgit to appreciate broadly to an average rate of USD-MYR 4.35, with an end-year target of USD-MYR 4.10.

This dynamic is expected to lower raw material costs for brewers, contributing to margin expansion, especially since brewers have already adjusted beer prices in April 2024.

With all considered, the earnings outlook for brewers in 2025 appears promising, supported by more sustainable growth drivers compared to the price hike-driven earnings of 2023-2024.

In addition to the full-year impact of the price increase effective April 2024, brewers’ 2025 earnings growth is expected to be supported by a stronger volume growth (primarily from domestic demand) alongside margin expansion.

These elements represent a more balanced and lasting growth trajectory, which we believe could return the industry to the spotlight after years of neglect by the market.

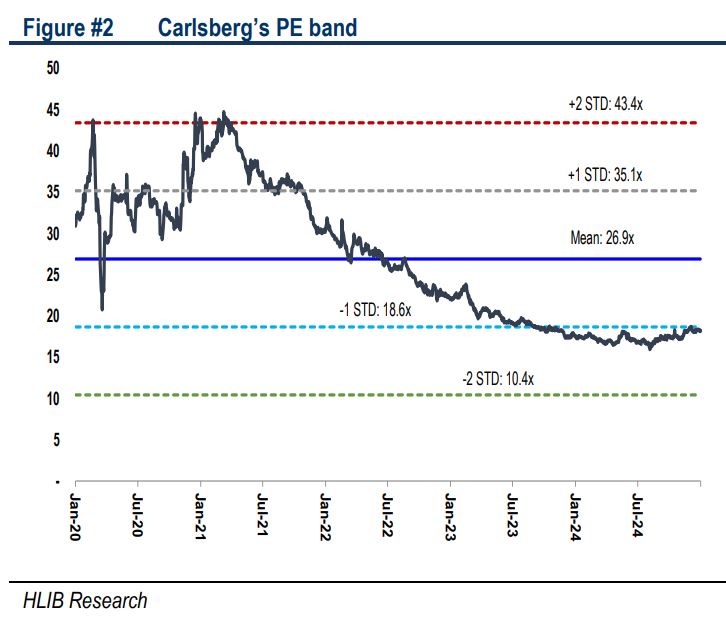

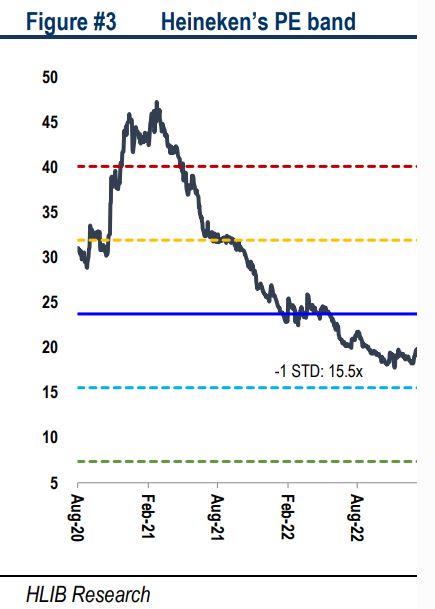

Moreover, brewers’ current valuations remain attractive, with HEIM and Carlsberg trading at -1SD below their 5-year mean (Figure#2 and 3), complemented by attractive dividend yield of 5.5-6.0% in FY26.

Among the two brewers listed on Bursa Malaysia, we believe Heineken is the better proxy to capitalize on the anticipated stronger beer sales and margin expansion in the Malaysian market, given that 100% of their sales are derived from this market, compared to Carlsberg’s approximately 70%.

Additionally, the latest survey by the Monetary Authority of Singapore (report), forecasts Singapore’s GDP growth to slow to 2.6% in 2025, down from 3.6% in 2024, with private consumption growth expected to decelerate to 3.3% from 6.1%.

This suggests a lower growth from the Singapore sales for Carlsberg. This outlook is in line with our forecast, where Heineken’s topline is expected to grow at a stronger 5% YoY, compared to Carlsberg’s 2.5% YoY. As a result, we now favour Heineken over Carlsberg for 2025.

We have a BUY rating on both brewers, as we believe the risk-to-reward profile for both is tilted to the upside, driven by a stronger beer sales outlook in 2025 and undemanding valuations.

The sector also offers exposure to the ongoing tourism recovery which still has legs to go. Between the two – Carlsberg (BUY, TP: RM31.08) and HEIM (BUY, TP: RM34.56) – we favour the latter for exposure. —Jan 6, 2025

Main image: miro.medium.com