MALAYSIA has emerged one of two markets in Asia where Fitch Solutions Country Risk & Industry Research has revised upward its 2022 real gross domestic product (GDP) growth forecast to reflect its view that the country stands to benefit from higher commodity prices caused by the Russia-Ukraine crisis.

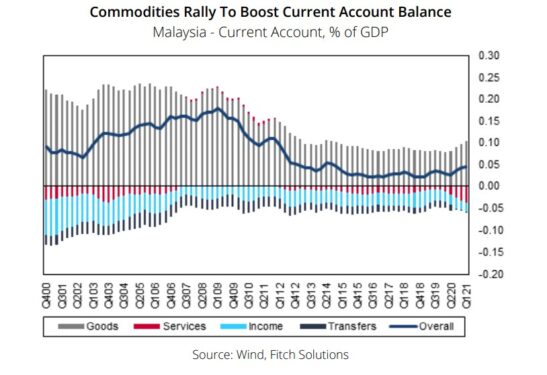

The research house has forecast a current account balance equal to 1.9% of GDP in 2022 for Malaysia, widening slightly from 1.6% in 2021.

“The goods trade balance will likely improve in light of elevated prices, in particular, palm oil and petroleum as well as their related products,” Fitch Solutions which is independent of Fitch Ratings pointed out in a commentary.

“Malaysia’s services balance is also likely to improve as a result of travel restrictions being lifted, in particular with Singapore which will likely support the tourism sector.”

The research house attributed the key reason behind its relatively strong current account balance forecast to the likely boost Malaysia’s exports will receive from the high commodity prices stemming from the Russia-Ukraine Crisis.

In particular, crude palm oil and crude oil prices have seen a stellar run of price growth, averaging 59.1% year-on-year (yoy) and 69.1% yoy respectively between January 2021 and January 2022.

For reference, these two categories as well as their related products make up more than 16% of total exports. During that same period, exports growth averaged 25.1% yoy compared to the 5.0% average in the five years between 2016 and 2020.

“However, this boost will likely be partly offset by the larger import bill that Malaysia is likely to incur over the course of 2022,” cautioned Fitch Solutions. “This will be exacerbated by the Government implementing additional price controls for food on top of existing fuel subsidies which will support demand for these goods.”

Elsewhere, the research house expects Malaysia to benefit from re-opening travel lanes, in particular, with Singapore with effect from April 1.

“As for the financial account, we see a mixed bag. On the one hand, portfolio and other investments are likely to be subdued by an increasingly hawkish US Federal Reserve which is likely to hike rates by five more times in 2022, making EM (emerging markets) assets, including Malaysia’s, less attractive by comparison,” Fitch Solutions foresees.

“Furthermore, the uncertainty caused by the Russia-Ukraine crisis and China’s slowing economy is likely to strengthen risk-off sentiment.”

On the other hand, the research house expects Malaysia to benefit from being a key part of the global semiconductor supply chain, particularly lower end chips that are used in smartphones and automobiles, thus presenting a strong incentive for greater investment in this sector given the global semiconductor shortage.

“This should see foreign direct investment (FDI) growth continue to accelerate. FDI amounted to 2.1% of GDP in 2021, growing from just 0.2% of GDP in 2020.” – April 5, 2022