TARIFFS bite but bargains bloom. This is how Hong Leong Investment Bank (HLIB) Research chooses to react to Malaysia being slapped with a 24% reciprocal tariff on imports into the US.

At first glance, although the glove sector would be the most affected, the research house justified that stock prices of Malaysian glovemakers here have fallen 40-50% year-to-date (YTD).

“As such, we believe much of the downside are priced in by the market, suggesting signs of bottom-fishing opportunity,” observed HLIB Research in its latest economics & strategy note.

“However, semiconductors are exempted, implying downside being overpriced for now (KLTEC: -24% YTD) amid scope for a potential relief rally.”

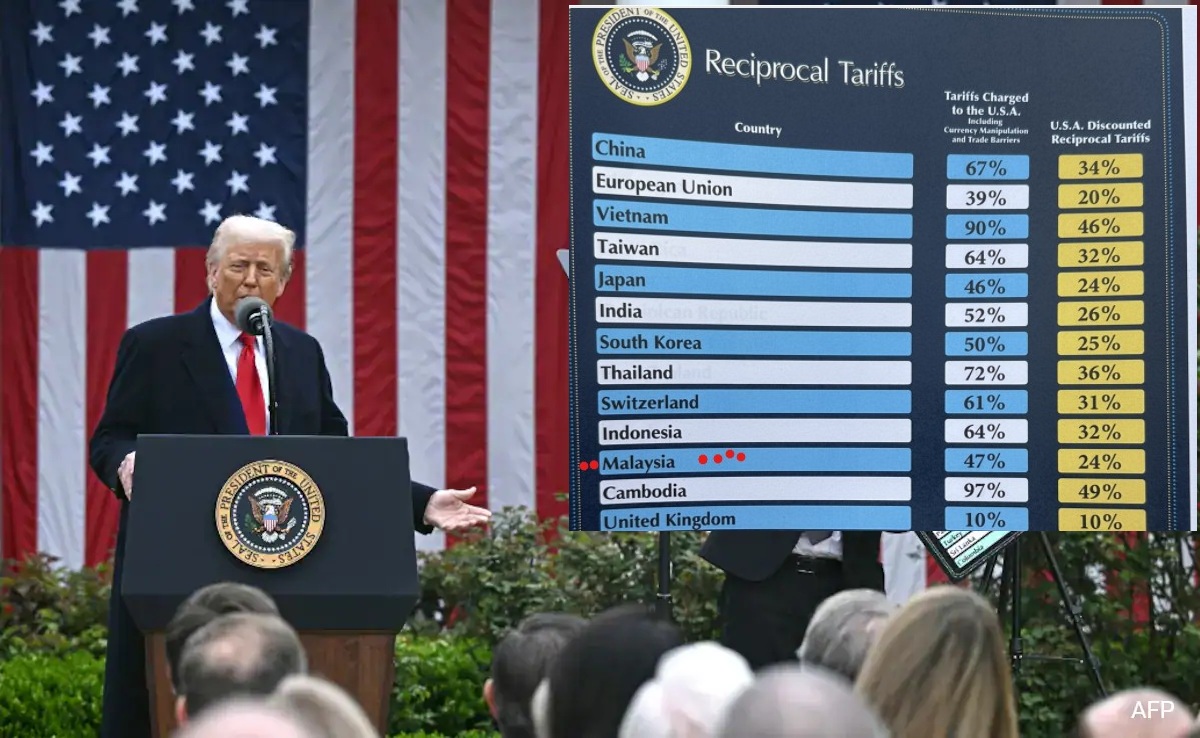

There are roughly 60 countries on this list distributed by the White House that are being hit with reciprocal tariffs. (The others have a 10% baseline tariff.) pic.twitter.com/MxFusLaBF1

— Kaitlan Collins (@kaitlancollins) April 2, 2025

Nevertheless, HLIB Research prefers to tread with caution as near-term volatility may persist with the prospect of new tariffs could still surface given US President Donald Trump’s accelerated reshoring and fair-trade agenda.

Considering Malaysia’s status as a trade-dependent economy and its non-confrontational stance in foreign policy, the research house further expects low likelihood of a retaliatory reaction from the Madani government.

“Instead, we expect this to be addressed via constructive, win-win negotiations since President Trump has shown openness to engage in such dialogues,” envisages the research house.

“Also, when examining the effective tariff rate imposed on Malaysia, it is evident Malaysia is not among the most heavily hit when stacked against other ASEAN nations with Vietnam/Thailand/Indonesia slapped with 46%/36%/32% respectively (Singapore: 10%).”

“Overall, we see the eventual tariff outcome for Malaysia to be contained and within manageable levels.”

Delving further on the glove sector, HLIB Research expects the 24% reciprocal tariff on the sector as having little impact but would instead improve the competitiveness of Malaysian glove players.

“This is especially so when compared to China which could face a much higher tariff of 50% + 20% + 34% (set to rise to 100% + 20% + 34% by January 2026) while Thailand will also be elevated at 36%,” projected the research house which has since upgraded the glove sector to “overweight”.

“In the near term, Malaysia is expected to gain US market share in higher-margin nitrile gloves (at the expense of Thailand) while losing some ground in lower-margin latex gloves for non-US markets.”

As for the plantation sector, the research house noted that despite elevated tariff imposed on the sector, “only a minimal at <5%” is imposed on Malaysa’s palm oil exports to the US.

Very broadly, however, the 24% reciprocal tariff on Malaysia is significantly higher vs HLIB Research’s base case of 2 percentage points (ppt) as computed from the Most Favoured Nation (MFN) tariff gap assessment vs the US. – April 3, 2025