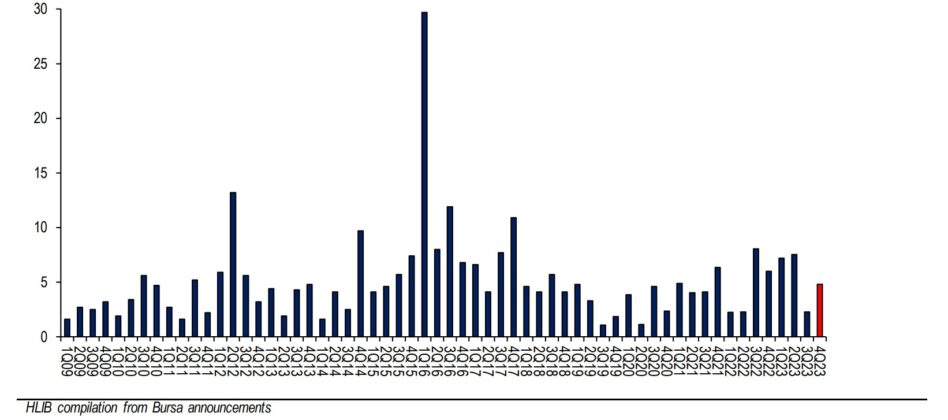

HONG Leong Investment Bank (HLIB) Research has maintained its “overweight” rating on the country’s construction sector with the revelation that domestic contract awards for the first quarter of 2024 (1Q 2024) was a commendable RM6.96 bil – up 45% quarter on quarter (qoq) but down 3% year-on-year (yoy).

According to the research house, contracts were again dominated by the private sector which saw robust flows notably from commercial and residential projects while the data centre space contributed as well.

“Going forward, we expect contract awards from several big-ticket infrastructure projects to drive jobs higher in 2024,” HLIB Research noted in a sector update on Thursday (April 4).

“We maintain sector ‘overweight’ keeping to our thesis of contract awards growth driven by mega infra projects and supported by robust private sector job flows. Sector valuations remain undemanding against this positive backdrop.”

HLIB Research’s top picks are Gamuda Bhd (“buy”; target price [TP]: RM6.11) and Sunway Construction Group Bhd (SunCon) (“buy”; TP: RM3.20).

Notable contract wins include the construction of a shopping mall in Ipoh to SunCon (RM721 mil); the construction of data centre in Selangor to SunCon (RM747.8 mil) and the construction of two apartment blocks in Setapak to Southern Score Builders Bhd (RM618.2 mil).

HLIB further noted two foreign contracts being awarded in 1Q 2024, namely multiple contracts in Saudi Arabia, United Arab Emirates (UAE) and India worth RM5.4 bil to Eversendai Corp Bhd and the construction of gas hookup system in Shanghai, China to Kelington Group Berhad (KGB) for RM143 mil.

“For the remaining quarters of 2024, we look forward to the rollout of big-ticket infrastructure projects like the Penang LRT (more than RM10 bil), Pan Borneo Sabah Phase 1B (RM15.7 bil), flood mitigation packages worth RM11.8 bil, Sabah-Sarawak Link Road (RM7.4 bil), LRT3 reinstatement (RM4.7 bil), the KUTS-Green Line as well as water scheme projects,” the research house pointed out.

“There are also other basic infrastructure projects to come, funded by the high level of development expenditure of RM90 bil.”

HLIB Research reckoned that these projects should help drive contract flows in 2024 while pipeline from industrial projects and data centres remains highly robust with Johor been touted as the fastest growing data centre market in the Southeast Asian region.

HLIB Research also anticipated further developments on the Johor LRT project (RM20 bil) and the Kuala Lumpur-Singapore high-speed rail (HSR) project in the coming months with the former serving as a critical dispersal system to the incoming Johor Bahru-Singapore Rapid Transit System (RTS) project that will be operational in 2027.

“Though there was disappointment over MRT3 (Mass Rapid Transit Line 3), our base case is a re-tender of the project as government prioritises state infrastructure developments,” added the research house. – April 4, 2024

Main pic credit: Construction Personnel Malaysia