THERE is no lacking of market spooking headwinds but it is as crucial to delve beyond the headlines, so opined Hong Leong Investment Bank (HLIB) Research. In fact, despite external market headwinds aplenty, Malaysia’s recovery remained favourable in 1H 2022.

With the transition to endemicity and the Employees Provident Fund (EPF) withdrawal scheme supporting consumption, the research house has upgraded its 2022 gross domestic product (GDP) forecast to +5.9% (from +5.5%) but expect it to slow in 2H 2022 especially in 4Q 2022.

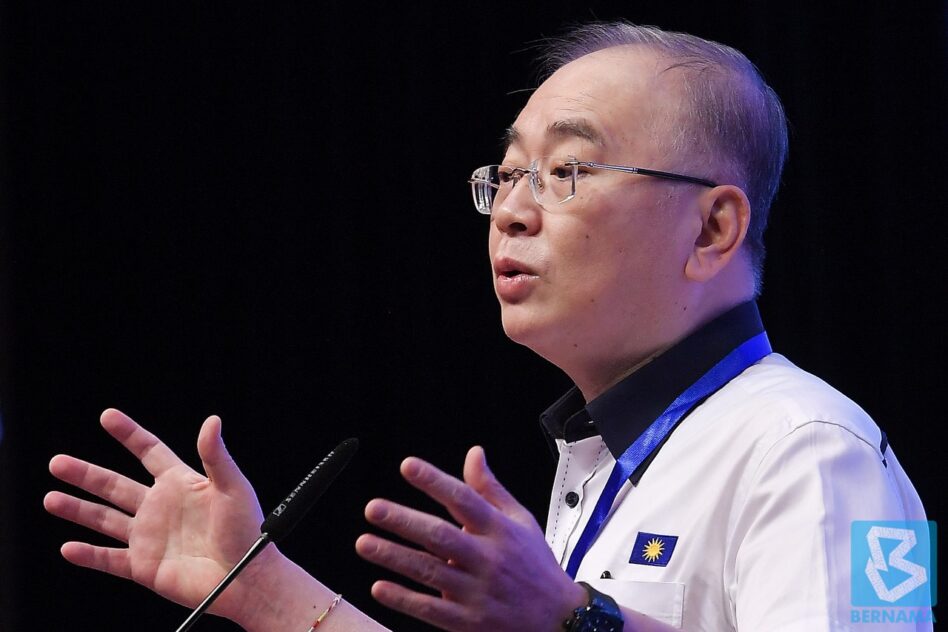

“We lift our 2022 CPI (consumer price index) forecast from 2.7% to 3.2% as we continue to see upside risk to food inflation,” projected head of research Jeremy Goh and economist Felicia Ling in an economics and strategy note.

“On OPR (overnight policy rate), our expectation is for another two +25bps hikes in 2H 2022 (July and September) to bring the benchmark rate to 2.50% end-2022.”

Despite the onslaught of the Russia-Ukraine conflict and China’s lockdowns in 1Q 2022, HLIB Research observed that supply chain disruption indicators (though elevated), have not worsened with some in fact easing, suggesting that these woes are past the peak.

“While (it is) still tough to imagine how (or when) the Russia-Ukraine conflict will end, Malaysia (and ASEAN) remains relatively more insulated from this compared to the developed West,” opined the research house.

“On domestic monetary policy tightening, we believe the market can stomach it, seeing that the spread between the FBM KLCI earnings yield and MGS10 is still generous at 2.88% (+1.1SD [standard deviation]).

“While FFR (Fed Funds Rate)-OPR spreads could potentially widen to +90 basis points (bps) by year-end (now: -38bps), we deduce that this has already been priced into the ringgit’s weakness.”

In fact, HLIB Research foresees a ringgit appreciation bias from August onwards with 2H 2022 average US$/ringgit projection of 4.33 (year-end: 4.23) with ringgit strength historically augurs well for the local bourse.

“Granted, the biggest risk seems to be a ‘hard landing’ scenario for the US, bringing recession contagion fears to our shores,” cautioned the research house.

“However, we reckon that battered valuations have reflected a reasonable degree of this as the FBM KLCI’s (i) forward PE (price-to-earnings ratio) is at a five-year low and (ii) trailing PB (price-to-book) is at -1.7SD; the only time it momentarily went lower was in March 2020 during the initial pandemic outbreak.”

Headwinds aside, perhaps it would be useful to also reflect that Malaysia is on a much stronger footing now (from its sustained re-opening beginning April 2022) than it was during the 2020-2021 pandemic, added HLIB Research. – June 29, 2022