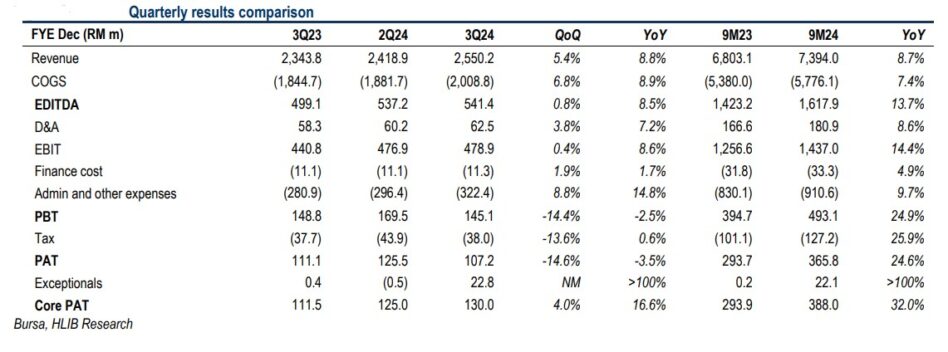

HONG Leong Investment Bank (HLIB) Research has reiterated its “buy” recommendation on 99 Speed Mart Retail Holdings Bhd (99Mart) after the convenience store chain chalked up a 32% year-on-year (yoy) jump in its nine-month core profit after tax (PAT) to RM388 mil.

The research house contended that it was encouraged by the group’s performance which continues to register growth in its top- and bottom-lines.

“The group remains focused on the expansion of store network which saw a net addition of 51 outlets (which brings the total to 2,697) in 3Q 2024,” observed analyst Syifaa’ Mahsuri Ismail in 99Mart’s results review.

“99SMart’s bulk sales e-commerce platform which was launched in the Klang Valley in December 2023 has received encouraging response and saw sales continue to grow.

“Moreover, the group also recently branched out its bulk sales e-commerce platform coverage to the southern region (July 2024) and the Northern region (November 2024).

Above all else, HLIB Research noted that 99SMart which is currently the 27th largest listed company in Malaysia with a market cap of RM19.5 bil may become eligible for inclusion in the FBM KLCI should it enter the top 25 ranking or an existing member fall below the 35th position.

This follows Bursa Malaysia’s semi-annual review of the FBM KLCI component stocks with the next review scheduled to occur in November 2024.

All in all, HLIB Research accorded a “buy” rating on 99Mart with a higher target price of RM2.98 (from RM1.98 previously) based on a higher price-to-earnings (PE) multiple of 45 times (from 30 times) pegged to the groups FY2025F earnings per share (EPS).

“We like 99SMart due to its strong market presence and extensive store network with competitive pricing that is well-positioned to drive stable and recurring revenue,” asserted the research house.

“Additionally, we opine the premium is justified to account for the possible inclusion into the FBM KLCI.”

At 9.39am, 99Mart was down 1 sen at or 0.43% to RM2.29 with 975,300 shares traded, thus valuing the company at RM19.24 bil. – Nov 12, 2024