WITH the Government keeping mum on the supposed exposure of several Malaysian banks due to Genting Hong Kong Ltd’s failure, a media release from 2012 is going rounds on how the latter secured lucrative loans from several banks for its business.

On Nov 26, 2012, Genting Hong Kong announced that it had secured a seven-year senior vessel term loan worth US$600 mil in addition to another revolving credit facility worth US$300 mil for a three-year term.

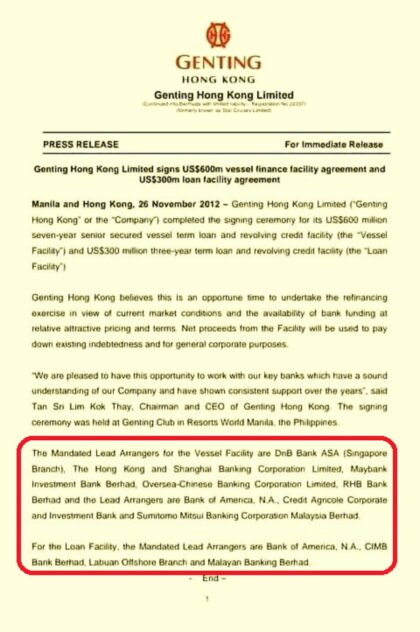

The media release stated that the mandated lead arrangers for the vessel facility were DnB Bank ASA (Singapore branch), HSBC Bank, Maybank Investment Bank Bhd, Oversea-Chinese Banking Corporation Ltd and RHB Bank Bhd.

The lead arrangers were Bank of America, NA Credit Agricole Corporate and Investment Bank, and Sumitomo Mitsui Bank Corporation Malaysia Bhd.

“As for the loan facility, the Mandated Lead Arrangers are Bank of America, NA, CIMB Bank Bhd and Malayan Banking Bhd.

“We are pleased to have this opportunity to work with our key banks which have a sound understanding of our company and have shown consistent support over the years,” Genting HK former chairman-cum-CEO Tan Sri Lim Kok Thay was reported as saying then.

Genting Hong Kong’s financial woes came about as it filed a winding-up petition in Bermuda after the bankruptcy of its shipyard in Germany triggered US$2.78 bil (RM11.68 bil) of debt and forced Asia’s largest operator of sea cruises to be liquidated.

Additionally, a US court has also issued an arrest warrant and ruled that the company’s luxury cruise ship Crystal Symphony would be seized if it docked in Miami. This follows the filing of a lawsuit by Peninsula Petroleum to recoup US$4.6 mil in total unpaid fees for bunker fuel it had delivered to three of Genting Hong Kong’s ships since 2017.

Irate by the Putrajaya’s silence on the matter, Opposition Leader Datuk Seri Anwar Ibrahim urged Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz to explain how Genting HK could obtain RM2.5 bil in unsecured loans from three local banks.

“The Government, through Permodalan Nasional Bhd (PNB), Khazanah Nasional Bhd and the Employees’ Provident Fund (EPF) are the largest shareholders of these three banks.

“How did the gambling company get an unsecured loan so easily? I urge Zafrul to explain this immediately,” the Port Dickson MP was reported as saying.

It is to note, however, that Datuk Seri Najib Tun Razak served as Malaysia’s first Finance Minister between September 2008 and May 2018 with Datuk Seri Ahmad Husni Hanadzlah serving as second Finance Minister in the same period. – Jan 29, 2022