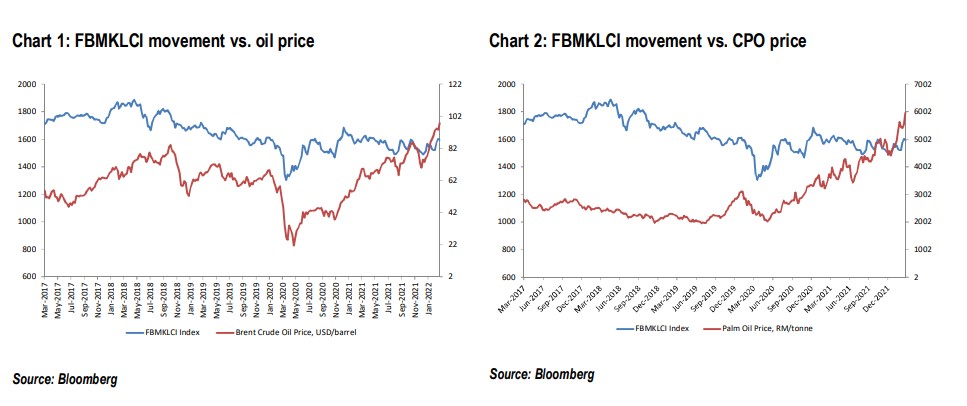

SINCE the Russian invasion of Ukraine on Feb 24, oil and crude palm oil (CPO) prices have surged. Both the oil and gas (O&G) and plantation sectors are clearly the near-term beneficiaries.

While almost all companies under our coverage do not have direct exposure to Russia or Ukraine, we believe that the indirect impact of rising commodity and raw material costs will have a slightly negative impact on the consumer, gloves, media and property sectors.

Meanwhile, the impact is neutral on the automotive, banking, electronics manufacturing services (EMS), insurance, healthcare, power, real estate investment trust (REIT), telecommunication and technology sectors.

Biggest beneficiaries

O&G: In terms of direct exposure to Ukraine or Russia, only Bumi Armada Bhd (among the stocks under our coverage) has a US$50 mil Lukoil job in the Caspian Sea which may be subjected to global sanctions.

Indirectly, the higher crude oil price environment will translate to higher revenue and earnings of exploration and production operators such as Hibiscus Petroleum Bhd and to a lesser extent, Sapura Energy Bhd and Dialog Group Bhd.

As the current price upcycle could spur renewed investments in the sector, a potential acceleration in capex roll-outs translates into increased orders and enhanced medium-term earnings prospects for all service providers across the value chain.

Dialog Group is one of our top 10 “buys”. For pure upstream exposure, we have a tactical “buy” call on Hibiscus Petroleum.

Plantation: The war in Ukraine is expected to cause shortages of vegetable oils. According to S&P Global Platts, Ukraine accounted for 46.9% of global exports of sunflower oil in 2020/2021 and 16% of global corn exports in 2021/2022.

Ukraine and Russia accounted for 23% of global wheat trade in 2021/2022. Due to the switch from Ukraine to other suppliers, there could be shortages of corn or soybean oil in the US or South America.

This is expected to push up vegetable oil prices and benefit CPO as well. As such, we have raised our CPO price assumption to RM4,000/metric tonne (MT) from RM3,000/MT for 2022F.

In spite of the high CPO prices currently, there is risk that CPO prices would soften in 2H 2022 as production picks up, underpinned by seasonality factors and the arrival of foreign workers.

Plantation companies with pure exposure and without Indonesia price discount would benefit the most. These include Hap Seng Plantations Bhd and companies without significant downstream operations such as TSH Resources Bhd and Genting Plantations Bhd.

Slightly negative

Consumer: Consumer companies within our coverage have no direct revenue exposure to Ukraine and Russia. However, another round of broad-based increase in commodity prices, including crude oil, may put further pressure on companies’ margin and force them to increase their products’ pricing to (partially) offset the impact.

Meanwhile, the impact of inflation has crept into the companies’ operating cost and is already reflected in their 4Q 2021 earnings.

Gloves: There is minimal sales exposure; only 0.5% of Top Glove Corp Bhd’s sales is to Ukraine. We believe that Hartalega Holdings Bhd and Kossan Rubber Industries Bhd’s sales exposure to Ukraine is also negligible.

As for indirect exposure, the spike in crude oil prices should cause nitrile butadiene’s cost to increase. Nitrile butadiene is the raw material used to make nitrile gloves. Due to the stiff competition currently, we believe that glove makers may not be able to completely pass on their cost increase to customers.

Media: The increase in raw material costs of consumer companies may result in margin erosion as it may be difficult to raise the selling prices of products. This may result in lower spending on advertising and promotions.

Property: No sales exposure to both Ukraine and Russia. Nevertheless, we do expect slightly higher costs of construction materials and logistics due to disruptions in the global supply chain. We believe that the bulk of the cost increase will be absorbed by both construction companies and property developers. – March 3, 2022

Alan Lim Seong Chun is the Head of Equity Research at AmInvestment Bank.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.