A STOCK market comprises the better companies in an economy. An economy is about the production of goods and services of all the companies in a country.

As such you would expect the performance of the stock market to track the economic performance of a country. Some would argue that since the stock market comprises the better companies, it should do better.

The FBM KLCI comprises the top 30 companies under Bursa Malaysia by market capitalisation. You could argue that it represents the better companies in the Malaysian stock market. So, it should do even better than the Malaysian economy.

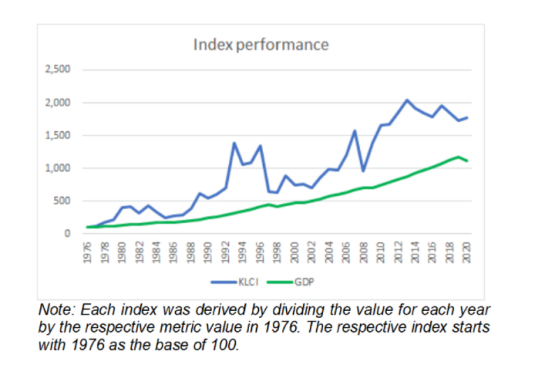

We find that this is the case as illustrated in the chart below comparing the FBM KLCI with the Malaysian gross domestic product (GDP) over the last 45 years. There is a 0.92 correlation between the FBM KLCI and the GDP.

The FBM KLCI had grown at a 6.8% compound annual growth rate (CAGR) from 1976 to 2020. During the period, the Malaysian GDP had grown at 5.6 % CAGR.

For the above argument to be valid, market prices should reflect the business performances of the component companies. Is this true or are market prices driven by other factors as well?

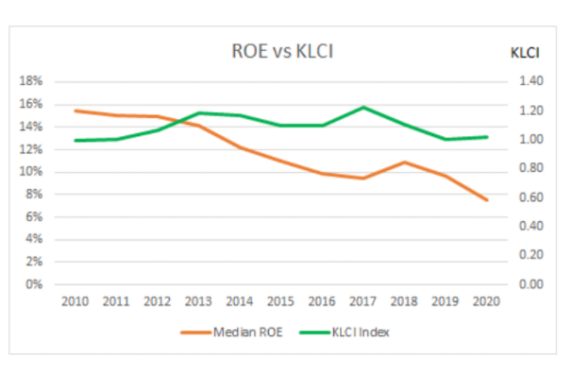

To get a sense of this, I compared the performance of the FBM KLCI with the business performance of the component companies from 2010 to 2020. The result for one metric is shown in the chart below.

From 2010 to 2020, the FBM KLCI had a CAGR of 0.2%. This was much better than the median return on equity (ROE) of the component companies which had a compounded decline of 7%.

The correlation between the FBM KLCI and the ROE was – 0.14. Generally, a correlation is only meaningful if it is greater than 0.7 or less than – 0.7. I would conclude that over the past 11 years, the FBM KLCI did not reflect the business performance of its component companies.

Note that the low correlations held for other metrics such as revenue, profit after tax, cash flows and return on asset (ROA). Unfortunately, I do not have the financial results of the component companies going back to 1976 to see the picture over a 45 years period.

In the analysis, I tracked the performance of the same companies based on the composition of the FBM KLCI as of Jan 1, 2021. This was even though the composition changed over the 11 years.

The change in composition does not affect the component companies’ performance. This is because I took the median performance to represent the performance of the component companies.

So even if there were changes to the composition of the component companies, if affected only the bottom one or two companies. The median was not affected.

By the way, the Malaysian economy expanded by a CAGR of 4 % during the same period.

Investing in the index

Warren Buffett is one of the most iconic and successful investors of our time. But he acknowledged that individual stock picking is not for everybody.

In fact, most retail investors would benefit from a much simpler strategy. He had advised investing in low-cost index funds.

“A low-cost index fund is the most sensible equity investment for the great majority of investors … By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals.”

Well, if you have invested in a FBM KLCI index fund over the last 45 years (assuming that such a fund existed) you would have a compounded annual return of 6.8%. But you would have needed nerves of steel to withstand the two major drawdowns:

- The largest drawdown was during the Asian Financial Crisis (1997) when the FBM KLCI dropped by almost half from 1996 to 1998. It took almost 13 years for the index to recover to the level before the drop.

- The next largest drawdown was during the US sub-prime crisis in 2007 when it dropped by about 40%. This time it took less than three years to recover to the level before the drop.

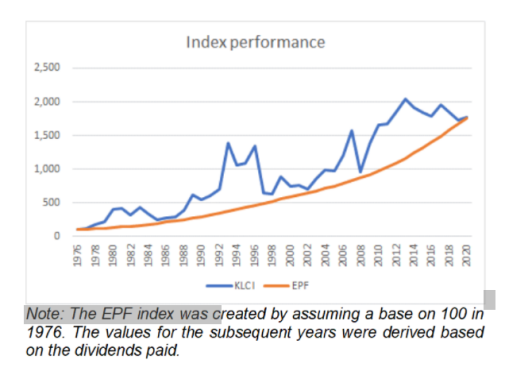

But look at the returns if you have kept your money with the Employees Provident Fund (EPF) as shown in the chart. You would have about the same returns but without the drawdown if you had kept your money with the EPF rather than invest in the FBM KLCI.

So, is the KLCI rationale?

By “rationale”, I meant that its performance should reflect the business performance of its component companies and that of the economy.

The results showed that in the long run it is. But over the short-term, it is not so. My short term was 11 years. Can you imagine what it would be like for investors who think in terms of weeks or days?

And for the no-nothing investor, wouldn’t you be better off to keep your savings with the EPF rather than invest in a FBM KLCI index fund? – Dec 3, 2021

Datuk Eu Hong Chew was on the board of I-Bhd from 1999 till 2020. As Group CEO, he led its transformation from a digital appliance manufacturer into the developer of i-City, the Selangor Golden Triangle.

The data for this article was extracted from the article that was first published under “Should you invest in the KLCI or let the EPF manage your savings?” in i4value.asia. Refer to the article for more analysis.

The views expressed are solely of the authors and do not necessarily reflect those of Focus Malaysia.