OVER the years, renowned investor Warren Buffet has made several comments on the types of businesses to invest in during inflationary periods.

“The best businesses during inflation are the businesses that you buy once and then you don’t have to keep making capital investments subsequently…” he said at a 2015 Berkshire Hathaway shareholders’ meeting.

“(They) must have two characteristics: (i) an ability to increase prices rather easily… without fear of significant loss of either market share or unit volume; and (ii) an ability to accommodate large dollar volume increases in business…with only minor additional investment of capital,” Buffet wrote in a 1981 letter to shareholders.

In the context of fundamental analysis, I would translate the above into the following:

- The company must have pricing power. One indicator of this is stable gross profit margins.

- The return on equity (ROE) should be higher than the expected inflation rate.

- The company should have low capital needs. One sign of this is a low re-investment rate. I defined re-investment as capital expenditure (capex) – Depreciation & Amortisation + Net Working Capital. The Re-investment rate = Re-investment / Earnings before interest and taxes (EBIT) (1-tax).

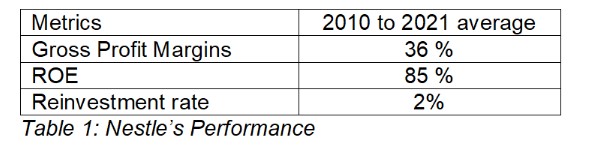

If you are hunting for investment opportunities in a high inflation environment, you should look at those with the above characteristics. I would like to illustrate this for one of the FBM KLCI component companies: Nestle Malaysia Bhd. Refer to Table 1 which shows the performance of Nestle over the past decade.

I would conclude that the company would be able to meet Buffett’s inflation-beating criteria.

- Nestle’s gross profit margins were also “stable” with a standard error of 6.2%. Nestle’s products are probably towards the “necessities” end of the necessity vs luxury scale.

- Secondly, with 85% ROE, there is almost certainty that Nestle will outperform the Malaysian inflation rate.

- Finally, the average re-investment rate is 2%. This was because there were also certain years when the amount spent on capex and increase in working capital was less than the depreciation and amortisation.

Buffett focuses on the price effect. I would argue that during periods of high inflation, the issue is not just addressing high prices. There will also be economic growth challenges resulting from the authorities’ efforts to combat the high inflation.

This means looking at companies with good business economics so that they can overcome both inflation and low economic growth. When looking for companies to invest in, you want those that are financially strong and where management has a good track record.

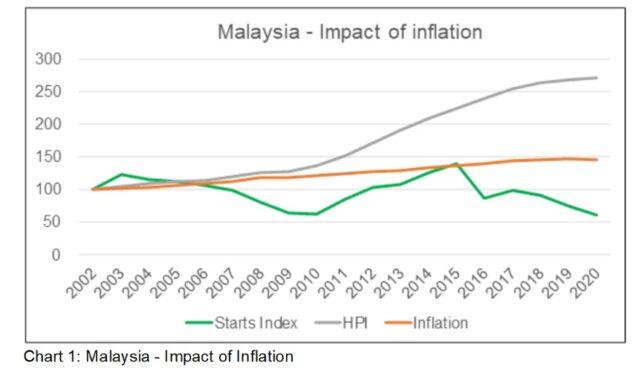

The property sector has the business economics to overcome high prices and low/negative economic growth. I examined the key drivers of business performance for this sector for the past 18 years. I first looked at two key metrics for this sector.

- The house prices as represented by the House Price Index (HPI).

- The number of houses constructed as represented by the Housing Starts.

Chart 1 shows how the HPI compared with the Inflation index for Malaysia over the past 18 years. You can see that the HPI outgrew the inflation rate. As for the Housing Starts, you can see that it is cyclical and does not seem to be correlated to inflation. I see this as a positive sign.

You can see why I consider the property sector as one with good business economics to overcome the impact of inflation. But you have to look at it over the long term.

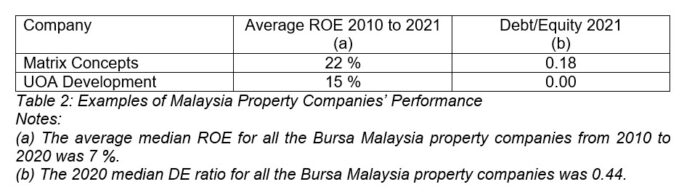

Are there Bursa Malaysia property companies that are financially sound with a good performance track record? Table 2 shows the metrics for two such companies that fit the bill.

We don’t know how high the inflation rate will go or how long it will last. Worse still, we do not know what the various counter-inflation measures will do to the economy.

That is why I believe that companies with the following characteristics are the ones that will do well in a high inflationary environment:

- Pricing power as reflected by stable gross profit margins.

- High ROE with low capital needs.

- Financially sound.

- A management team with a good ROE track record.

In the parlance of Buffett, we need a good jockey riding on a good horse. – June 24, 2022

A self-taught value investor who has been investing in Bursa Malaysia and SGX companies from a value investment perspective for more than 15 years, Datuk Eu Hong Chew was re-appointed to the board of I-Bhd as non-independent non-executive director on Jan 1, 2022. The data for this article was extracted from “Investing in a High Inflation Environment” and “Will the Malaysian Property Sector Turn Around By 2024” on i4value.asia. Refer to the article for the methodology and further analysis.

Author’s disclaimer: The companies stated here are for illustration purposes. Whether they are good investment opportunities depends not only on the business characteristics but also on their prices relative to their intrinsic values.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.