SINCE the birth of investment instruments, financial media worldwide have used a wide range of financial terminology in describing markets.

Among others, some of the most commonly used ones are the “bull market”, “bear market” and “correction territory”.

Generally, “bull markets” are associated with rosy or healthy economic environments where asset prices have risen by at least 20% and are expected to continue rising (upward market trend).

In bull markets, investor optimism and business confidence are clearly indicated by the increasing volume of buy trades as well as the rising number of companies entering the market.

In contrast, “bear markets” – although not always true – are predominantly associated with a general weakening of economies where asset prices have fallen by at least -20% and are foreseen to continue doing so (downward market trend).

A general lack of confidence can be witnessed as investors are seen retreating from the investment scene. What happened in past US Bear markets?

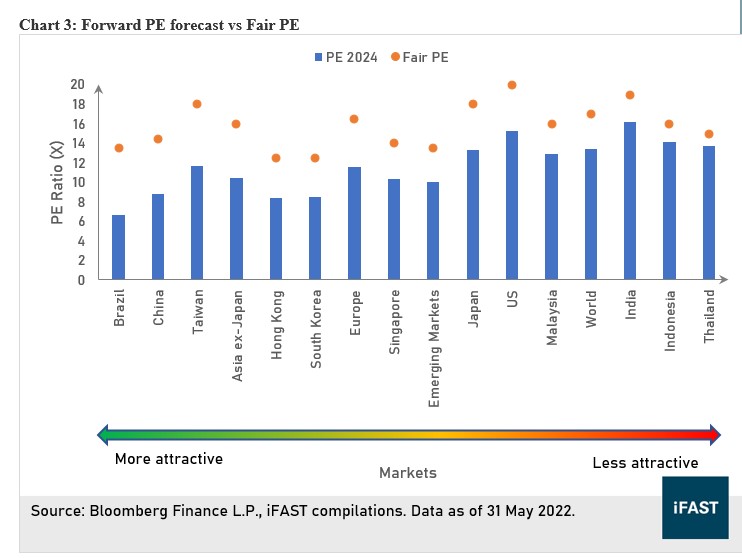

This is not the first time US equities have gone into a bear market. In fact, this has happened countless times before in the past (see Chart 1).

Since 1950s, US equities (as represented by the S&P 500 Index) have experienced 13 bear markets with an average drawdown of -31.1% over an average period of 225 days. On a positive note – subsequent to every bear market – US equities have gone on bull runs with an average return of 137.9% over an average span of 1,162 days.

Bear markets in other markets

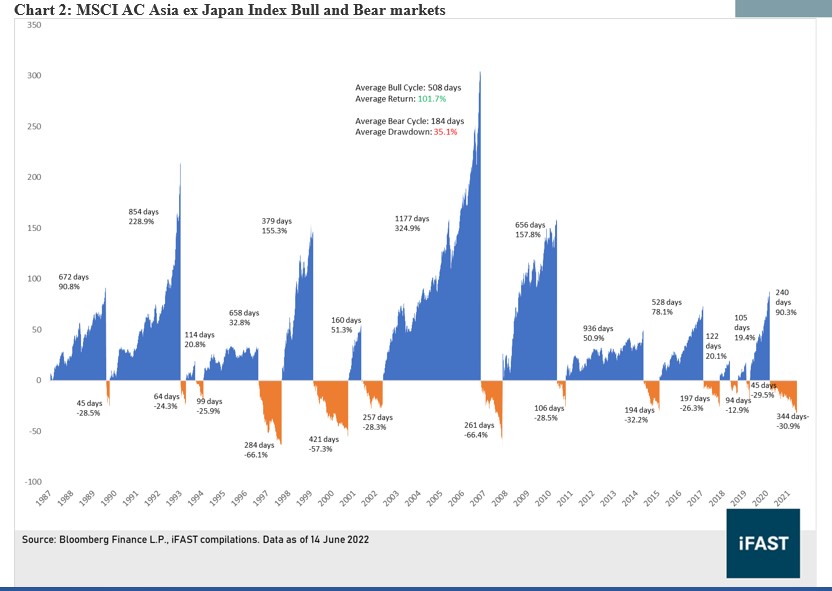

Other than the US, bear markets have also occurred in other major markets. In Chart 2, we have the historical chart of MSCI AC Asia ex Japan Index which is the commonly used benchmark for Asia ex Japan equities.

Since 1980s, Asia ex Japan equities have experienced 13 bear markets with an average drawdown of -35.1% over an average period of 184 days.

On a positive note, subsequent to every bear market, Asia ex Japan equities have gone on bull runs with an average return of 101.7% over an average span of 508 days.

Conclusion

As shown above, bear markets have happened before. If history is any precedent, bear markets are not the end of the world but instead precede bull markets.

For patient long term investors, this could be a once in a blue moon opportunity.

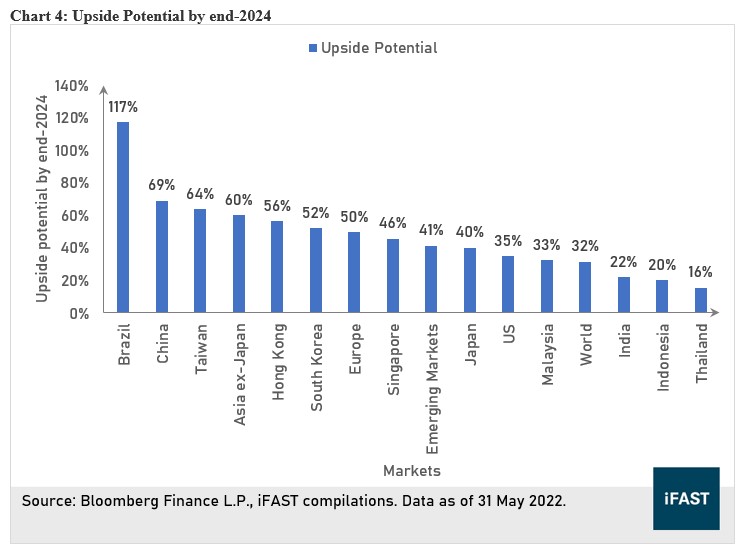

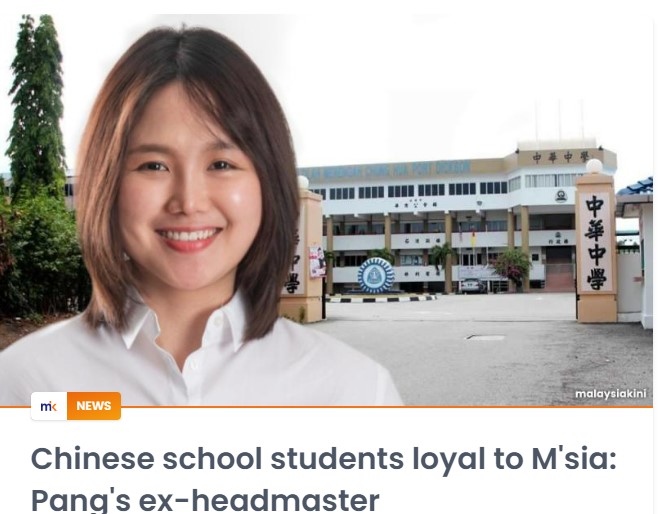

Here are some of the biggest opportunities we see right now (see Chart 3 and 4). – June 17, 2022