THE unprecedented COVID-19 pandemic has dealt a big blow to the Malaysian economy as the prolonged lockdowns and economic slowdown has led to business closures and job losses.

With the ramped-up speed of COVID-19 vaccinations, the overall daily COVID-19 cases have dropped to below 5,000 while the various COVID-19 restrictions have been eased gradually in most areas.

That being said, we expect the prolonged COVID-led disruption to alleviate in 2022. Furthermore, the economic re-opening would revitalise economic activities, restore domestic consumption, business operations, exports and import thereby underpin recovery in 2022.

Based on the recent positive economic data and latest COVID-19 developments, we believe Malaysia is now on the right track to full recovery.

Going forward, with the economy finally reopening after the prolonged lockdowns, we do expect corporate earnings to improve. At this juncture, we think that earnings revisions have bottomed and priced in most of the negatives.

After being downgraded throughout 2021, downward revisions have stabilised in October, coinciding with the tapering of COVID-19 cases in the country which allowed the Government to fully reopen the economy and remove lockdown measures.

In fact, we are seeing slight upgrades to 2021 and 2023 earnings in November which reflects better optimism from analysts.

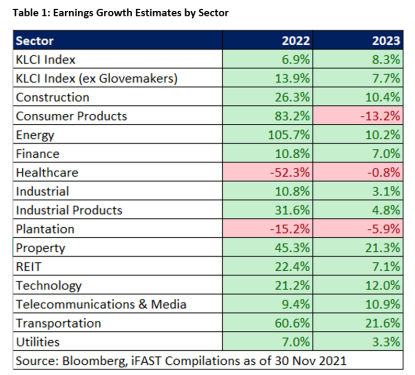

The FBM KLCI earnings are expected to grow by 6.9% in 2022 and another 8.3% in 2023. Overall, it may seem that the FBM KLCI earnings growth is sluggish, mainly dragged down by glove stocks which are expected to see a normalisation in earnings post pandemic.

If we were to strip out glove stocks from the equation, the FBM KLCI earnings growth are at much more palatable levels of 13.9% and 7.7% in 2022 and 2023 respectively.

Better prospects

On another positive note, we are also seeing broad-based positive earnings growth in 2022 across most sectors except for the healthcare sector.

Earnings growth for the FBM KLCI Index will be mainly driven by the financial sector – the biggest sector with a weightage of 30.7%. The financial sector is expected to grow earnings by an impressive 10.8% in 2022 and 7.0% in 2023 amid a few key catalysts for growth that include:

- Higher net interest margins as central bank Bank Negara Malaysia (BNM) finally starts to raise interest rates in 2022 and 2023 after cutting rates to a record low of 1.75% in 2020; and

- Improving non-performing loan ratio and easing loan loss provisions as the economy recovers.

Another key driver for the FBM KLCI earnings growth is the consumer products and services sector which is also expected to grow strongly in 2022. We think the sector will benefit from re-opening of the economy after lockdowns were finally relaxed recently.

We foresee that pent up consumer demand will be unleashed as consumers will finally be able to spend in brick and mortar stores whereas holiday makers can resort to domestic travel to satisfy their travel itch.

Re-look under-appreciated equities

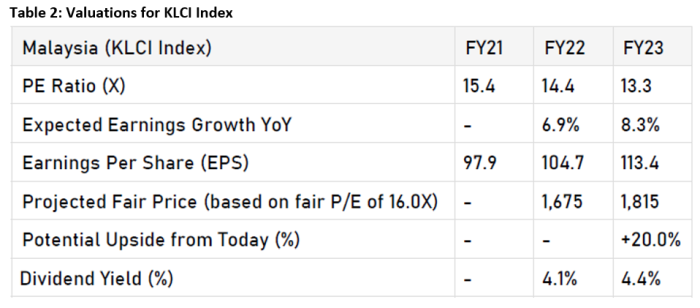

In terms of valuations, Malaysian equities look attractive as the FBM KLCI Index is now trading at 13.3 times forward price-to-earnings ratio (PE) based on FY2023 estimated earnings.

We believe markets are pricing in some political uncertainty as the much anticipated general elections could be held in 2022.

That said, value investors can expect the current entry level to provide a good opportunity. Our fair PE for the market is 16 times. As such, our target price for the FBM KLCI is 1,815 by end-2023 which represents a decent 20% upside potential from the current level of around 1,500.

On top of that, the estimated dividend yield of more than 4% in the coming two years is set to bulk up the total return for investors.

All-in-all, we have upgraded our star ratings for Malaysian equities to three stars “attractive” in view of their attractive upside potential, cheap valuations and appealing dividend yields. Perhaps it is time for investors to reconsider this under-appreciated market. – Dec 8, 2021