A MINORITY shareholder of Main Market-listed ILB Group Bhd (formerly Integrated Logistics Bhd) has taken to the courts in an attempt to prevent the company’s board from conducting transactions that oppress the rights of the minority shareholders.

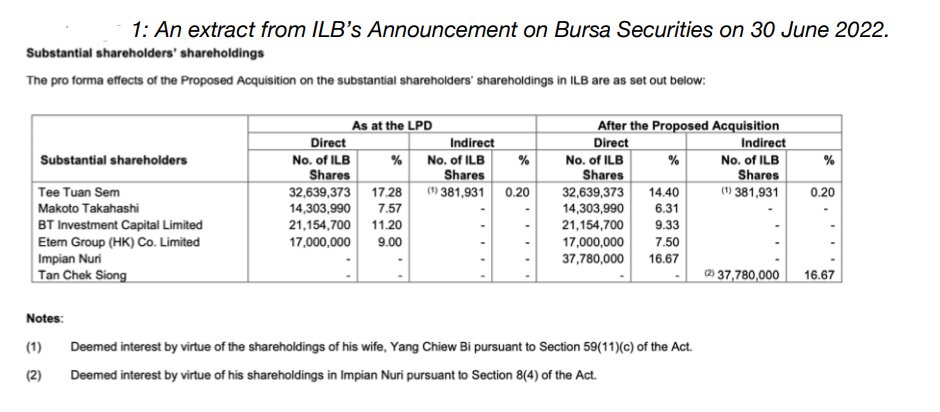

The action by BT Investment Capital Ltd, which held a 11.2% stake in ILB, came about following an announcement by ILB to fully fund a RM15.9 mil proposed acquisition of nine parcels of commercial land with shoplots in Seksyen 19 Petaling Jaya, Selangor via the issuance of 37.78 million new ordinary shares in ILB.

The proposed issuance of the new shares will enlarge the number of issued shares to 232.81 million from the current 195.03 million.

“This move will dilute existing shareholding and does not create value for shareholders as ILB’s earnings per share and any dividends, rights, allotments or other distributions that ILB may declare will be negatively impacted,” BT Investment pointed out in a media statement.

This dilution impact was announced by the ILB’s board on July 15 via a Bursa Malaysia filing.

“At the same time, the proposed transaction will create a new single largest shareholder in the form of the seller of the commercial parcel, Impian Nuri Sdn Bhd, who will have a 16.67% stake in ILB,” added BT Investment.

The proposed 37.78 million new shares are equivalent to 19.37% of the current share base of ILB or just under the 20% general mandate.

ILB’s Board cited the 20% general mandate for the proposed transaction which was announced by Bursa Malaysia on April 16, 2020 as a way to provide a relief measure to public listed companies that need to raise capital in a timely and cost-effective manner to be injected as working capital or for operational expenditure to sustain business during the pandemic.

This interim measure was allowed until Dec 31, 2021 but was further extended to Dec 31, 2022.

Contrary to the intention of this 20% general mandate, the proposed transaction does not result in funds being injected into the company nor does ILB appear to need to raise cash as shown by the company’s FYE Dec 31, 2021 annual report which recorded a cash and bank balance of RM86.03 mil.

“ILB positions itself as active in the solar renewable energy business following the divestment of most of the group’s warehousing and logistic operations over the past few years,” observed BT Investment.

“ILB cited a strategic plan to generate sustainable earnings as the reason to acquire the commercial land – a move inconsistent with its core business focus.”

Moreover, the commercial parcel only has an occupancy of 45% as announced by ILB. It yields RM324,600 return per annum for properties valued at RM16.2 mil.

“This translates to a 2.2% gross revenue for ILB and does not make sound or sensible commercial reasoning for a proposed acquisition meant to provide substantive recurring income,” revealed BT Investment.

Hence, BT Investment is of the view that the proposed transaction to give up a 16.67% stake and dilute existing shareholders for low-yielding assets does not benefit or create value for shareholders.

“Directors have a duty to act in the best interest of shareholders. Regretfully, a minority shareholder such as us has to seek recourse in court to protect ours and the rights and interest of existing minority shareholders by seeking an injunction to restrain the proposed transaction from being executed,” lamented BT Investment.

“BT Investment currently holds a 11.2% stake which will be diluted to 9.33% not through any action of its own but purely through the proposed transaction.”

At the same time, BT Investment also made clear of its intention to requisition for an extraordinary general meeting (EGM) for shareholders to query the board of their rationale and proposes to revoke the 20% general mandate.

Defendants named in the suit are ILB’s board comprising Tee Tuan Sem, Datuk Karownakaran @ Karunakaran Ramasamy, Makoto Takahashi, Wan Azfar Wan Annuar, Datuk Wan Hashim Wan Jusoh, Soh Eng Hooi and Jamilah binti Kamal as well as the seller Impian Nuri Sdn Bhd and ILB itself.

At the close of today’s mid-day trading, ILB was untraded at 49 sen which gave the company a market capitalisation of RM96 mil. – Aug 3, 2022