DESPITE concerns over rising inflation, Malaysia’s industrial real estate sector continues to flourish while the retail sector is slowly recovering.

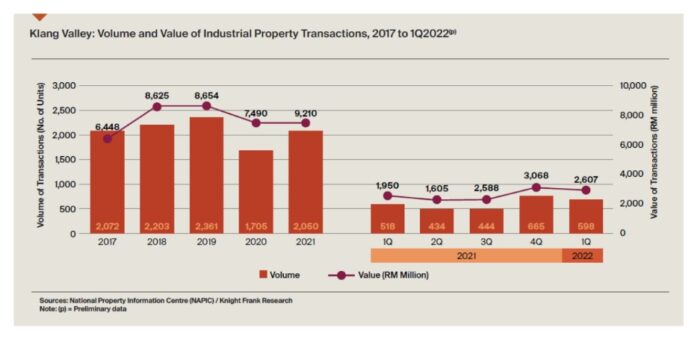

In fact, the industrial property sector in Klang Valley saw a rebound in market activity with 2,050 industrial properties worth RM9.21 bil changed hands in 2021, reflecting annual increments of 20.2% and 23.0% in transacted volume and value respectively, according to independent global property consultancy Knight Frank.

“The logistics sector continues to grow with 3PL and e-commerce key players expanding their operations, leading to higher demand for logistics and warehousing space,” commented Knight Frank Malaysia’s senior executive director (research and consultancy) Judy Ong with reference to the company’s real estate highlights for 1H 2022.

This was re-affirmed by the property consultant’s executive director (land and industrial solutions) Allan Sim who expects Malaysia to benefit from the diversification and re-shaping of global supply chain strategies with more multinational companies setting up new businesses and facilities within the ASEAN region.

“Unsurprisingly, the number of institutional investors and real estate investment trusts (REITs) chasing after industrial and logistics real estate in Malaysia continues to increase, evidenced by entry of new investors,” observed Sim.

“The first industrial-related acquisition by KIP REIT consisting of a mixture of industrial facilities and industrial land in Pulau Indah amounting RM78 mil and Capitaland Malaysia Trust’s first industrial purchase of a 5.11-hectare freehold industrial warehouse for RM80 mil in Batu Kawan, Penang.”

Additionally, developers are also seen venturing into large industrial and warehousing developments such as Titijaya Land Bhd with its recent RM200 mil build-to-suit arrangement of a logistic commercial complex for DHL Properties in Penang, and IJM Corp Bhd partnering China Harbour Engineering Company Ltd (CHEC) for their first industrial and logistics development in Kuantan.

Over in Penang, Knight Frank Penang executive director Mark Saw described the industrial segment as the silver lining in Penang’s property market as there is encouraging demand for logistics facilities to serve the state’s expanding e-commerce and logistics sector.

“Batu Kawan Industrial Park will continue to be the main hotspot over the next three years and as reported, Penang Development Corp (PDC) plans to develop between 100 acres and 150 acres of industrial land annually in Batu Kawan in addition to a new industrial park in Kepala Batas,” Saw pointed out.

“This will become a smart and high-tech industrial park with the best infrastructure for 5G internet access, in order to attract more interest especially from foreign investors.”

Meanwhile, the logistics sector in Johor is thriving with Port of Tanjung Pelepas (PTP) recording growth in its yearly volume and with its current free zone expansion expected to be completed in 2023.

As for the retail sector, Knight Frank Malaysia noted that occupancy rates of shopping centres were stable during the review period with improvement of revenue for mall operators. Major malls like Suria KLCC, Pavilion Kuala Lumpur, Mid Valley Megamall and Sunway Pyramid continue to retain solid crowd pulls and have stable occupancy rates.

As of 1H 2022, the cumulative supply of retail space in Klang Valley stands at circa 66.09 million sq ft following completion of Mitsui Shopping Park Lalaport and Malaysia Grand Bazaar.

While Lalaport BBCC brings with it an authentic Japanese shopping experience by introducing a throng of first-to-market brands, including NITORI, Nojima, Coo&RIKU, Shin’Labo, Matcha Eight and Tamaruya, Malaysia Grand Bazaar is the city’s first artisanal mall and seeks to become an incubator of local entrepreneurs catering to a wider customer base. – Aug 8, 2022