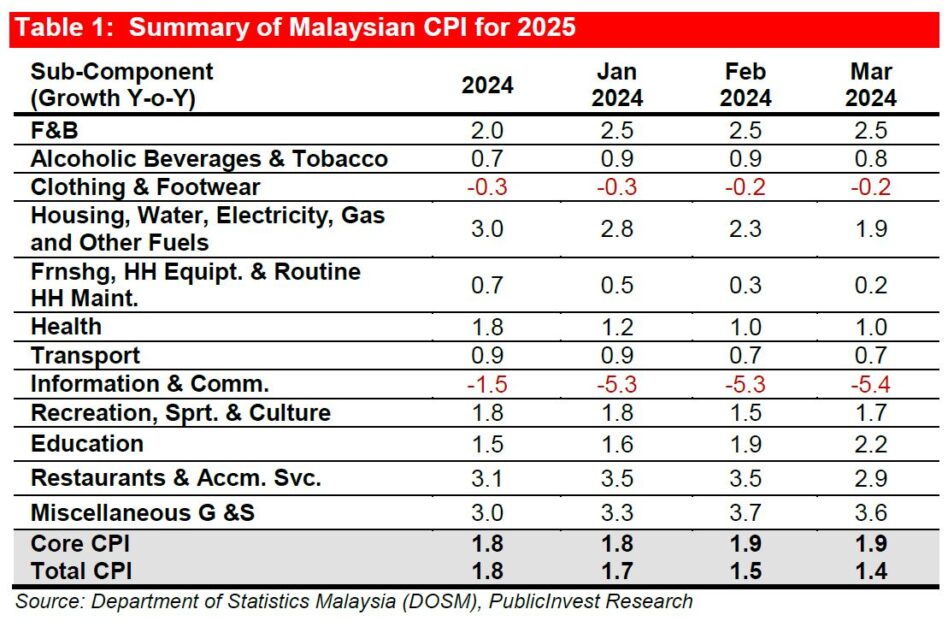

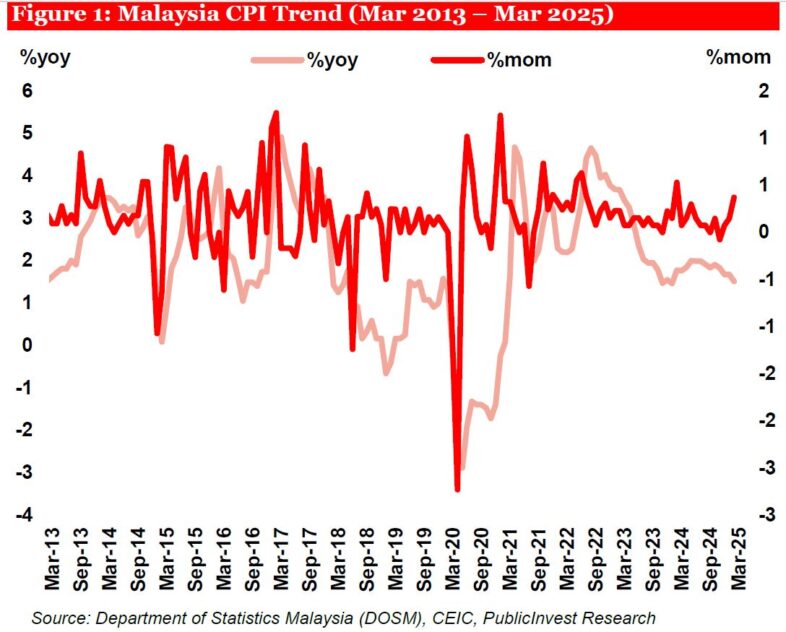

MALAYSIA’s headline inflation moderated to +1.4% year-on-year (YoY) in March, driven by slower price increases across several key categories. Note that February was +1.5%.

“The Personal Care, Social Protection and Miscellaneous Goods and Services group rose by +3.6% YoY in March compared to +3.7% in February,” said Public Investment Bank in a recent report.

Price growth in Restaurants and Accommodation Services eased to +2.9% YoY in March from +3.5% previously. Inflation in Housing, Water, Electricity, Gas and Other Fuels slowed to +1.9% YoY from +2.3%.

Similarly, Alcoholic Beverages and Tobacco registered a softer increase of +0.8% YoY in March vs +0.9% in February while Furnishings, Household Equipment and Routine Household Maintenance edged up by +0.2% YoY from +0.3%.

Education and Recreation, Sport and Culture posted higher inflation in March at +2.2% YoY and +1.7% YoY respectively, compared to February.

In contrast, inflation in Food and Beverages (+2.5% YoY), Insurance and Financial Services (+1.5% YoY), Health (+1.0% YoY) and Transport (+0.7% YoY) held steady relative to the previous month.

Meanwhile, prices in Information and Communication and Clothing and Footwear remained in contraction, registering declines of −5.4% YoY and −0.2% YoY respectively, reflecting continued deflationary trends in those segments.

Core inflation, which excludes price-controlled and fresh food items, remained at +1.9% YoY in March, unchanged from February.

Excluding fuel-related components such as RON95, RON97 and diesel, the adjusted headline consumer price index (CPI) moderated to +1.5% YoY in March (Feb: +1.6%).

In March, the majority of states registered inflation rates below the national average of +1.4% YoY, with Wilayah Persekutuan Labuan recording the lowest increase at +0.6% YoY.

Conversely, four states posted inflation rates above the national level, led by Johor (+2.1%), followed by Selangor (+1.8%), Negeri Sembilan (+1.7%) and Melaka (+1.6%).

Key inflation drivers in 2025 include the targeted removal of RON95 petrol subsidies by mid-year, minimum wage adjustments, and an expanded scope of the Sales and Services Tax (SST).

Additional upward pressures could stem from further cuts to subsidies on essential items, potential electricity tariff revisions in the second half of 2025, and increased labour costs arising from mandatory EPF contributions for foreign workers and the implementation of the multi-tier foreign worker levy.

Industry sentiment suggests mounting concern over the timing of fiscal consolidation efforts, with businesses increasingly calling for a pause in policy measures that may raise operating costs, particularly following the announcement of US reciprocal tariffs.

A recalibration of the reform schedule could support a more contained inflation environment, especially if heightened global competition results in greater price discounting across import-dependent sectors.

While domestic cost pressures from mid-year policy changes, including fuel subsidy rationalisation, utility rate adjustments and labour-related levies, remain under watch, recent trends suggest a more gradual and possibly delayed passthrough to consumer prices.

Core CPI has picked up modestly, but underlying inflation remains contained, with limited evidence of broad-based spillovers.

On the external front, the introduction of the US Reciprocal Trade Tariff Act, despite the temporary 90-day pause, has reintroduced trade policy uncertainty.

This, combined with continued FX volatility and fluctuations in global commodity prices, could add to cost-side pressures in 2H25.

The impact is likely to be uneven across sectors, particularly those sensitive to import costs.

“We expect inflation to regain momentum in 2H25, with markets remaining cautious of further external shocks and evolving trade dynamics,” said PIB.

In PIB’s view, the trajectory of monetary policy in 2H25 will hinge on the timing and scale of domestic subsidy rationalisation, outcomes of ongoing tariff negotiations, and further trade policy shifts by the US and China.

With domestic activity broadly aligning with Bank Negara Malaysia (BNM)’s baseline projections and downside risks to growth remaining, PIB expects the MPC to adopt a cautious stance and keep the policy rate unchanged in the near term.

The recent introduction of the US Reciprocal Trade Tariff Act, alongside potential retaliatory measures and sector-specific trade actions, adds a layer of uncertainty to Malaysia’s external outlook.

While BNM is expected to remain on hold barring any material shock to the growth or inflation path, incoming data on global trade disruptions and their spillovers to the domestic economy will be closely scrutinised.

The governor’s recent remarks underline that monetary policy has limitations in addressing trade-related shocks and reaffirm the availability of other policy tools to mitigate external pressures. —Apr 25, 2025

Main image: iStock