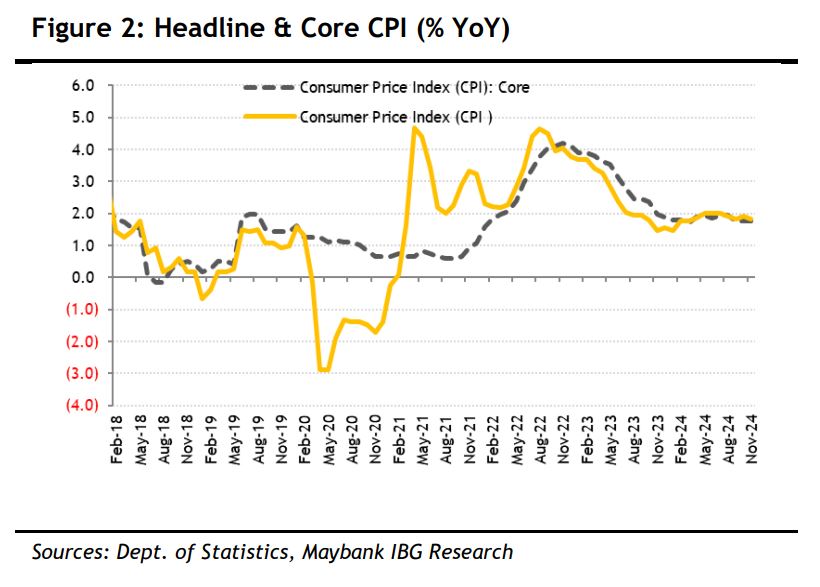

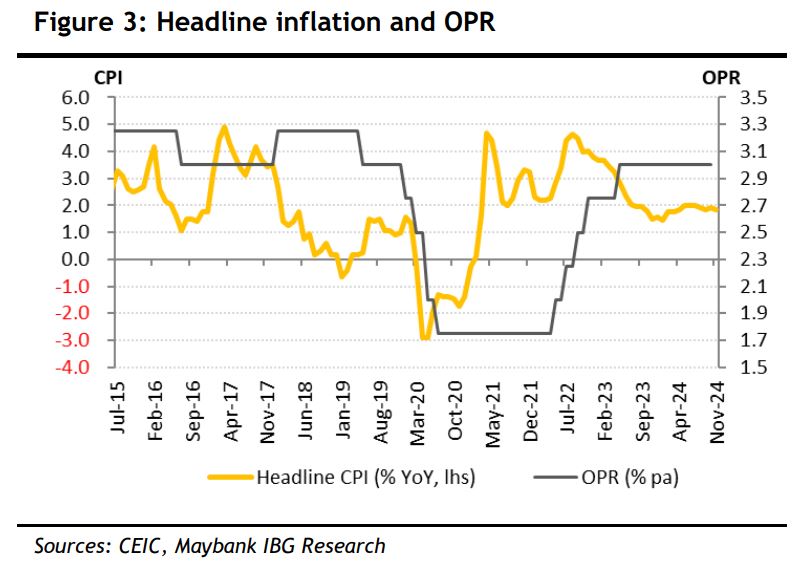

Headline inflation eased slightly to +1.8% year-on-year (YoY) in Nov 2024 while core inflation stayed at +1.8% YoY.

“Maintain headline inflation’s 2024 estimate of +1.9% and 2025 forecast of +3.0% has factored in impact from the Budget 2025 measures that is RON95 petrol subsidy rationalisation and higher labour costs,” said Maybank Investment Bank (MIB) in a recent report.

Labour costs comprises the minimum wage hike, foreign workers’ multi-tier levies and mandatory EPF contribution.

Headline inflation rate eased slightly to +1.8% YoY and declined month-on-month (MoM) by -0.1%.

Slower rises in costs of Healthcare and Transport offset higher increases in the prices of Food & Beverages (F&B) amid the effect of monsoon season and Housing, Water, Electricity, Gas & Other Fuels on elevated inflation of water supply.

Meanwhile, inflation rate ex-fuel prices and core inflation were unchanged.

The inflation impact of broadening of services tax base and its rate from 6% to 6%-8% range effective 1 Mar 2024 is muted, as per stable services inflation as the tax rate on F&B and telecommunication services remains at 6%.

Impact from the diesel price adjustment in Peninsular Malaysia on 10 June 2024 following the government’s targeted diesel subsidy rationalisation is also limited, from the previous blanket subsidised price of RM2.15 per litre to a two-tier diesel price.

The unsubsidised price of diesel has been on a downtrend since the week beginning 8 Aug 2024 (RM3.30/litre from 10 June 2024’s RM3.35/litre) to the current week (19 Dec 2024: RM2.95/litre), unchanged since week beginning 19 Sep 2024.

Consequently, diesel inflation in Nov 2024 remained at +15.0% YoY.

Diesel’s low weight in the CPI basket of goods and services of 0.2% (vs 5.5% for petrol) means the direct impact of targeted diesel subsidy rationalization on inflation is small.

The knock-on effect on the prices of other goods and services was contained by the continued diesel subsidies for eligible logistics vehicles.

MIB maintains inflation forecasts for 2024 at +1.9% and for 2025 at +3.0%, with the upside risk to next year’s consumer prices, taking into account of potential impact of Budget 2025 announcements.

This is namely the RON95 subsidy rationalisation and higher labour costs, that is the minimum wage hike, foreign workers’ multi-tier levies and mandatory EPF contribution. —Dec 23, 2024

Main image: rbcroyalbank.com