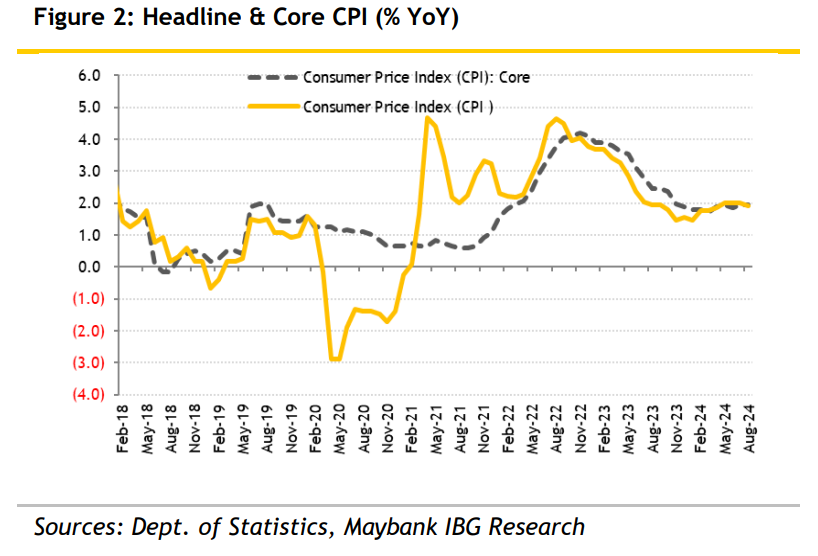

HEADLINE inflation eased to +1.9% year-on-year (YoY) in Aug 2024 while core consumer price index (CPI) remained steady at +1.9% YoY.

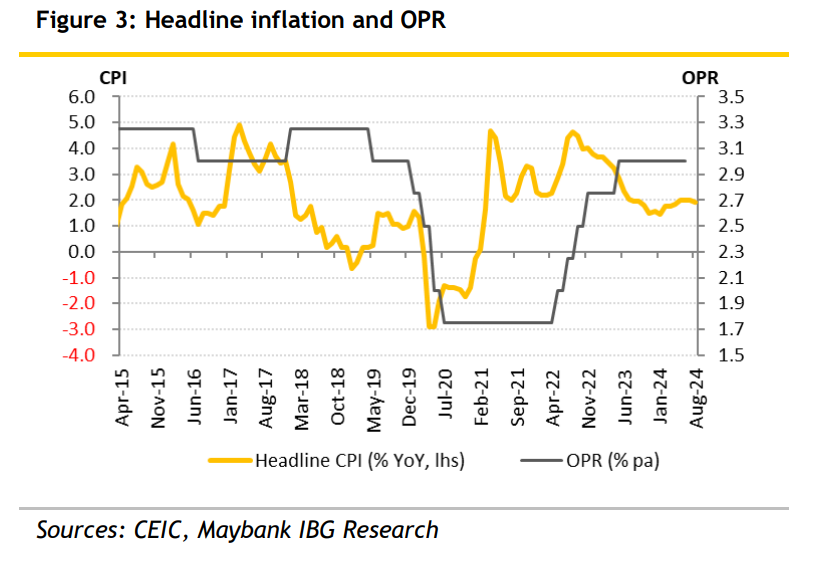

“We maintain our 2024 and 2025 inflation forecast at +2.0% and 2.5%-3.0% range respectively amid the uncertain timing, quantum and mechanics of RON96 subsidy rationalization,” said Maybank Investment Bank (MIB) in a recent report.

1/ Headline inflation rate moderated to +1.9% YoY in Aug 2024.

2/ Food & Beverages (F&B) remained at +1.6% YoY in Aug 2024 like other key CPI components.

3/ Housing, Water, Electricity, Gas & Other Fuels inflation eased to +3.1% YoY following water tariff hike on 1 Feb 2024, which caused the “water supply” component of CPI to be +29.3% higher in Aug 2024 than a year ago.

4/ Transport inflation picked up slightly at +1.3% YoY while non-food inflation slowed to +2.0% YoY.

Month-over-month, headline inflation sustained at +0.1%. Meanwhile, inflation rate ex-fuel prices moderated to +1.9% YoY, similar to the momentum for core inflation.

The inflation impact of broadening of services tax base and its rate from 6% to 6%-8% range effective 1 Mar 2024 was mild, as per services inflation as the tax rate on F&B and telecommunication services remains at 6%.

Plus, there are the exemptions for selected logistics services (for example, freight forwarders; haulage, warehouse, port terminal and conventional truck operators) and repairs and maintenance services of residential properties.

There was also muted impact from diesel price adjustment in Peninsular Malaysia so far, which was set higher at RM3.35 per litre from RM2.15 per litre from 10 Jun 2024 as the government embarked on targeted diesel subsidy rationalisation while prices remain unchanged for East Malaysia and eligible logistics vehicles and fishermen.

Nonetheless, the unsubsidized price of diesel has trended lower from the week beginning 8 Aug 2024 (RM3.3 per litre) to current, week beginning 19 Sep 2024 (RM2.95 per litre) following lower crude oil price (22 Sep 2024: USD76.075) and stronger Ringgit versus USD (20 Sep 2024: RM4.2037).

Diesel inflation was at +21.0% YoY and -1.2% MoM. Diesel’s low weight in the CPI basket of goods and services of 0.2% versus 5.5% for petrol means the direct impact of targeted diesel subsidy rationalisation on inflation is small, although the wildcard to keep an eye on is the knock-on effect on prices of other goods and services in coming months.

With the mild inflation effect from the services tax adjustment and diesel subsidy rationalisation plus the likely “no show” of RON95 subsidy rationalisation this year, MIB maintains their full-year 2024 inflation forecast to +2.0%.

This assumes that the blanket RON95 petrol subsidy holds, and its price remains at RM2.05 per litre for the rest of the year.

“For 2025, we maintain our 2.5%-3.0% range inflation on the back of the uncertain timing, quantum and mechanics of RON95 subsidy rationalisation, which we assume to take place next year,” said MIB. – Sept 24, 2024

Main image: nytimes.com