IT is often said that in gambling/betting, the operators are likely to topple their opponents (gamblers/betters) nine out of 10 times.

“In gambling, there’s one certainty – one thing not left to chance: The house always comes out the winner in the end,” deduced an Investopedia article entitled “Why Does the House Always Win? A Look at Casino Profitability”.

“A casino is a business, not a charitable organisation throwing free money away. Like any other business, it has a business model in place designed to ensure its profitability.”

This could be the underlying ‘truth’ to support Genting Bhd’s “buy” rating by numerous research houses despite the casino operator incurring yet another round of quarterly core loss of RM326.7 mil in its recent 3Q FY2021. This nevertheless is still line with RHB Research’s expectations.

“Moving forward, we can expect stronger quarters ahead with the opening of Resorts World Genting (RWG) and ongoing recovery from its overseas operations as the business environment normalises,” projected analysts Loo Tungwye and Lee Meng Horng in a results review.

“Valuation remains attractive to position for a tourism-recovery play and as a cheap proxy to buy into the growth of Resorts World Las Vegas (RWLV).”

Doubtlessly, RMLV may well be Genting’s proxy to find a safer haven outside the Malaysian shores amid rising concerns that Malaysia may embrace a stronger Islamic stance after the 15th General Election (GE15) amid PAS-driven agenda to prohibit gaming-related activities (including number forecast and horse racing) – and even alcohol production (breweries).

Probably, foresight is the keyword here as the Genting group has actually started the process of spreading it wings outside its home base about 15 to 20 years ago by diversifying its business interests to Australia, Singapore and the US.

Nevertheless, Genting lacks ‘gambling luck’ with regard to Japan as its proposal to erect a casino complex or “integrated resort” (IR) in the Yokohama metropolis was ditched by the city’s newly-elected anti-casino mayor Takeharu Yamanaka.

UOB Kay Hian Research was impressed with RWLV’s strong debut which culminated in an impressive revenue of US$175 mil (RM723 mil) and EBITDA (earnings before interest, taxes, depreciation, and amortisation) of about US$27 mil (RM110 mil) in 3Q FY2021.

“The results would have been better if RWLV had not been impacted by Nevada’s mandate requiring face masks since July 30 which have caused several conventions to be cancelled,” opined head of research Vincent Khoo.

“We believe that the strong industry-wide rebound could enable RWLV to positively surprise on earnings in coming quarters although it remains to be seen whether such encouraging achievements can be sustained past the ‘revenge spending’ phenomenon.”

A bullish Khoo added: “Nevertheless, we expect RWLV to eventually thrive in the Vegas Strip over the longer term, as visitation growth will be further electrified by the Allegiant Stadium and Las Vegas Convention Centre.”

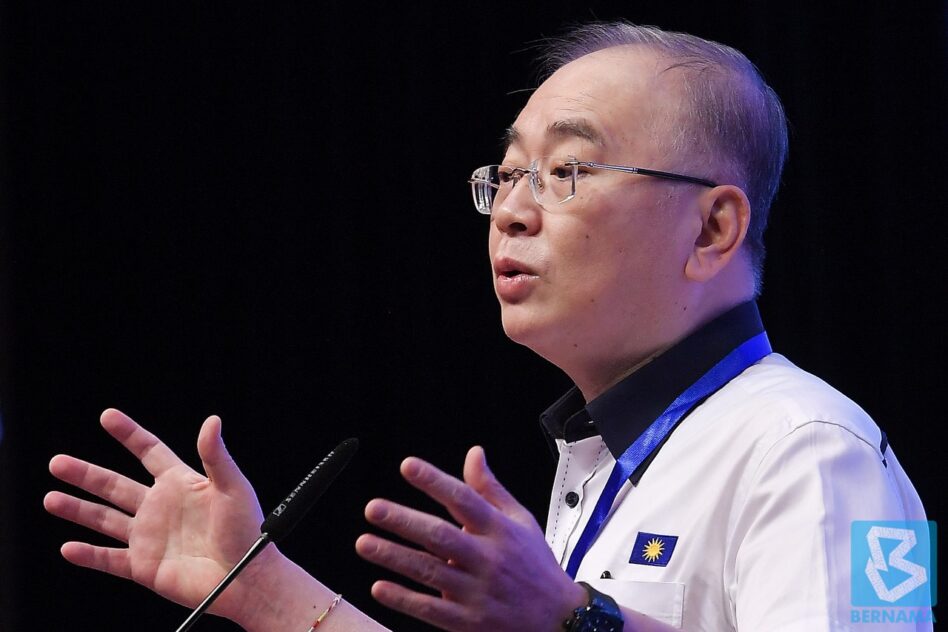

Pitted against the recent number forecast debacle mooted by controversial Kedah Menteri Besar Datuk Seri Muhammad Sanusi Md Nor – which could well serve as a harbinger for prohibition of gambling-related activities across Malaysia – the Genting group has probably acted wisely by searching for a more conducive environment elsewhere to grow it business.

As of yesterday’s (Nov 26) close of trading, Genting was down 22 sen or 4.45% to RM4.72 with 18.39 million shares traded, thus valuing the company at RM18.3 bil. – Nov 27, 2021