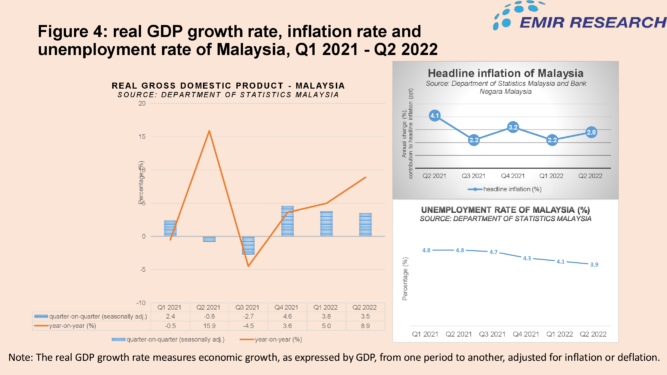

UNDOUBTEDLY the international border reopening effective April 1, 2022, enabled Malaysia to achieve a higher economic growth rate of 8.9% year-on-year (y-o-y) during the second quarter of the year (Q2 2022), which outperforms the market forecast of 6.7%.

Even so, it will be from a previously lower base effect accumulated since the third quarter of last year when the economy contracted by 4.5% (due to enhanced lockdown measures imposed to stop the “third wave” of COVID-19).

However, it is still way too early to tell whether Malaysia remains consistently on a positive economic trajectory for the next two quarters (Q3 and Q4 2022) as well as next year.

The Statistics Department revealed a substantial rise in the headline inflation rate since Q2 2022 – from 2.3% y-o-y in April to 2.8% and 3.4% in May and June, respectively.

Among all items, the food and non-alcoholic beverages category remains the main contributor (i.e. in terms of the levels) to the overall inflation rise – from 4.1% in April to 5.2%, 6.1% and 6.9% in May, June and July, respectively. Apart from that, the restaurants and hotels group recorded a rise in inflation from 5% in June to 5.8% in July.

However, in terms of the percentage increase month-on-month (m-o-m), the housing, water, electricity, gas and other fuels category experienced the most increment (i.e. in terms of the differences) by 2.6% – from 1.2% in June to 3.8% in July.

The reason is due to the lower base effect last year as a result of the electricity bill discount given to households under the People’s Well-Being and Economic Recovery Package (Pemulih) from July to September 2021.

The increase in headline inflation also reflected higher core inflation – which measures changes in prices of all goods and services but excludes prices of volatile items of fresh food and goods controlled by the government – going up to 3.4% in July.

Although Malaysia’s unemployment rate in July is yet to be known, would the rising cost of inflation have negative implications for the country’s labour force participation and economic growth rates in Q3 and Q4 2022?

Comparing Malaysia with its trading partners

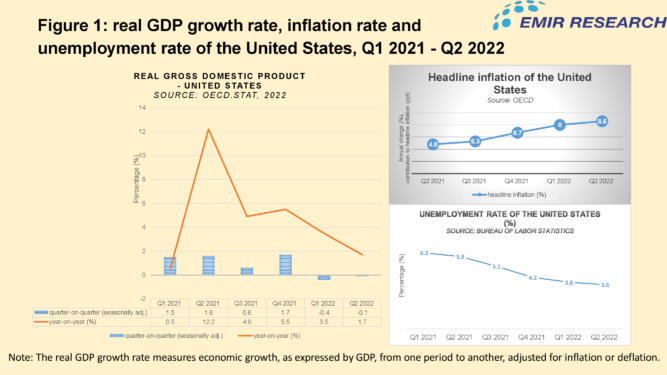

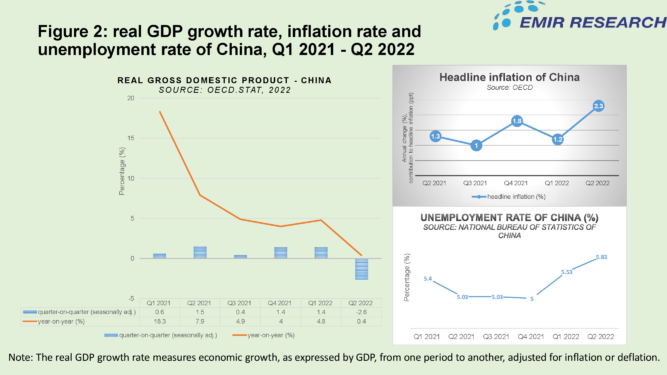

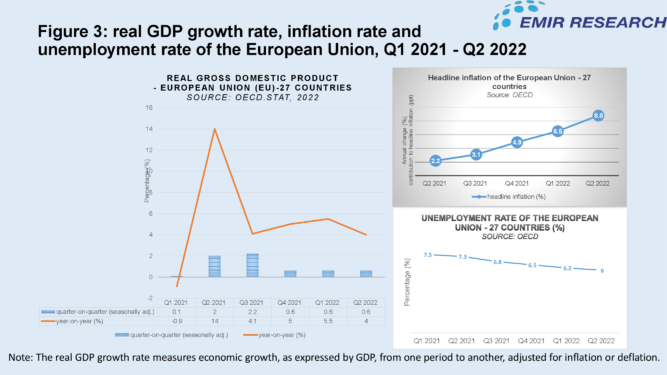

First, let us make a comparison with Malaysia’s main trading partners such as the US (Figure 1), China (Figure 2) and the European Union or EU (Figure 3) based on the economic indicators of real gross domestic product (GDP), growth rate, inflation rate and unemployment rate.

Although the US Federal Reserve raised its policy interest rate three times during the final month of Q1 2022 (March) and the last two months of Q2 2022 (May and June), the measures have not helped ease inflation (i.e. looking backwards from now all the way back to the inaugural rate hike) – even with the time-lag; the headline inflation of the US reached 8.6% as of Q2 2022.

A longer time lag is not expected to allow the Fed’s rate hikes to do their cumulative job, either.

According to the San Francisco Fed branch, consumer demand-side only accounts for one-third (at most) of the inflation surge.

Notwithstanding, whatever the composition or, in other words, irrespective of the demand level, the impact of pre-existing supply-side constraints and bottlenecks on prices cannot be brought down by interest rate hikes except only by increasing unemployment as a deflationary tool.

With two consecutive quarters of declining real GDP growth rate (from -4.1% to -0.1% per cent m-o-m), the US has already entered into a technical recession.

The EU, on the other hand, has been experiencing an accelerating rate of inflation – from 2.2% in Q2 2021 to 8.8% in Q2 2022.

Nonetheless, the EU is yet to enter into recession as it only experienced a decline in the real GDP for one quarter – from 5.5% y-o-y in Q1 2022 to 4% in Q2 2022.

Meanwhile, due to its ongoing zero COVID-19 policy (with strict lockdown measures and travel restrictions imposed countrywide), China’s economic growth has dropped drastically since 2021.

Although there is a slight improvement in the real GDP growth rate – at 4.8% y-o-y during Q1 2022 – this only lasted for one quarter. As of Q2 2022, China’s real GDP growth rate was only 0.4%.

While the US, EU and Malaysia experienced lower unemployment rates over six financial quarters (from Q1 2021 to Q2 2022), China witnessed an increase in the unemployment rate since Q4 2021 – from 5% to 5.83% in Q2 2022.

Will a fall in the real GDP growth rate and a rise in inflation and unemployment rates imply that China is entering into stagflation territory soon? (Stagflation is an economic condition characterised by stagnant economic growth, accelerating inflation and high unemployment.)

As China only underwent a fall in the real GDP for one quarter and inflation has fluctuated, the country cannot be said yet to be in a recession or stagflation for now.

The risk of a recession

With declining economic growth from the US and EU and even China too expected to join the ranks, Malaysia faces the risk of experiencing a recession by the end of this year:

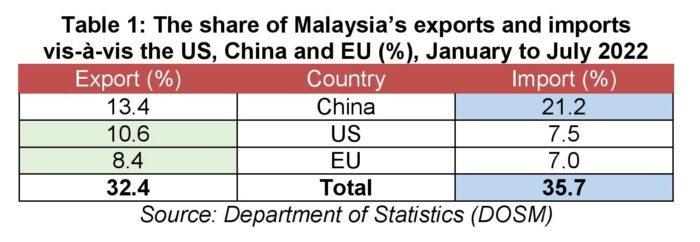

Table 1 shows Malaysia importing over one-third (35.7%) of goods from the same main trading partners. Monetary policy that strengthens the currency would affect the exchange rate and hence our cost of imports – with particular reference to the US (and to a much lesser extent, the EU).

Since the Fed approved the first interest rate hike on March 16, the ringgit has witnessed a depreciating trend. US$1 was equivalent to RM4.1967 that day.

However, the frequent interest rate adjustments from the US have resulted in a more expensive dollar relative to the ringgit; as of Sept 1, US$1 traded for RM4.4829.

When the European Central Bank (ECB) raised its key interest rate by 0.5 percentage points to 0.0% on July 21, EUR1 was equivalent to RM4.5333. As of Sept 1, EUR1 traded for RM4.4661, cheaper than two years ago (EUR1 equalled RM4.9381 on September 1, 2020).

While it is good news that the ringgit has appreciated with respect to the euro over the past two years, Malaysia’s over-reliance on food imports will still result in more expensive bill.

When the People’s Bank of China (PBoC) unexpectedly lowered the interest rates for medium-term lending facilities (MLF) and reversed operations by ten basis points on Aug 15, CNY1 was equivalent to RM0.6583. As of Sept 1, CNY1 traded for RM0.6498.

Although the ringgit appreciated in relation to the renminbi over the past two weeks, Malaysians will still find goods from China are now more expensive compared to two years ago. As of September, 2020, CNY1 was only worth RM0.6067.

In 2020, Malaysia imported RM55.5 bil in food products compared to its exports of RM33.8 bil, leaving it with a deficit of RM21.7 bil. When more dollars are required to purchase the same amount of imported food and goods, this will continue to exert downward pressure on the ringgit.

There is an increasing concern that Malaysians will further cut their spending if food inflation rises between 7 to 8% in August and September; when aggregate demand drops, it will contribute to lower real GDP growth.

The plausibility of the rise in food price inflation also correlates with findings from Bank Negara (BNM). According to its Quarterly Bulletin for Q2 2022, headline inflation is expected to trend higher during the remainder of the year.

Although BNM adjusted the overnight policy rate (OPR) twice this year, the policy measure has not helped mitigate inflation.

The increase in OPR implies that those servicing housing and car (and other personal) loans have to pay more for their monthly instalment payments.

Indirectly, it has increased the financial burden of households, especially among the lower middle 40 and bottom 40 income (M40 and B40) households struggling to cope with various living expenses such as food, utilities, children’s education and medical treatment and so on in this rising cost-of-living period.

As Malaysia’s favourable economic growth during Q2 2022 (see Figure 4 above) was mainly driven by Government policy initiatives, private consumption grew at 18.3% y-o-y compared to the previous financial quarters.

The implementation of the minimum wage hike, Bantuan Keluarga Malaysia (BKM) cash transfers, Employees Provident Fund (EPF)’s special withdrawal scheme of RM10,000 and the Sales and Services Tax (SST) exemption for new vehicles were among the policy support that provided an additional boost to consumer spending.

Notwithstanding, would Malaysians be able to allocate more money out of their savings when they exhaust all of their EPF withdrawals and cash assistance from the Government – at a time when the OPR hikes are contributing to higher costs of living and doing business?

It would, therefore, seem to be overly optimistic for Prime Minister Datuk Seri Ismail Sabri Yaakob to claim that Malaysia’s projected economic growth could achieve between 5.3 to 6.3% growth in 2022.

In a nutshell, to avoid Malaysia moving towards recession or even the possibility of stagflation, the Government should take pro-active and pre-emptive steps to effectively and properly manage the cost-of-living crisis affecting businesses and households by requesting BNM to halt any impending OPR hike and, instead, plan for monetary “loosening” with a drastic reversal by Q4 this year.

This will give the rakyat a much-needed breathing space – to recover and build up their savings.

At the same time, the Government needs to discuss with the central bank on what should constitute policy normalisation going forward.

Not least, as has been consistently called for by EMIR Research, the Government needs to also embark on greater/closer fiscal and monetary policy coordination.

This will ensure that deficit spending is not leaked towards higher interest payments (for our bonds), for example. — Sept 11, 2022

Amanda Yeo is a research analyst at EMIR Research, an independent think tank focused on strategic policy recommendations based on rigorous research.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.