FOR decades, this question has been resurfacing: Will the US dollar (USD) continue to be the world’s dominant reserve currency and continue to dominate the international monetary system?

The greenback’s share of the world’s foreign exchange reserves has been falling gradually. Structural changes in global economic and financial order as well the fintech evolution have weakened the USD’s market share in global cross-borders payment systems.

The US Federal Reserve’s resolve to get soaring inflation (9.1% in June 2022) back down to a more acceptable level (US Fed’s inflation target of 2%) through more interest rate hikes has nevertheless helped to strengthen the USD.

The broad US Dollar Index which had strengthened by 3.5% in 2021 continued to increase by 7.1% as of mid-July 2022.

Higher Treasury yields have made the USD more attractive to long-term investors, especially central banks and sovereign funds as they take into account the inflation’s return impact on their strategic allocation of assets and portfolio investment.

As of Aug 1, the US bond yields (at the levels of UST 2-yr at 2.8964%, 5-yr at 2.6911% and 10-yr at 2.6590%) are becoming more attractive compared with other comparable advanced and emerging bond markets.

This will increase if US inflation starts to slow which is likely to happen by 2023.

Reducing appeal

Enhancing the greenback’s appeal is the interest rate differential which became a natural tailwind for the USD.

With the US Fed’s hawkish bias to tackle inflation head on – which is reinforced by quantitative tightening (QT) that resulted in tighter financial conditions – this will prove a challenge for most assets classes and should help to buoy demand for the USD as a safe haven amid economic uncertainty and interest rate differential gains.

The USD’s dominant status as world reserve currency and its high liquidity has always been the investors’ undisputed safe haven currency choice.

In times of economic turmoil, investors’ flight to quality shed riskier assets and acquire less volatile ones. This happened during the 2008-2009 Global Financial Crisis when the global demand for the US government bonds was held steady.

Will the USD lose its dominance status in the global international system? Over the years, structural changes in the world economic and financial order, geopolitical power play as well as the emergence of new technology and digital payment have undermined the USD’s role.

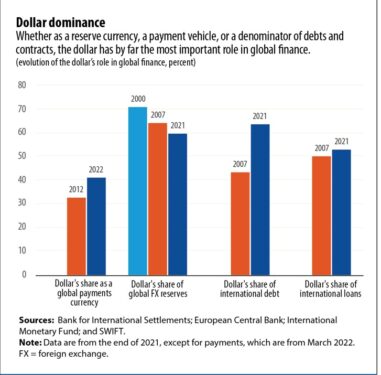

The USD’s share of global reserve currency has been shrinking to 58.9% in 1Q 2022 from 62.2% in 2010; 71.1% (2000) and 65.1% (1997). Have there been any significant shift into other reserve currencies?

It is observed that the reduced share of the USD hasn’t been matched by increases in the shares of the other traditional reserve currencies: the euro (1Q 2022: 20.1%, 2000:18.3%); Japanese yen (1Q 2022: 5.4%, 2000: 6.1%); and pound sterling (1Q 2022: 5.0%, 2000: 2.8%).

It is further observed that currencies of smaller economies such as the Australian dollar, South Korean won, Swiss franc, Swedish krona and other currencies have featured in recent years. The combined share of shifting from the USD stood at 7.85% in 1Q 2022 from 6.12% in 4Q 2016.

These smaller economies’ currencies are relatively less volatile and higher returns have appealed to the central banks and investors. New financial technologies have integrated online and cross-borders payment systems (automated market making and liquidity management) make it cheaper and easier to trade the currencies of smaller economies.

RMB’s challenging USD’s dominance

The bilateral swap arrangements and lines between some Asian central banks and the US Fed and the People’s Bank of China respectively are not only intended to meet the USD and Chinese renminbi (RMB) liquidity needs but to create confidence that their currencies will hold their value against the USD and RMB.

Nevertheless, it is observed that these non-traditional reserves’ currencies tend to fluctuate widely against the USD and they have rarely drawn on their bilateral swap lines with the US Fed.

A regression analysis shows that having a US Fed swap line is associated with a 9-percentage point increase in the USD share of the recipient’s reserves.

Will RMB’s rise challenge the USD’s dominance? Although the share of RMB in held as reserves more than double to 2.88% in 1Q 2022 from 1.08% in 4Q 2016, its increasing share is constrained by the country’s relatively closed capital account.

China has entered into bilateral currency swap agreements with 41 countries around the world from 2009 to 2020 with the total amount exceeding RMB3.5 tril (US$554 bil).

These agreements allowed the central banks to settle bilateral trade and investment transactions in RMB or other local currencies.

This in a way will gradually reduce the reliance on the USD and also to avoid minimise the USD value of local currencies due to the US Fed’s tighter monetary policy.

The important attributes for the international acceptance of the currency of a particular country as a global reserve currency is such that the currency not only carries a significant weight of economic and financial, but is a reliable and stable unit of exchange (safe haven status).

Moreover, the fundamental value of the currency must be backed by the stability of the economy and financial system, the implementation of track records of sound, transparent and predictable policies. – Aug 8, 2022

Lee Heng Guie is the executive director at Socio-Economic Research Centre (SERC) Malaysia.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.