FORMER UMNO supreme council member Isham Jalil has trolled the Madani government for having amassed a national debt circa RM200 bil – or an average of RM90 bil-RM100 bil a year – in the almost two years it has been in power.

This follows revelation by the Auditor-General’s Report on Minday (Oct 14) that the Federal government’s debt was recorded at RM1.173 tril in 2023 or an increase of RM92.918 bil or 8.6% from RM1.080 tril in 2022 (2018: RM686 bil),

The debt consists of domestic loans amounting to RM1.143 tril or 97.5% of the total federal debt and foreign debt totalling RM29.851 bil or 2.5%.

“In simple language, this is like saying ‘I take a loan to spend more and pay the debt’,” teased the now opposition-slant former UMNO information chief after Finance Minister II Datuk Seri Amir Hamzah Azizan claimed that the government did not borrow excessively but only to fund fiscal deficit and maturing debt.

“Non (referring to Prime Minister Datuk Seri Anwar Ibrahim) has added close to RM200 bil in two years of his reign. And he said debt level has fallen, leading to all-round cheer by his supporters that the country’s debt is on the way down.”

“This is the consequence when you hang out with the Madani gang for their maths can be confusing.”

In an earlier FB post, Isham further took a swipe at the Madani government for having compared debt level during the COVID-19 era when the then Perikatan Nasional (PN) administration incurred RM100 bil debt “to give out financial aids to the people during the pandemic and MCO (movement control order)”.

“Before COVID-19 the government only owed an average of RM30 bil-70 bil year,” contended the once special officer to incarcerated former premier Datuk Seri Najib Razak.

“In contrast, the Madani government has further removed subsidies which led to diesel price increase with new taxes already implemented or underway which resulted in the cost of goods and services having spiralled.”

Added Isham: “They want to spend big. Before this, I’ve said that today’s government is one of big taxes and big spending. When their policy is such, this pushes the costs of goods and services upward which promoted consumer prices to skyrocket, thus leaving laypeople in a quandary.” – Oct 16, 2024

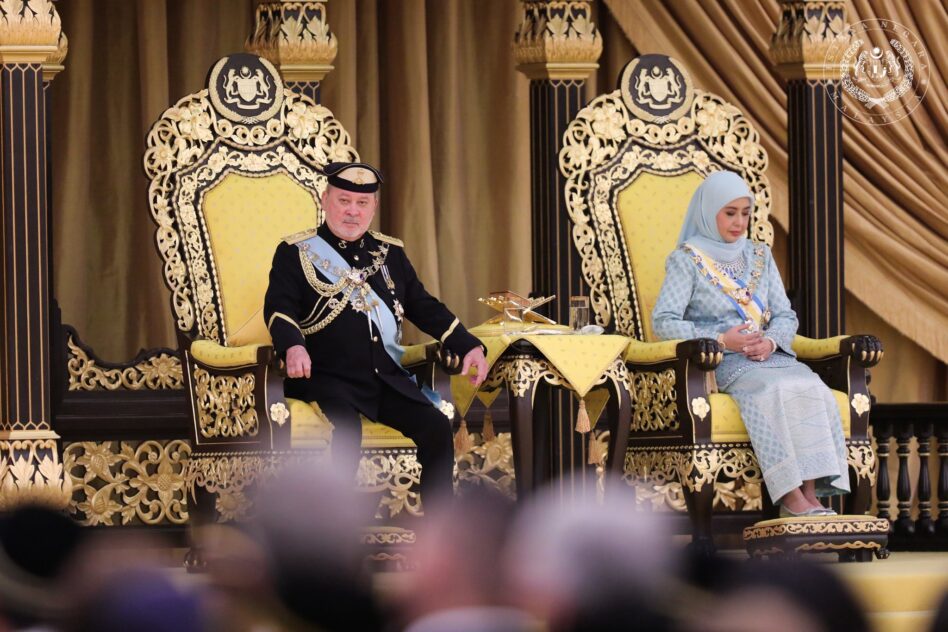

Main image credit: Malay Mail