YESTERDAY, an economist attempted to downplay the depreciation of the ringgit by saying that the Malaysian currency was not the only one affected.

Juwai IQI chief economist Shan Saeed told Astro Awani that like ringgit, currencies such as the Yen, Yuan, Euro, Pound Sterling and the Swiss Franc were also affected.

“What I’m saying is that it’s not that the ringgit is weakening but the USD is strengthening, which has upped by 6.8%.

“And I project that the ringgit will be traded between 4.25 and 4.50 against the greenback as investors are prioritising the USD and gold for now,” he noted.

Shan added that he was sceptical over USD’s long-term performance as Goldman Sachs, JP Morgan and Bank of America have forecast that it would weaken in this quarter.

“This is because the strengthening of USD is not good for the global economy and its own country,” he quipped.

However, the economist’s view was not well-received by netizens who later took to social media to criticise him.

“Kalau dollar AS mengukuh kenapa pula dollar Singapore tidak terkesan. Pakar jawab lah,” Juki Panggi.

(If USD is strengthening, then how come the SGD remains steady? Can the expert explain that to me?)

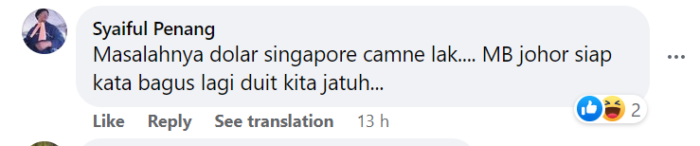

Echoing Juki Panggi’s sentiments, user Syaiful Penang added:

(Then how come the SGD is doing well? The Johor MB even claimed that it’s good that our currency is depreciating in value)

Netizen T Wong jested:

(It’s okay to lose but we must go down in style. It’s a not about the ringgit weakening but the USD is way too strong)

On April 25, Bloomberg reported that after hitting a five-year high the week before, the SGD continued its upward trend against the ringgit by posting an all-time high of 3.1688.

Compared to US dollar, the ringgit was valued at RM4.3568 against the greenback. As of April 29, the ringgit closed at RM3.14 to SGD1.

Several experts and politicians have warned the Government to act on the matter immediately as the downward trend would impact Malaysians’ already depleting purchasing power.

UMNO supreme council member Datuk Seri Ahmad Shabery Cheek cautioned that the ringgit’s downward trend will affect the country’s export value.

“China, for example, is one our largest trading partners but its series of lockdowns over COVID-19 is affecting their economy and in turn, our exports.

“Plus, the weakening ringgit will also increase our import bill. Food prices will soar further and our agriculture related costs will spike too.

“And this problem will get worse if fuel prices keep rising too,” the former minister mentioned.

Ringgit’s problems a long-standing issue

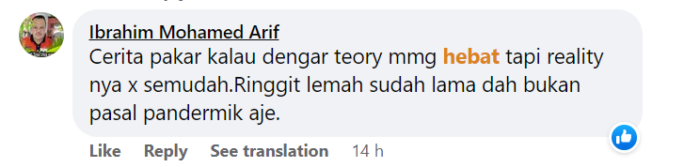

On that note, user Ibrahim Mohamed Arif reminded everyone that the weakening of ringgit is a longstanding problem and affecting Malaysian even before COVID-19 came by.

(The experts can come up with all sorts of theory but the reality is different. The problems plaguing our currency has been going on for a long time, not due to the pandemic alone)

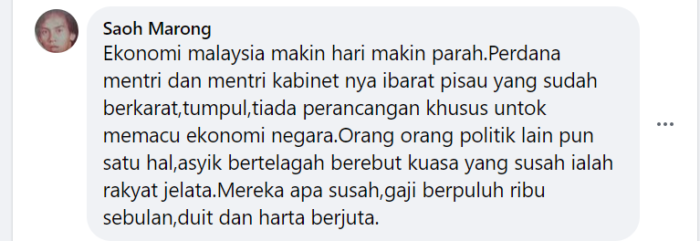

Netizen Saoh Marong remarked: “Ekonomi malaysia makin hari makin parah.Perdana mentri dan mentri kabinet nya ibarat pisau yang sudah berkarat,tumpul,tiada perancangan khusus untok memacu ekonomi negara.Orang orang politik lain pun satu hal,asyik bertelagah berebut kuasa yang susah ialah rakyat jelata.Mereka apa susah,gaji berpuluh ribu sebulan,duit dan harta berjuta. – May 10, 2022

(The Malaysian economy is in dire state but our prime minister and his team are clueless. They have no plans to revitalise the economy but are too busy with their political infighting on top of enjoying salary and perks costing millions, at the expense of an already suffering populace)