KENANGA Research sees a successful integration of LPI Capital Bhd into the Public Bank Group which was a subject of takeover by Malaysia’s third largest bank by assets earlier this month as capable of yielding long term financial benefits to Malaysia’s sixth largest general insurer.

The foreseeable synergies include tapping into Public Bank’s extensive branch network, more cross selling and higher flow-through from its industry-leading lending business.

“These are not reflected in our forecasts for now, pending its (LPI) successful integration into the Public Bank group,” analyst Clement Chua pointed out in a LPI results review.

“According to Public Bank, less than 25% of LPI’s revenues previously were made up of referrals from Public Bank (mainly from its mortgage business), suggesting more opportunities to collaborate in the future.”

Kenanga Research expects this to be more applicable to LPI’s non-residential mortgage and motor financing business of which in Public Bank’s books stand at RM86.4 bil and RM72.3 bil respectively while LPI’s insurance contracts amount to RM2.3 bil.

“Moreover, LPI will be able to tap into Public Bank’s 260-strong branch network for cross-selling with minimal investment on LPI’s front,” projected the research house.

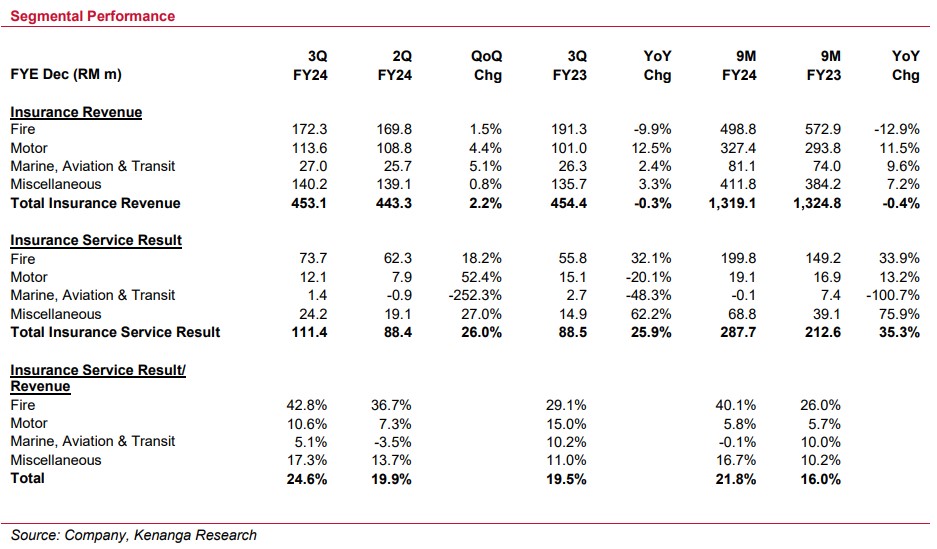

Kenanga Research further deemed LPI’s 9M FY2024 net profit of RM303.2 mil (up 29% year-on-year) to be within expectations due to typically softer reporting in 4Q periods as claims may pick up on higher seasonal movements and dividend income to narrow.

“With LPI facing sustained challenges in the fire insurance space following the industry’s de-tariffication, we opine that the recently announced acquisition by Public Bank (“outperform”; target price: RM5.10) is timely,” reckoned the research house.

All in all, Kenanga research retained its “outperform” call on LPI with a target price of RM15 based on an unchanged 2.6 times FY2025F price-to-book value (PBV) evaluation.

“This represents a 25% premium against the industry average of 2.1 times which we believe is fair given: (i) better net margins of 17% (vs peer’s 11%); and (ii) higher dividend returns of 6%-7% (vs peer’s 4%-5%),” suggested the research house.

“LPI’s premium valuation may also be supported by its long-term viability from its affiliation with Public Bank with the pending acquisition further solidifying synergies.”

Risks to Kenanga Research’s call include (i) lower premium underwritten; (ii) higher-than-expected claims; and (iii) higher-than-expected management expense ratio.

At 11.25am, LPI was down 6 sen or 0.44% to RM13.44 with 24,100 shares traded, thus valuing the insurer at RM5.35 bil, – Oct 30, 2024