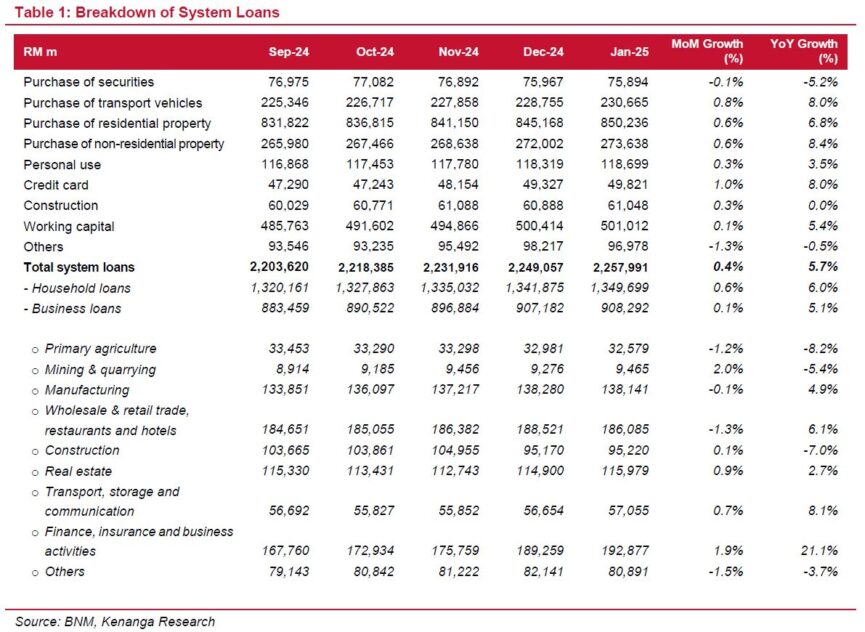

IN JAN 2025, system loans grew by 5.7% being sustained by household loans (+6.0%) as residential mortgage and hire purchase remains supportive.

Business loans (+5.1%) improved with more funding to service and retail sectors.

“On a month-on-month basis, we saw similar movements with households (+0.6%) outpacing business loans (+0.1%) as consumers were likely borrowing ahead of the year festivities,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

Substantiating their abovementioned statement, loan applications were up by 1% year-on-year (YoY) but entirely due to higher business loan applications (+20%) whereas household loan applications eased (-11%).

This was similarly seen on a MoM basis, where business loan applications rose by 35% and household loan applications declined by 5%.

The rise in applications (largely working capital) could be to finance more SME set ups ahead of Hari Raya festivities in March, though Kenanga is watchful for a slowing down in numbers during the month itself.

As banks take greater precaution on the inflow of applicants, loan approval rates have dropped to 42.4%.

Industry gross impaired loans came in at 1.46% (Dec 2024: 1.44%) slightly creeping up from the lowest reported point in Dec 2024.

“We attribute this to possible pivots in cash flows as consumers and businesses may allocate their funds into more festive spending, thereby deferring loan repayments which also fell by 4.9% YoY,” said Kenanga.

Kenanga opines that banks are guarded by such seasonal trends, loading up industry LLC to 91.6% (Dec 2024) ahead of potentially prolonged delinquencies.

On the business side, we remain watchful on potential turnarounds to asset quality which could arise from:

(i) unfavourable trade policies introduced in the Trump administration.

(ii) tighter-than-expected RON95 subsidy rationalisation.

(iii) setbacks in data centre development.

Jan 2025 deposits grew by 3.1% YoY but were flattish MoM. Current Account Savings Account (CASA) ratio also remained stagnant at 28.7% as depositors remained discouraged by the relatively low interest rates in the market.

Closing up the results reporting season, most banks are eyeing for some challenges in maintaining interest margins but remain confident on loan growth (averaging between 5%-6%).

This ties well with Kenanga’s projection for industry loan growth to come in at 6% on the back of ongoing developments in Johor’s Special Economic Zone and ongoing data centre projects, supported by a stable OPR of 3% anticipated throughout CY25.

“We hold a deposit growth target of 3% as we reckon banks are not likely to grow more aggressively with their offered rates in the near-term,” said Kenanga.

A cheaper funding cost structure benefits retail-centric banks as corporate wholesale deposits typically demand more attractive rates, which Kenanga sees the likes of AMBANK pivoting away from.

If an easing in funding cost comes quicker-than-expected, Kenanga sees greater relief in the likes of RHBBANK and MBSB who saw the largest sequential decline in 4QCY24. —Mar 3, 2025

Main image: Linkedin