MALAYSIAN Oct palm oil output of 1.79mil metric tonnes was slightly below the 10-year average but within Kenanga Research (Kenanga) and market’s expectations.

However, exports hit a 10-year high of 1.732mil metric tonnes for an Oct month leading to a closing inventory of only 1.885mil metric tonnes or 6% below Kenanga estimates but within consensus expectation.

Oct crude palm oil (CPO) price averaged at RM4,388 per metric tonnes, much stronger than Kenanga and industry’s expectations.

Despite record US soybean harvest and palm oil price premium rival soybean oil, Kenanga believe the confluence of poor Indonesian yield, pending year-end festivity and coming Chinese New Year and Ramadan demand as well as Indonesian plan to raise its biodiesel mix from B35 to B40 effective Jan calendar year 2025, will support prices.

“Thus, we are upgrading our CPO price assumption for calendar year 2024 to 2025 from RM3,800 per metric tonnes to RM4,000 per metric tonnes,” said Kenanga.

Trading at price book value of 1.2x and prospective price-earnings ratio of 16x, the downside risk of the sector looks limited.

Upstream and downstream margins are recovering and CPO prices are starting to trade between RM4,000-RM5,000 per metric tonnes.

“However, we maintain a NEUTRAL stance for the sector. Whilst firm palm oil demand is likely till quarter two calendar year 2025, demand should ease thereafter along with the seasonal supply uptick leading to easier CPO prices than current lofty levels of around RM5,000 per metric tonnes,” said Kenanga.

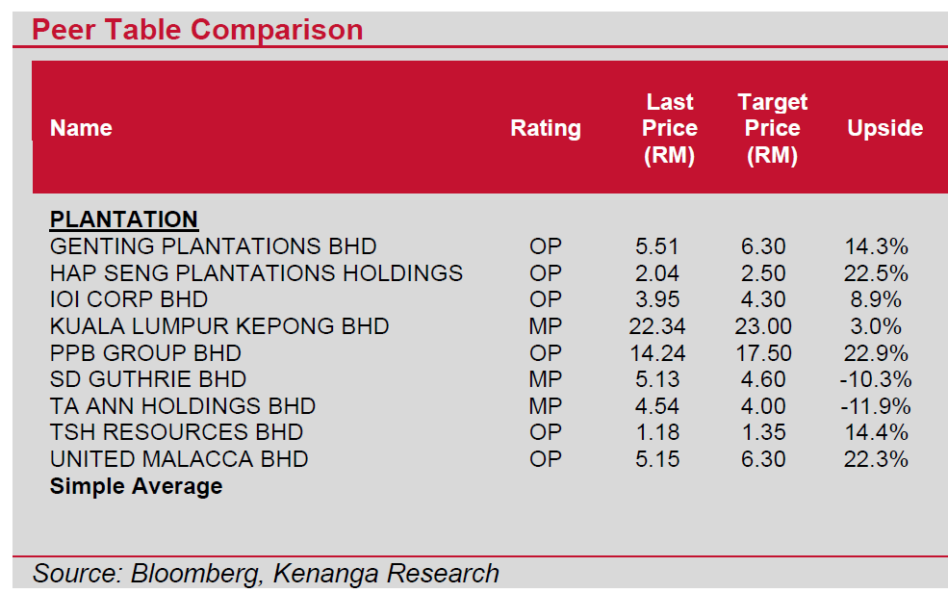

Kenanga has upgraded individual planters’ core earnings per share and target price. Due to higher gearing, KLK and SDG’s earnings are rather sensitive to CPO price changes.

However, purer upstream players such as HSPLANT, TSH and UMCCA offer more upside potentials with less demanding valuations. For similar reasons, Kenanga’s large cap picks are IOI and PPB. —Nov 12, 2024

Main image: asianagri