THE ringgit traded within a relatively stable range this week, initially weakening to above 4.45/USD on Monday, due to stability in the US equity market.

“However, it later firmed up, trading between 4.42–4.44 against the USD as global sentiment improved following softer US inflation prints,” said Kenanga Investment Bank (Kenanga) in the recent economic viewpoint report.

The USD index dipped below 102.6 after the inflation release, while the 10-year US Treasury (UST) yield fell below 3.85%, as markets fully priced in a September rate cut.

To note, the narrowing of the 10-year Malaysian Government Securities – US Treasury Securities negative yield differential to an average of -10.8 basis points this week has helped attract RM2.3 bil inflows into Malaysia’s domestic debt market, bolstering the ringgit.

Resilient US consumer spending, evidenced by a stronger-than-expected 1.0% month-on-month retail sales increase and a drop in jobless claims, reinforces our view that recession fears are overblown.

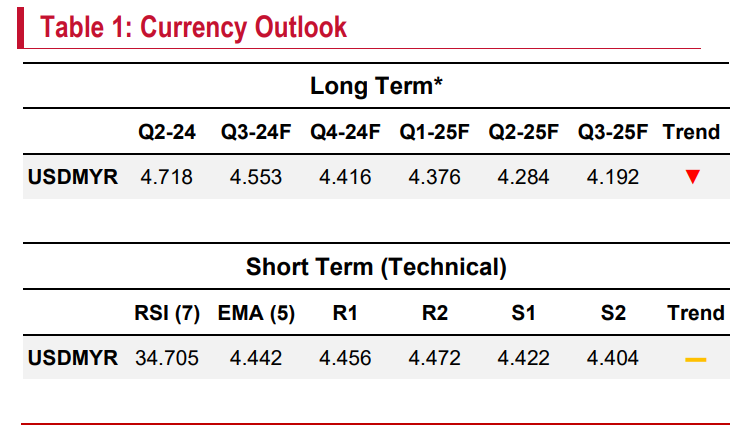

The market has recalibrated its expectations, now anticipating a 25 basis points cut, more than a 70% probability, at the September FOMC meeting instead of a 50 basis points cut.

Next week, focus will shift to key Fed speeches for dovish signals ahead of the Jackson Hole event on Aug 22–24.

With uncertainty over the scale of the Fed’s rate cut, the ringgit may experience some volatility but should remain range-bound around 4.43–4.46 against the USD, with potential upside if domestic macro conditions further improve. – Aug 16, 2024

Main image: fxstreet.com