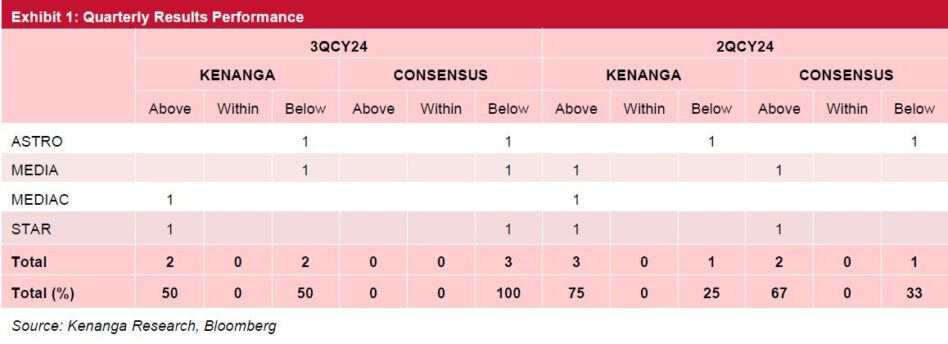

KENANGA Research (Kenanga) in the recent Sector Update report said companies that disappoint include ASTRO and MEDIA as costs remained stubbornly escalated, while top line was weighed by weaker advertising expenditure (adex) and subscriber rout (for ASTRO).

Conversely, media players that outperformed are STAR, propelled by increased unit sales and steady progress billings from its property development project, and MEDIAC, boosted by new offerings for its premium CEO-led luxury tour coupled with lower costs in terms of newsprint and depreciation.

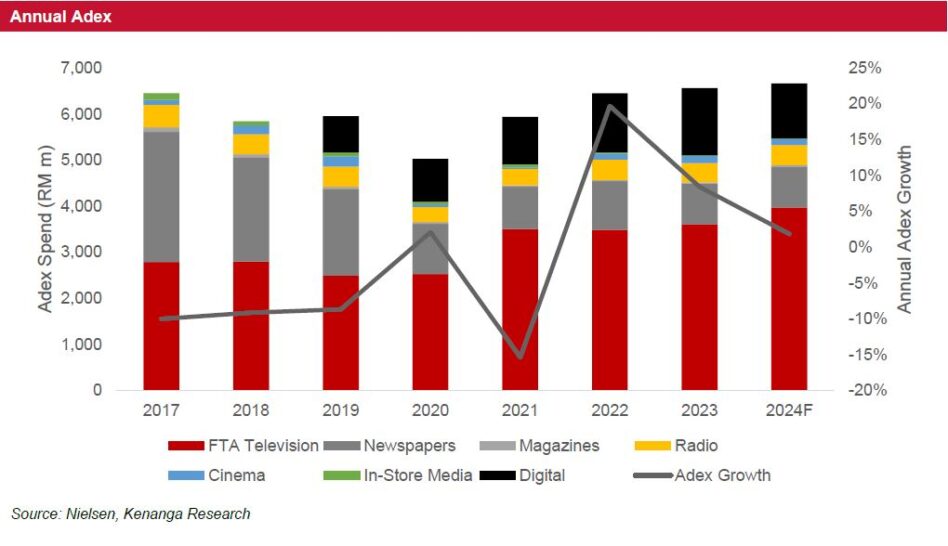

In the nine months of calendar year 2024 (9MCY24), there was a broad-based decline in actual adex receipts at ASTRO, MEDIA and MEDIAC.

In the case of STAR, while it does not disclose its adex receipts, Nielson data indicated a 4% year-on-year (YoY) decline in 9MCY24 adex for STAR’s daily newspaper publication.

“We believe the weakness was partly driven by the lingering impact of consumer boycotts targeting major international brands associated with the Gaza conflict,” said Kenanga.

This is compounded by heated competition and subdued consumer sentiment, as inflationary pressures continue to weigh on spending habits.

Traditional media players in Malaysia face intense competition from key opinion leaders (KOL), digital media such as streaming websites, apps and social media.

This shift is largely driven by structural changes in consumer behaviour and the evolving marketing landscape. Consumers are increasingly drawn to short-form videos, live-stream merchandise sales, KOL product endorsements, and online shopping.

Advertisers and brands are also favouring digital media due to several advantages:

1/ Lower cost-per-impression rates.

2/ More effective AI-driven ad personalization and targeting.

3/ Interactive features that enable two-way communication between consumers and brands.

4/ Ability to direct traffic to online stores.

As a result, brands and retailers are increasing digital marketing spend and collaborating with KOLs through direct sponsorships and partnerships to generate market buzz.

“Looking ahead, we expect print publishers to gain to some extent from a stronger MYR against the USD, which would help lower expenses for both newsprint and licensed content,” said Kenanga.

“As we head into quarter four calendar year 2024 (4QCY24), we anticipate a sequential uptick in 4QCY24, as consumers are likely to engage in higher spending due to the upcoming holiday season during the year-end school break, Christmas, and New Year’s celebrations,” said Kenanga.

This period presents a prime opportunity for advertisers to ramp up their marketing spend to capture the festive demand, especially after holding back during the earlier part of the year.

Additionally, Kenanga anticipate a boost to adex driven by the gradual recovery from easing consumer boycotts related to Gaza.

“We maintain our underweight stance as traditional media players are burdened by both revenue headwinds and legacy costs,” said Kenanga.

Evidently, smaller media players are struggling to achieve profitability, while segments within larger firms continue to alternate between quarterly profits and losses.

“We do not have any stock picks within the sector,” said Kenanga. —Dec 13, 2024

Main image: amazonaws.com