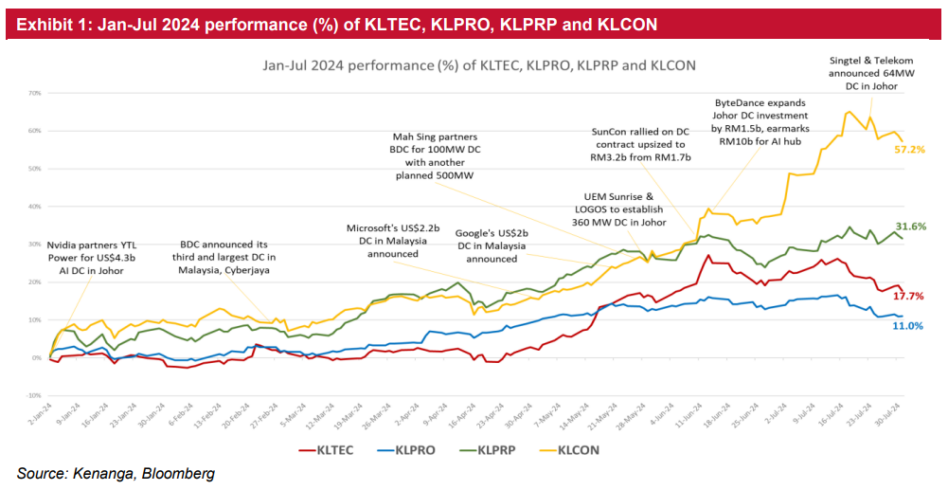

FOR the first seven months of 2024, news flow of data centre expansions in Malaysia has significantly boosted the construction sector (KLCON +57.2%) and the property sector (KLPRP +31.6%), while the technology sector (KLTEC +17.7%) and the industrial/EMS sector (KLPRO +11%) have lagged behind.

“The disparity is primarily due to the current phase of the data centre projects, which are still in the construction stage which typically spans across 12-18 months from breaking ground,” said Kenanga Investment Bank Bhd (Kenanga).

Property companies have managed to benefit early from this trend due to their land banks.

They have capitalised on this opportunity either through one-off land sales to data centre operators or by collaborating with overseas data centre owner-operators to build and manage the facilities, with the majority opting for the former.

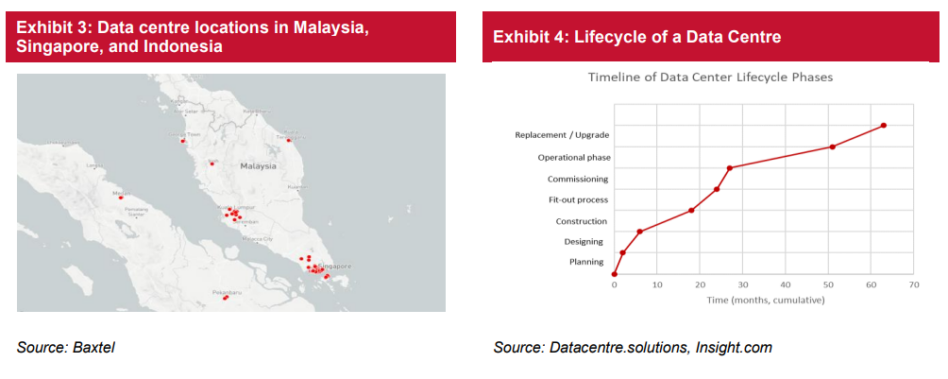

The demand for industrial land has increased significantly, more so in the state of Johor which has recently emerged as a prominent data centre hotspot in Malaysia.

According to the data centre information portal Baxtel, there are 12 companies, including major players like Equinix, Airtrunk, Princeton Digital Group, and GDS, operating 14 facilities across the state of Johor.

The local government has played a crucial role in bolstering the state’s data centre ecosystem through the development of industrial parks with suitable infrastructure, such as the 745-acre Sedenak Tech Park and the 509-acre Nusajaya Tech Park which are just 56km and 32km away from Singapore’s Woodlands checkpoint, respectively.

Given its proximity to resource-scarce Singapore, Johor’s appeal as a Singapore+1 option for data centre expansion is further enhanced by its lower costs for land, water, and power.

“Based on channel checks, we learnt that the typical lifecycle of a data centre begins with the construction phase of the core and shell, which typically spans 12-18 months,” said Kenanga.

Subsequently, the fit-out process follows, during which newly built data centres are fitted with essential components like server racks, power distribution units, cooling systems, and security measures.

This is the phase where tech players with exposure to server and server-related equipment will start to benefit.

“If we were to put a timeframe on this, our estimate would be the period of quarter four calendar year 2024 to first half of calendar year 2025, which is roughly the completion time for data centre construction jobs that started earlier this year,” said Kenanga.

Malaysian Outsourced Semiconductor Assembly and Test services (OSAT) and Electronic Manufacturing Services (EMS) players may be relatively new to the server-related business, but they are well-versed in servicing multinational corporations (MNCs).

With a strong track record of capabilities and reliable deliveries, they are well positioned to excel in this expanding sector.

With Malaysia expected to support over 3,000 Megawatt (MW) of IT capacity, compared to the current live IT capacity of under 500MW, the addressable market for AI servers in the country is estimated to be valued at approximately RM97.8bil.

This estimation modestly assumes that 40% of the incremental IT capacity (around 2,600MW in this scenario) will be allocated to AI servers, which typically consume about 11kW each.

This is divided by a power usage efficiency (PUE) of 1.45, an average between MCMC’s 2015 guideline of 1.60 for excellent efficiency and Singapore’s new standard of 1.30.

It is also worth noting that the Malaysian government is set to update the PUE and water usage effectiveness (WUE) guidelines in quarter three calendar year 2024 as announced by Trade and Industry Minister Tengku Datuk Seri Zafrul Abdul Aziz during the groundbreaking ceremony for Vantage Data Centers’ second campus on August 6, 2024.

Positioning for the fit-out phase is crucial in staying at the forefront of the data centre expansion theme in Malaysia.

“We believe the current time is ideal, offering a 3-6 months lead time to accumulate positions before the anticipated run-up in quarter four calendar year 2024 to first half of calendar year 2025,” said Kenanga.

Additionally, the recent market correction provides a timely opportunity to build significant positions in technology companies poised to benefit from the fit-out stage, ahead of the sector rotation that will favour technology names.

This run-up period is likely to be further supported by the conclusion of the US Presidential election, which is expected to bring about political stability, along with potential rate cuts anticipated by the US Federal Reserve.

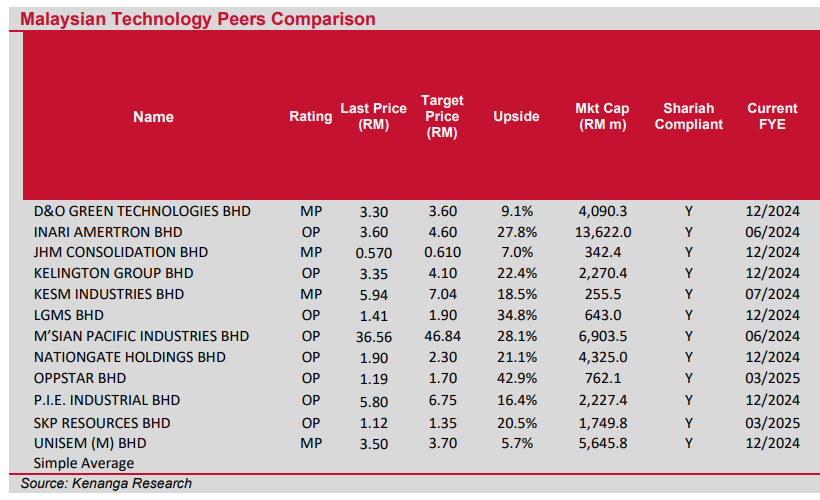

As such, Kenanga has mapped out the data centre supply chain in Malaysia below and identified key players in the EMS (examples: PIE, NATGATE) and OSAT (examples: INARI, MPI) space that are poised to benefit during the data centre fit-out stage. – Aug 15, 2024

Main image: 5gnetworks.au