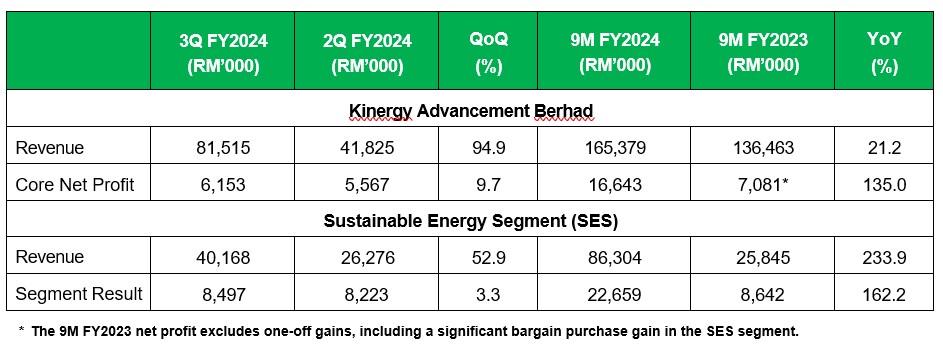

SUSTAINABLE energy & engineering solutions specialist Kinergy Advancement Bhd (KAB) (previously Kejuruteraan Asastera Bhd) has posted steady growth in its 3Q FY2024 ended Sept 30, 2024 with a 95% surge in quarter-on-quarter (qoq) revenue to RM81.51 mil from RM41.8 mil in 2Q FY2024.

This growth was primarily driven by higher contributions from the group’s sustainable energy solutions (SES) segment.

Additionally, KAB which is reputed to be Asia-Pacific’s (APAC) top energy sustainability solutions provider also recorded a 17.3% hike in gross profit to RM13.2 mil which further reinforced the group’s successful execution of capital-intensive projects and strategic expansion of both its SES and engineering segments.

Meanwhile, the group reported a core net profit of RM6.11 mil for its 3Q FY2024, reflecting resilient core operations during a capital-intensive growth phase.

Year-to-date, the group’s core net profit stands at RM16.64 mil or a 135% jump from the core net profit of RM7.08 mil in the same period a year ago.

Similarly, KAB’s gross profit edged up 32.1% to RM36.1 mil in its 9M FY2024 (9M FY2023:RM27.3 mil) in line with its revenue growth of 21.2% to RM165.38 mil (9M FY2023: RM136.46 mil)

Fuelled by contributions from new projects and recent acquisitions, the group’s growth remains robust, driven by the SES segment which delivered RM86.3 mil in revenue or more than thrice the RM25.8 mil recorded in the same period last year.

“Our results demonstrate strong underlying growth across the SES segment which continue to perform as planned,” commented KAB’s group managing director and deputy executive chairman Datuk Lai Keng Onn.

“We remain focused on achieving our targeted milestones, supported by steady project execution and enhanced gross profit which underscores our strategic direction.”

As it is, KAB’s extensive order book and project pipeline provide a strong platform for future growth. The group currently holds an order book valued at RM850 mill with RM120 mil in engineering projects and RM730 mil in SES projects.

Its active tender pipeline has grown to an impressive RM3.3 bil, indicating significant potential and opportunities in sustainable energy and engineering projects on the horizon.

“KAB’s proven track record in executing complex projects within set timelines showcases our expertise in operational excellence, instilling confidence in the group’s extensive capability to consistently deliver value to clients and shareholders,” added Lai.

At 3.45pm, KAB was up 0.5 sen or 1.56% to 32.5 sen with 9.51 million shares traded, thus valuing the company at RM646 mil. – Nov 21, 2024