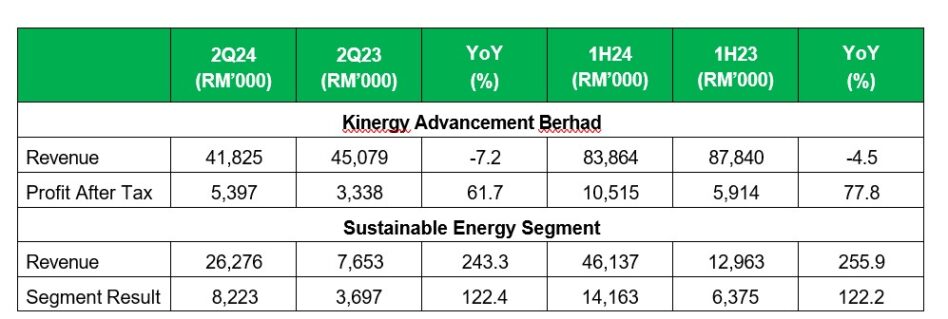

SUSTAINABLE energy solutions specialist Kinergy Advancement Bhd (KAB) (formerly Kejuruteraan Asastera Bhd) has posted a 77.8% jump in its net profit to RM10.5 mil, up from RM5.9 mil a year ago.

This record-breaking achievement growth is supported by a nearly a four-fold increase in the group’s revenue within its sustainable energy solutions (SES) segment following a 255.9% year-on-year (yoy) surge to RM83.9 mil.

For its latest financial quarter ended June 30, 2024, KAB’s net profit edged up 66.2% to RM5.57 mil (2Q FY2024: RM3.35 mil) which reflected the group’s effective earnings contributions and growth potential.

Since 2023, the SES segment has reported substantial growth with consistent performance improvements.

In 1H FY2024 alone, the segment generated RM46.14 mil in revenue and RM14.2 in operating profit which is a significant increase from RM12.9 mil and RM6.4 mil respectively yoy.

This reflects a nearly four-fold increase in revenue and more than double the segmental results, hence underscoring SES’s pivotal role in driving the group’s exponential expansion.

“We are gaining greater certainties as we continue to deliver consistent financial performance as our dedicated efforts have translated into strong results and visible earnings,” commented KAB’s group managing director Datuk Lai Keng Onn.

“As we uphold the mission to create substantial value for our shareholders, our momentum is also bolstered by support from state government agencies and established partners.”

Moving forward, Lai expects KAB to be well-positioned to achieve significant milestones in both its energy and engineering segments.

“The SES segment which saw RM2.7 mil profit growth in 2022 has become central to the group’s strategy, contributing over RM10 mil in 2023’s core earnings while quadrupling that of the previous year,” he envisages.

“With two consecutive quarters of on-target results in FY2024, KAB is making strides in securing both local and regional developments, strengthened by strong state partnerships. I’m confident that ongoing projects will come to fruition, thus boosting our orderbook as we drive towards our ambitious targets for 2025.”

Looking ahead, KAB expects stronger contributions to both its revenue and profit growth in the upcoming quarters amid a sustained momentum that could see a doubling of its FY2023’s results.

“The group remains firmly focused on meeting its FY2024 targets as its scalable business model supports a bullish outlook for exceeding past performance with a substantial uplift in profits expected in FY2025,” projected Lai who is also KAB’s executive deputy chairman.

“With strategic positioning for long-term value creation and on-going expansion efforts, KAB’s future profitability appears well-supported, contingent on the successful execution of upcoming developments.”

As of 30 June 2024, KAB’s order book for its engineering and SES segments stood in the region of RM137 mil and RM759 mil respectively. Additionally, the group is bidding for projects worth around RM160 mil in engineering and a substantial RM2.89 bil in SES.

At the close of today’s trading, KAB was unchanged at 33 sen with 8.19 million shares traded, thus valuing the company at RM656 mil. – Aug 20, 2024