THE transition towards e-invoicing implementation in Malaysia has revealed taxpayers at various stages of readiness.

A survey by KPMG in Malaysia found that while some taxpayers reported their experience somewhat met their expectations, many highlighted areas for improvement.

A major challenge identified were the need to incur additional costs for IT upgrading and the necessity for more training of their manpower.

Many respondents also emphasised the need for clearer guidelines and additional support from the Inland Revenue Board (HASiL), particularly regarding technical clarifications, business practice requirements and the need to make the MyInvois portal more user-friendly.

The survey was conducted at a recent tax forum organised by KPMG in collaboration with HASiL Selangor which was attended by over 100 senior business executives.

“On an encouraging note, our study of businesses in the Phase 2 and 3 of the e-invoicing implementation mandate reported that 32% are more than 50% ready while 62% are up to 50% ready,” revealed KPMG in Malaysia tax head Soh Lian Seng.

“Learning from the experiences by Phase 1 taxpayers, there is a clear need for continued support and clear guidance from HASiL to ensure a smooth transition to full implementation nationwide.”

KPMG’s survey further found that the top challenge taxpayers impacted by the Phase 2 and 3 stages of implementation are experiencing is in seeking additional resources such as manpower, IT and funding (35%).

This is closely followed by the need for an immediate upgrade of their organisation’s systems to support e-invoicing (27%). Another 22% of taxpayers expressed the need for additional support from HASiL during the transition.

As of November 2024, HASiL has received 90.2 million submissions of e-invoices from 8,000 taxpayers. With the experience from Phase 1 implementation since Aug 1, HASiL is preparing to handle the increased volume of queries and engagements expected during the next phases.

“Upon full implementation of e-invoicing, HASiL can leverage real-time data collection that will enable more accurate and timely monitoring of tax compliance, thereby reducing the risk of errors and fraud,” noted Soh.

“This increased level of transparency would be a push factor for Malaysia to shift towards co-operative compliance.”

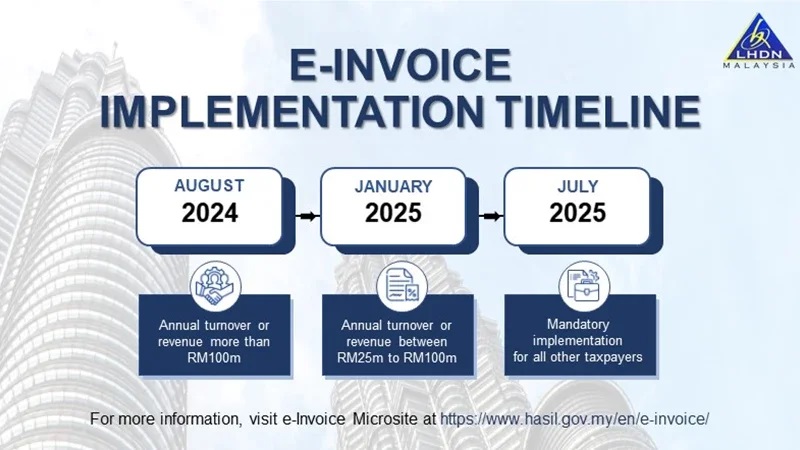

For the record, e-invoicing will be implemented gradually as follows – Aug 1 for taxpayers who have an annual turnover or revenue of more than RM100 mil; and Jan 1, 2025 for taxpayers who have an annual turnover or revenue of more than RM25 mil. – Dec 4, 2024