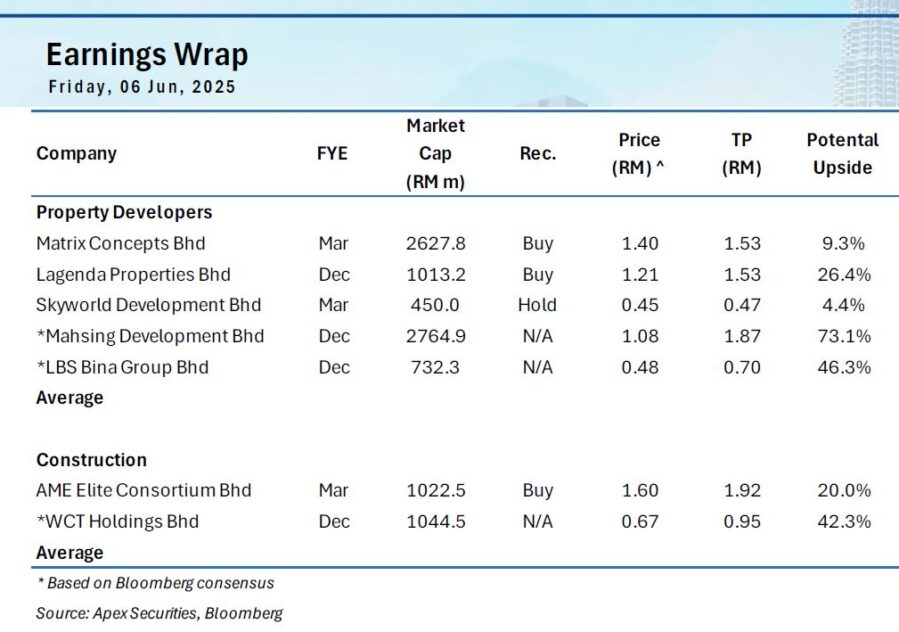

THE property sector remained resilient in quarter one of 2025, with the four companies under APEX Securities coverage delivering mixed results.

MATRIX and SKYWLD exceeded expectations, driven by stronger revenue recognition from ongoing projects and cost savings from completed developments.

AME met expectations with stable performance, while LAGENDA slightly underperformed once again, due to slower construction progress, higher finance costs and cost overrun from completed projects.

In quarter one 2025, four property companies under their coverage delivered an aggregate marginal quarter-on-quarter (qoq) increase of 3.3% in core net profit (CNP), primarily driven by positive contributions from LAGENDA and SKYWLD.

The improvement was supported by higher revenue recognition from ongoing projects, the absence of major one-off expenses that impacted the prior quarter, and cost savings following project completions.

Conversely, MATRIX experienced decline in CNP, impacted by increased operating expenses, while AME reported flat earnings qoq.

On a year-on-year (yoy) basis, aggregate CNP declined 14.6%, with AME being the sole contributor to growth at 37.7%. AME’s CNP improved on accelerated construction progress and higher rental income.

The gains were insufficient to offset earnings contraction from SKYWLD and MATRIX.

SKYWLD’s earnings contracted due to the absence of contributions from completed projects, while MATRIX was weighed down by higher operating expenses and higher finance costs stemming from its MVV land acquisition.

Despite greater revenue recognition from new launches, these gains are likely to be eroded by higher financing costs linked to pipeline expansion. The property market remains saturated with mid-range products, leading to a buildup of overhang inventory.

“However, our coverage is focused mainly on landed homes, affordable housing, and industrial properties, segments that continue to enjoy strong demand,” said APEX.

The strategic positioning places APEX’s covered developers in a favourable position. Furthermore, rising housing demand beyond Kuala Lumpur, driven by industrial growth in Johor and Penang, presents additional opportunities.

Several companies under their coverage have expanded into these high-growth regions to capitalise on the spillover effect, supporting a positive outlook for the property sector.

All in all, APEX upgraded their sector view from neutral to overweight on the property sector as they see stronger earnings visibility, resilient demand in key segments, and sustained momentum in project launches. —June 6, 2025

Main image: AFP Pic