LEGACY media in Malaysia are contending with the rapid ascent of modern platforms such as social media networks, key opinion leaders (KOLs), messaging applications, streaming services, search engine advertising, and retail media.

“These channels offer advertisers advanced tools for audience targeting and engagement via the application of AI-driven programmatic advertising,” said Kenanga Research.

This technology leverages on machine learning algorithms to enable real-time bidding, precise audience segmentation, and dynamic ad placements.

Additionally, by analyzing vast datasets, these platforms can customize ads to individual user behaviors and preferences; thereby enhancing the efficiency and effectiveness of ad campaigns.

In contrast, for traditional media, measuring return on investment (ROI) is more challenging due to less granular audience data and slower feedback mechanisms.

On a more positive note, we observe a growing shift among legacy media companies in Malaysia toward the development and commercialization of original local content.

This strategic pivot reflects a broader effort to diversify revenue streams and reduce reliance on traditional advertising income.

Increasingly, these companies are channelling resources into the production of Malaysian dramas, feature films, news programming, documentaries, and entertainment formats such as talent competitions, reality shows, and game shows.

Content development is being driven through a mix of in-house capabilities as well as co-productions and partnerships with local creative studios.

Native Malaysian media companies possess a distinct competitive edge in the local content landscape, an area that remains relatively under-penetrated by international over-the-top (OTT) platforms.

Local media players are uniquely equipped with an intimate understanding of Malaysian cultural nuances, social dynamics, and language preferences.

This deep-rooted familiarity enables them to craft stories, characters, and formats that resonate more authentically with domestic audiences.

Whether through culturally relevant themes, vernacular dialogue, or the portrayal of everyday Malaysian experiences, these companies are able to build stronger emotional connections and viewer loyalty which global players may struggle to replicate at scale.

We retain our UNDERWEIGHT outlook on the sector – reflecting the structural headwinds that continue to undermine its profitability.

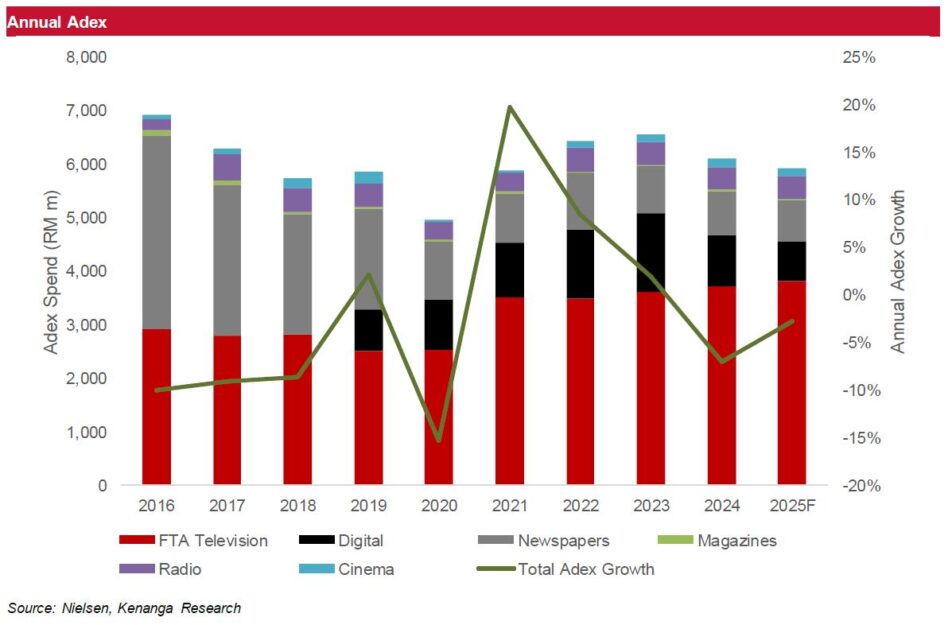

Legacy media players are grappling with ongoing revenue erosion – stemming from heightened adex share erosion to modern digital platforms, that are capturing both audience attention and advertising spend.

These challenges are exacerbated by the burden of high fixed operating costs tied to traditional infrastructure, including broadcasting towers, printing facilities, physical distribution network and an aged workforce with dated skillsets.

Although media players have made efforts to trim expenses, profitability remains under strain.

As such, we believe the sector is in need of bold, transformative change which could take the form of regional market expansion, entry into adjacent or high-growth segments, consolidation via mergers and acquisitions, or even a full strategic divestment.

Meanwhile, in the near term, we anticipate that traditional media players will continue to pursue asset disposals or monetization to shore up balance sheets and boost liquidity buffers. —July 7, 2025

Main image: Barron’s