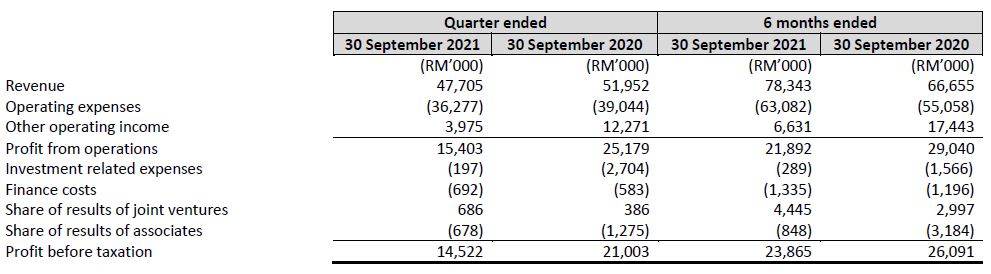

WHILE Land & General Bhd (L&G) managed to post a revenue of RM47.7 mil for its second quarter ended Sept 30, 2021, the amount is actually 8% lower compared to the RM51.9 mil that was recorded in the preceding year’s quarter.

This is mostly attributed to the higher progress billings in the preceding year’s quarter for the developments of Sena Parc Phase 1A and Astoria Ampang Phase 1 projects, following the completion and handing over of both projects in September 2020.

The group also registered a 31% lower profit after tax (PAT) of RM14.5 mil for the second quarter ended Sept 30, 2021, compared to the RM21 mil from the preceding year’s quarter.

This, on the other hand, was mainly due to writeback of impairment loss on amount from its 50%-owned joint venture, Hidden Valley Australia Pty Ltd (developer of Hidden Valley project in Melbourne, Australia), which amounted to RM9.8 mil in the preceding year’s quarter.

Apart from that, the lower quarterly revenue also followed the completion and handling over of the Sena Parc Phase 1A and Astoria Ampang Phase 1 in September 2020.

The group’s profit before tax (PBT) also experienced a decline of 9% compared to the RM26.1 mil in the preceding year’s six-month results, which was primarily due to writeback of impairment loss on amount due from the Hidden Valley Australia Pty Ltd (amounting to RM12.8 mil).

However, taking into consideration of the group’s six-month results of the preceding year (RM66.7 mil), L&G’s revenue for six months ended Sept 30, 2021 increased 18% to RM78.3 mil, which was mainly due to higher sales and progress billings for its ongoing Damansara Seresta project, as well as higher sales achieved for its completed Astoria Ampang Phase 1 and Sena Parc Phase 1A. – Nov 25, 2021