IN MAR 2025, system loans grew by 5.2% year-on-year (YoY). Household loans stayed supported by both residential mortgage and auto loans, which was also seen on a month-on-month (MoM) basis at +0.4% and +0.7%, respectively.

“We opine this could be loans undertaken ahead of the end of the Hari Raya festivities,” said Kenanga Research (Kenanga) in the recent Sector Update Report.

This is also reflected in business loans with financial service sectors being its chief driver.

Kenanga notes that the construction segment exhibits a decline in system loans, possibly due to lower project replenishments during the first quarter of the year, with more expected to come in the year end.

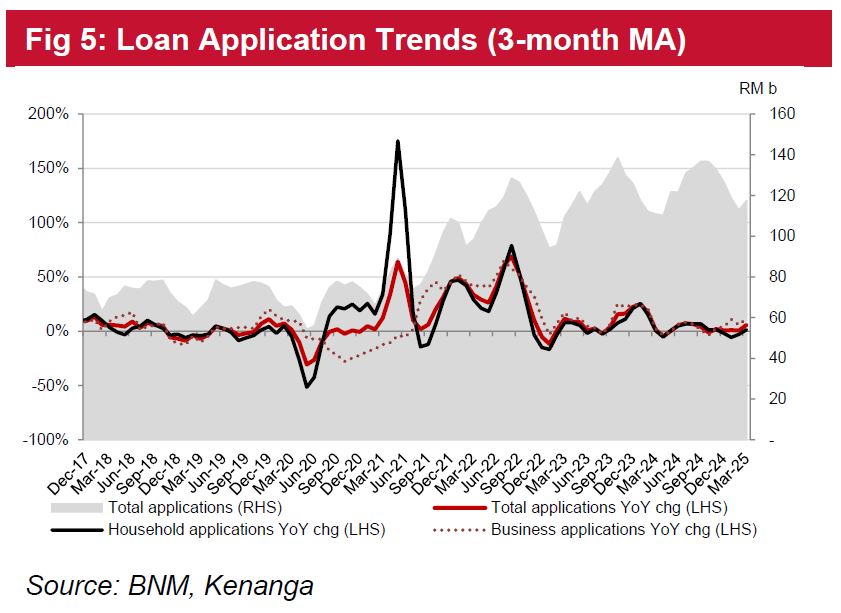

Overall applications grew by 5% YoY but at a much higher momentum on a MoM basis at 11%, both in household and business loans.

“We note stronger inflows for non-residential properties and working capital uses, suggesting for more business activities to persist beyond Hari Raya festivities,” said Kenanga.

In relation to loan approvals and the abovementioned decline in construction loans in the system, Kenanga also saw a surge in construction-related approvals in preparation of more project flows in the coming months for example on data centre construction.

Meanwhile, Kenanga gathered that business loans in Malaysia may not likely be overly hampered by pressures from tariffs.

Channel checks indicate less than 10% of overall trade-related loans directly relate to the import of goods.

Mar 2025 deposits grew by 3% YoY and 0.4% MoM, with current account savings account (CASA) ratio remaining muted at 28.6%.

The lower growth continued to fuel a higher industry loan to deposit ratio at 87.6%.

As banks rationalise their funding mix to lower yielding products, there is an increase in preference towards fixed deposits with a tenure of less than six months, making up 51% of total fixed deposits.

Meanwhile, 6-12 months fixed deposit (FD)s were stable at 46%, with more than 1-year FDs reclining to 3% of total fixed deposits.

With appetite for deposits appearing low, banks may be more inclined to fund their loans via non-deposit sources going forward.

“We believe industry readings may exhibit mixed signals owing to festivity-related behaviour,” said Kenanga.

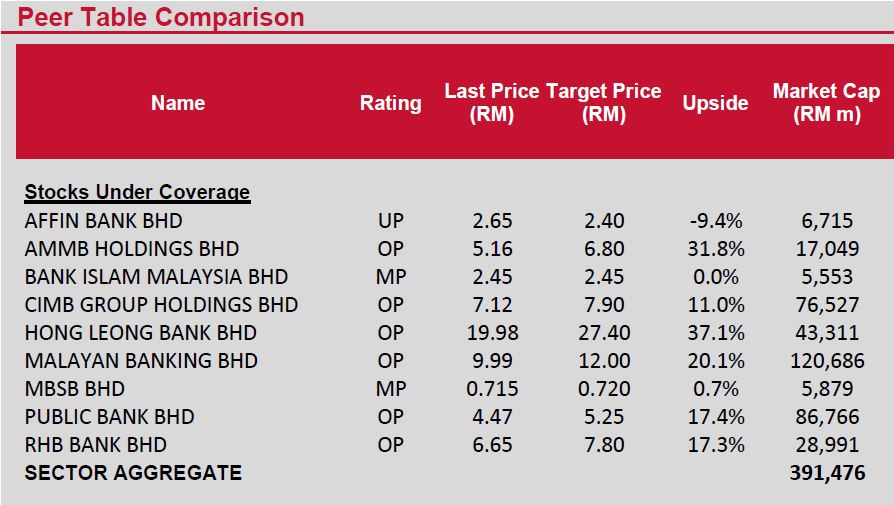

Not helping also is the uncertainty surrounding trade policies. Kenanga opines investors would lean towards the second half of 2025 for solace, whereby they anticipate better loan growth to stay supported by foreign investment to spur gross domestic product as well as inflation to stay well-contained.

“While we expect overnight policy rate to remain stable at 3%, our recently conducted sensitivity analysis reflects a moderate impact of 1%-3% lower earnings with every 25 basis points cut,” said Kenanga. —May 2, 2025

Main image: The Star