TA Securities (TA) sees the establishment of the Forest City Special Financial Zone (SFZ) as a significant step toward becoming a regional financial hub, thanks to its strategic location in Southeast Asia.

Its proximity to Singapore, a leading financial hub both regionally and globally, positions the SFZ as a natural complement to Singapore’s well-established financial sector.

This could drive a spillover in demand for investments and financial services. Additionally, its location within the Johor-Singapore Special Economic Zone (JS-SEZ) strengthens its potential for economic integration and allows it to capitalise on the JS-SEZ’s potential growth.

“We note that the SFZ offers several strategic benefits that make it an attractive financial hub,” said TA in the recent Thematic Report. One of its standout features is foreign exchange flexibility, which allows unrestricted offshore borrowing in foreign currencies and investments in foreign currency assets.

One of its standout features is foreign exchange flexibility, which allows unrestricted offshore borrowing in foreign currencies and investments in foreign currency assets.

It also provides strong incentives for sustainability-driven activities and appealing tax packages, creating a supportive environment for diverse financial services, including fintech firms and family offices.

“We believe these measures could help attract high to ultra-high-net-worth individuals,” said TA.

Additionally, preferential tax rates for returning experts and knowledge workers could help deepen the local talent pool and mitigate brain drain, thus further strengthening the SFZ’s financial ecosystem.

From a banking perspective, all banks under their coverage are well-positioned to capitalise on Johor’s economic expansion.

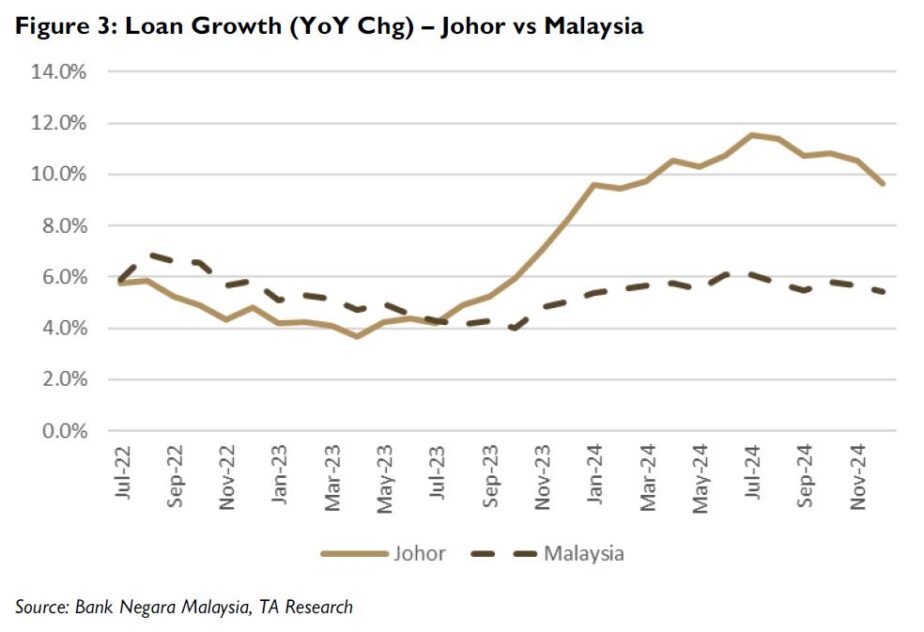

According to Bank Negara Malaysia (BNM), total loans and advances in Johor grew by 9.7% year-on-year (YoY) in 2024 vs overall Malaysia’s loan growth of 5.4%.

“We note that Johor has outpaced the industry average since the second half of 2023, driven by rising economic activity in the state. We see this trend as a signal of strong demand,” said TA.

Beyond traditional loan growth, banks also stand to benefit from a broader range of customised financial solutions and transactional activities.

“We anticipate rising demand for corporate financing solutions, M&A advisory, and equity or debt capital market transactions, driven by an influx of investment and business expansion in the region,” said TA.

Fee-based income from trade finance, treasury services, and cash management is also likely to see an uptick.

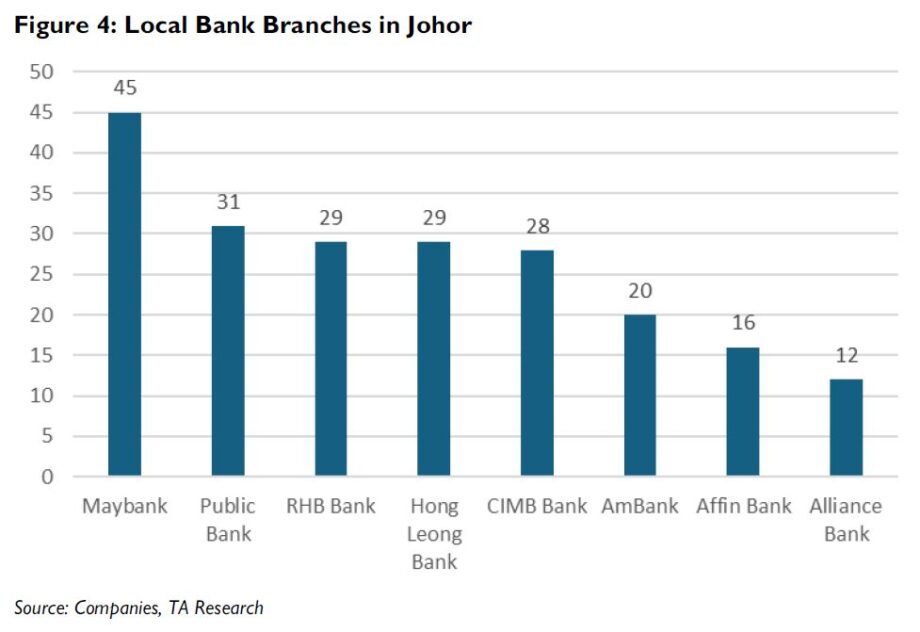

In terms of presence, Alliance Bank and RHB Bank have the highest branch concentration in the state, with 15% of their total Malaysian network located there.

In absolute numbers, Maybank leads with approximately 45 branches, followed by Public Bank with 31. Hong Leong Bank and RHB each have 29 branches, while CIMB has around 28.

However, competition among local banks in Johor will likely intensify as locally incorporated foreign banks, such as UOB and OCBC, each already having around seven branches in Johor, will enjoy regulatory flexibility to open additional branches within the SFZ.

“Nevertheless, we believe all banks are poised to benefit from the overall increase in business activities,” said TA.

With the JS-SEZ’s ambitious plan to attract 50 projects within five years and 100 projects within the decade, banks could tap into emerging high-value industries such as data centres, renewables, semiconductors, and advanced manufacturing, as well as new priority sectors such as aerospace, electrical and electronics, chemical, medical devices and pharmaceuticals setting up operations in Johor.

Narrowing down potential beneficiaries, TA believes banks with an established presence in Singapore and Johor—such as Maybank, CIMB, Hong Leong, and RHB Bank—are particularly well-positioned to capitalise on the growth opportunity in this state.

“We believe the ability to facilitate smoother cross-border financial services will be a key advantage, making them a one-stop solution for investors and businesses in both Johor and Singapore,” said TA.

This includes enabling more seamless trade, enhancing credit facilities, and offering more comprehensive financial solutions.

Maybank has also noted that it is looking to introduce innovative payment systems such as cross-border QR and P2P payments.

In all, TA foresees Forest City Special Financial Zone presents a compelling growth opportunity for the financial sector as banks play a critical role in driving cross-border financial integration and economic expansion.

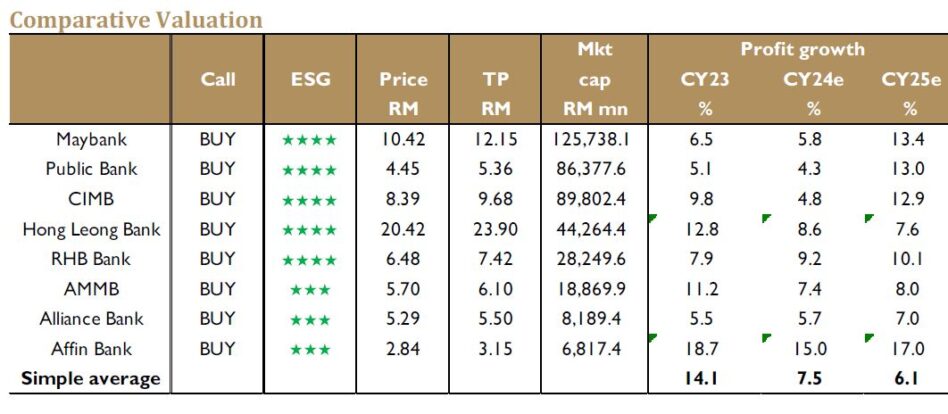

TA maintains an overweight stance on the sector. Their top recommendations for the industry are the top three listed banks, Public Bank, CIMB, and Maybank, which they anticipate will be at the forefront of benefiting from the improvements in domestic spending, solid economic prospects, robust investments, and increased capital activity.

“However, we also have buy recommendations for AMMB, Hong Leong Bank, RHB Bank, Affin Bank and Alliance Bank,” said TA. —Feb 10, 2025

Main image: UOB Group