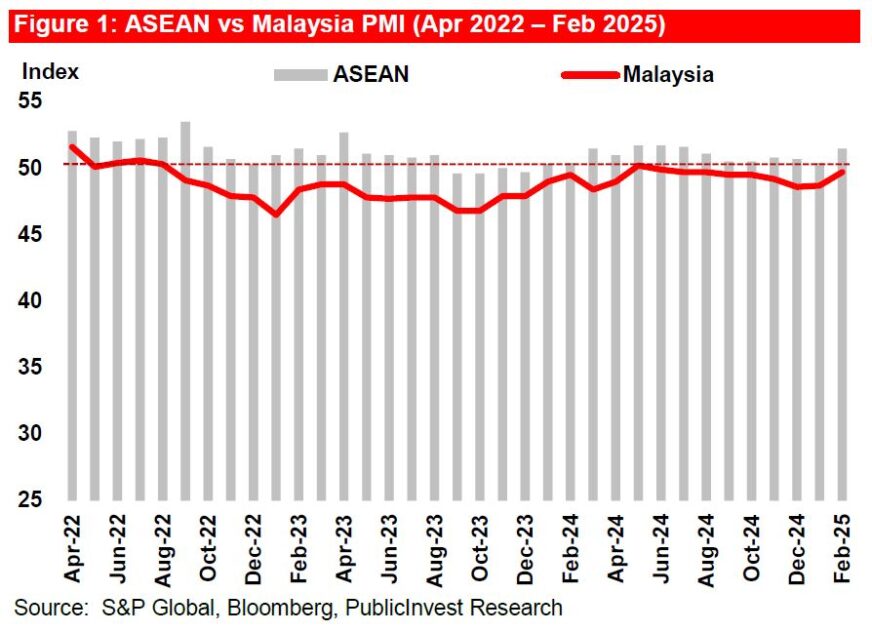

THE ASEAN manufacturing sector continued to strengthen, with the PMI rising to a seven-month high of 51.5 in February (January: 50.4), marking the second consecutive month of expansion.

“The improvement was driven by a faster increase in output and new orders, reflecting sustained demand momentum,” said Public Investment Bank (PIB) in the recent Economic Update Report.

S&P Global highlighted a notable acceleration in purchasing activity and employment, with firms expanding their workforce at the quickest pace in several months.

Business confidence surged to a 22-month high, underpinned by a brighter demand outlook. Encouragingly, despite the pick-up in production, inflationary pressures remained muted.

Malaysia’s manufacturing sector remained under pressure in February, though business conditions moved closer to stabilisation midway through quarter one of 2025 (1Q25).

The PMI edged higher to 49.7 (January: 48.7), marking the highest reading since August 2024 and signalling a softer contraction in industrial activity.

For the first time in four months, firms recorded an increase in new orders, easing the decline in production volumes.

As a result, purchasing activity contracted at a slower pace, while employment levels saw a marginal decline, unchanged from January.

Business sentiment strengthened, reaching its highest level since October 2024, as firms anticipated a sustained recovery in demand.

Cost conditions remained broadly stable, with input price inflation little changed from early 2025, while firms continued to cut output charges.

According to S&P Global, the latest PMI reading remains consistent with modest GDP growth in 1Q25, extending the trend seen in 3Q24 and 4Q24.

“Looking ahead, firms are optimistic that the renewed rise in new orders will gain momentum, supporting a gradual recovery in production levels in the coming months,” said PIB.

Open economies with high trade dependencies, such as Malaysia, remain particularly vulnerable given their integration into global supply chains.

While Malaysia’s higher value-added exposure to Mexico’s exports to the US suggests that tariffs on Mexico could have a larger indirect economic impact than those on China, the continued realignment of global supply chains, particularly the shift of electronics, automotive, and machinery production to Mexico, has deepened Malaysia’s trade linkages with North America, making it more susceptible to rising US protectionism.

As trade frictions escalate, Malaysia’s exposure to North American trade flows could weigh on external demand, amplifying downside risks to Malaysia’s export sector.

“While current indicators suggest limited short-term effects on the semiconductor sector, we believe ongoing monitoring remains crucial, particularly as broader trade risks and geopolitical uncertainties continue to evolve,” said PIB. —Mar 4, 2025

Main image: Jackster