THE proverbial tailwinds behind the aviation sector have turned positive. The USD and fuel prices have eased markedly, lowering expenses in the process.

“We also gather that fares will rise following MAS’ decision to temporarily cut capacity,” said Maybank Investment Bank (MIB) in a recent report.

MIB maintains their CAPITALA and AAX BUY calls, earnings estimates and target prices for now.

But under a ‘blue sky’ scenario, MIB estimated that their CAPITALA and AAX financial year 2025 (FY25) earnings estimates could double if the status quo of relatively stronger RM and lower jet fuel prices hold.

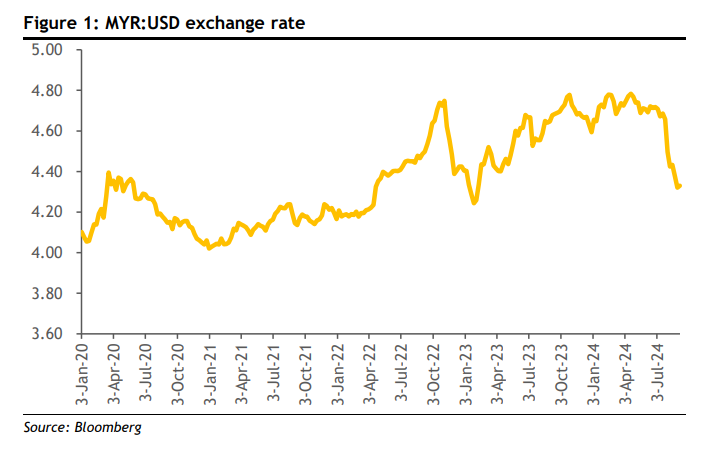

The RM has recovered to RM4.25: USD1.00 and jet fuel prices have plunged to USD86 per barrel.

This is positive for airlines as 70-80% of their operating expenses are denominated in USD and jet fuel accounts for 40- 50% of their operating expenses.

“In the past, airlines would usually pass on lower expenses via lower fares lest they ceded market share. That said, we believe that airlines will not do so this time after MAS temporarily reduced capacity by 18% until year end,” said MIB.

This will enable other airlines to raise fares on reduced industry supply. MIB saw this very same thing occur in 2015 and 2016 following the MH370 and MH17 tragedies.

“From a low of RM4.80: USD1.00 on 20 Feb 2024, the RM has recovered to RM4.25: USD1.00. This is positive for airlines under our research coverage as 70-80% of their operating expenses are denominated in USD,” said MIB.

Typical USD denominated operating expenses are aircraft fuel, aircraft finance lease, user charges such as airport related charges, ground operational charges and aircraft insurance cost.

Then there are the inflight related expenses such as maintenance, repair and overhaul and aircraft operating lease. – Sept 19, 2024

Main image: orientflights.com