A COMEDIAN has seemingly an axe to grind with the Inland Revenue Board (IRB) for hauling up his events and talent company for audit review twice in three years only for him to realise that in-hot-soup Global Ikhwan Services and Business Holdings Sdn Bhd (GISBH) “never paid taxes (the company was founded in 2010) and never got found out for years”.

“Meanwhile, LHDN (Malay abbreviation for IRB) ‘randomly’ selected my events and talent company for audit review TWICE in 3 YEARS,” Phoon Chi Ho🇵🇸 (@chihohoho) who is also an actor, comedy writer and casting manager expressed his frustration on the X platform.

GISBH never paid tax and never got found out for years.

Meanwhile, LHDN “randomly” selected my events and talent company for audit review TWICE in 3 YEARS. Found nothing but I had to pay my auditors. RM700 down the drain.

Mungkin sebab director company bangsa Cina lah.

— Phoon Chi Ho🇵🇸 (@chihohoho) September 27, 2024

“Found nothing but I had to pay my auditors. RM700 down the drain. Could this be because the company’s director is a Chinese?”

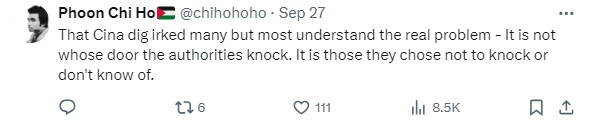

He went one step further to convey his dismay: “That Cina dig irked many but most understand the real problem: It is not whose door the authorities knock. It is those they chose not to knock or don’t know of.”

For context, Inspector-General of Police (IGP) Tan Sri Razarudin Husain has recently exposed that that based on cooperation between the police and IRB, it has been discovered that the GISBH business network has never paid any business taxes.

While this corroborates the investigations conducted by the Royal Malaysia Police (PDRM) under the Income Tax Act 1967, the Selangor Zakat Board (LZS) revealed yesterday (Sept 28) that over 20 GISBH-linked companies have never paid a single sen of zakat (tithe).

Despite this, the board is unable to determine the amount owed because it has never received any information regarding assets and liabilities of those businesses.

According to LZS, legal action can be taken against GISBH for failing to pay tithe under the Administration of the Religion of Islam (State of Selangor) Enactment 2003 which provides penalties of imprisonment and fines for those who deliberately avoid paying zakat.

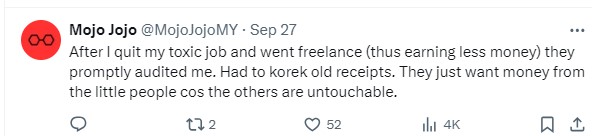

Fortunatrely for Phoon, many netizens came forward to both console and help him to better understand his plight.

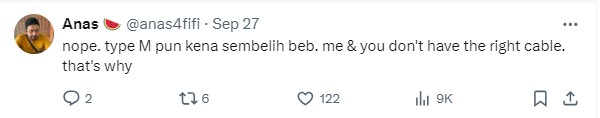

“LHDN doesn’t take race into account, bro … I’m even a Malay yet I also kena two times in three years 🤣🤣🤣” contended a commenter with a fellow Type M also confessing of getting “slaughtered for not having the right cable”.

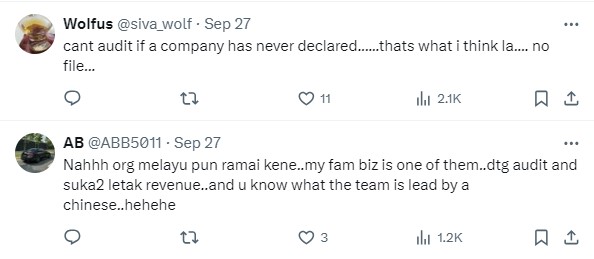

Another commenter shared his personal ordeal while dismissing the notion that IRB’s action is racist in nature.

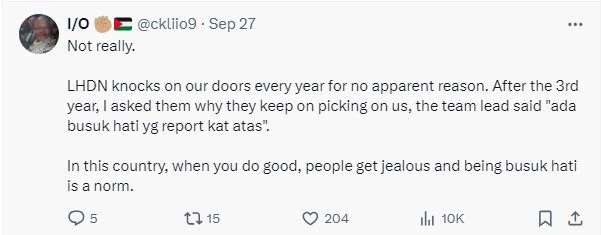

“LHDN knocks on our doors every year for no apparent reason. After the third year, I asked them why they keep on picking on us. The team lead said ‘ada busuk hati yg report kat atas’ (implying some business rivals must have reported the business to IRB),” he explained.

“In this country, when you do good, people get jealous and being busuk hati (literally, bad hearted) is a norm.”

In all fairness, loyal taxpayers cannot be blamed for fuming over how GISBH can be outside the radar range of IRB for so long, hence the so-called unfounded assumption of double standard practice. In fact, not only IRB but also the Customs Department as another business owner found out

I spent almost three months in and out of Jabatan Kastam cause our company owed like RM10k in unpaid taxes after they noticed an error in our accounting.

Really, actually, how is this even possible? https://t.co/0EYR3rLUEa

— Iqbal (@Iqtodabal) September 26, 2024

At the end of the day, this commenter summed up best the reality of doing business in Malaysia: “Everyone also kena. Gomen has no money. Don’t be so sensitive 😅.” – Sept 29, 2024

Main image credit: Bernama