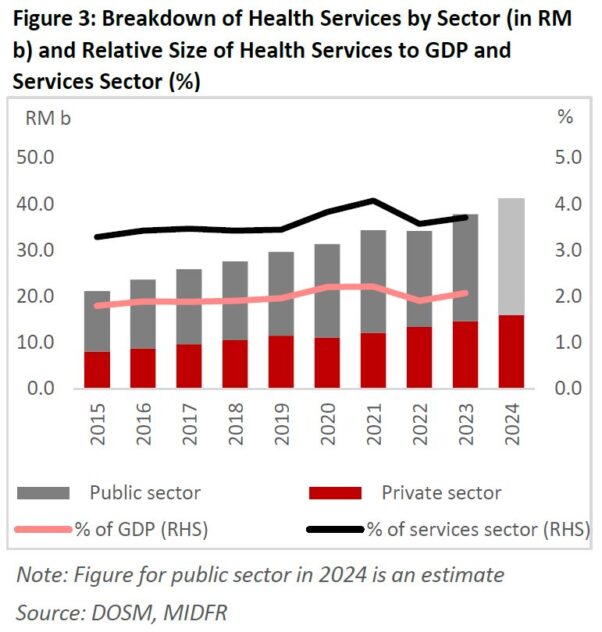

THE size of Malaysia’s health services has grown to RM37.8 bil as of 2023 (2015: RM21.2 bil) on nominal basis, with a compounded annual growth rate (CAGR) of +7.8% which is faster than +5.6% growth per year in nominal gross domestic product (GDP).

With the sector’s robust growth, it accounted 2.1% of Malaysia’s 2023 GDP (2015: 1.8%). Although the growth in private health services was substantial, the public health services still accounted for more than 60% of the overall health services industry.

Given the greater focus on the rakyat’s well-being, public health services took up a larger portion of 15.5% of overall government services in 2023 (2015: 13.2%).

In 2020, the year when COVID-19 pandemic hit the country, private health services experienced nominal contraction of -3.3% but has since grown on average +9.6% a year between 2021 until 2024.

Public health services, on the other hand, grew strongly at +11.3% in 2020, but later experienced annual decline of -6.1% in 2022 when demand condition normalised as the economy began to be reopened.

“We expect the trend will continue as demand for health services increases in line with the increased life expectancy, which is estimated having improved to 75.2 years as of 2024 (2014: 74.5 years)” said MIDF Research (MIDF) in the recent Thematic Report.

Based on the real GDP data, the real growth in private health services showed a more robust growth of +9.3% on average in 2022-2024. The expansion was more encouraging than average growth of +5.8% in 2016-2019.

This reflects stronger demand for private healthcare services, which continued even after the reopening of the economy after being hit by the global pandemic.

In general, the sector’s growth continued to surpass the overall GDP growth, which grew on average +5.9% in 2022-2024 and +4.9% in 2016-2019.

Compared to other services sub-sectors, the private health services remained the 8th fastest growing industry in the services sector.

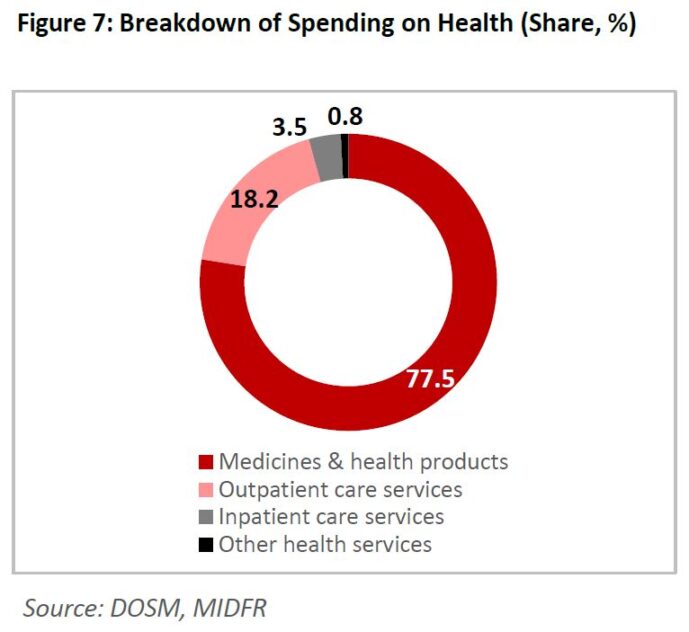

Based on consumption basket, an average Malaysian typically spends around 2.7% of their total consumption on health products and services.

Out of the overall spending on health, more than three-quarter are spent on medicines and health products, 18.2% on outpatient care services, 3.5% on inpatient care services and the rest, or roughly 1%, on other health services.

Between 2015 and 2022, the total number of doctors in Malaysia increased significantly from 46K to 79K, representing a 7.0% CAGR over the 8-year period.

The government sector consistently held the majority share, averaging around 74% of total doctors, while the private sector’s share averaged around 24%.

In 2022, the doctors in the government sector increased by +2.2% (2021: +5.1%), maintaining single-digit growth in three consecutive years.

In the private sector, growth was stable throughout the years, averaging at 3.8%, though there was a decline of 3.0% in 2020.

Overall, the consistent dominance of the government sector in terms of doctor numbers suggests a sustained public-led effort to ensure healthcare accessibility and supply of talents in the sector, although the slower growth rates recently may indicate a resource limitation.

Meanwhile, the private sector’s relatively stable trajectory underscores its supportive role, with potential for further growth should healthcare demand and affordability increase.

Malaysia’s healthcare sector’s overall revenue is expected to grow at a 5-Y CAGR of 6-8% to 2030, with an estimated governmental spending of up to RM100 bil by 2030 (Budget 2025: RM45.3 bil) for healthcare providers, pharmaceuticals, medical devices and PPE makers.

The key driver for the optimistic growth remains to be the:

(1) growing aging population leading to rising NCDs.

(2) improvement and upscaling of pharmaceuticals subsector.

(3) medical tourism boom via regional marketing push.

(4) digital health transformation and AI-driven technology advancement.

(5) healthcare reforms via PPPs, diplomacy and tech transfers.

“In the next 3 to 5 years, we are expecting medical tourism to boost the local healthcare sector, notably for healthcare service providers, with Malaysia having the competitive edge due to the lower costs of treatments, English-speaking workforce and the strong branding of hospitals,” said MIDF.

This is followed by the growing implementation of digital healthcare, telemedicine and AI diagnostics, as well as continuous expansion and upgrades of existing general hospitals, specialist centres and teaching hospitals.

These are in tandem with the 2025 Malaysia International Healthcare Megatrends initiative, which aims to position Malaysia as a regional leader in healthcare transformation and innovation. —May 5, 2025

Main image: World Health Expo