AS Malaysia transition to the endemic phase of COVID-19, the further relaxation of COVID-19 protocols that will take effect from May 1 augurs well in incentivising international travel.

CGS-CIMB Research views the latest development positively as it will remove many impediments that continue to discourage locals from travelling abroad despite the removal of quarantine-on-arrival requirements from April 1.

“For instance, travellers have been apprehensive about the cost of testing which can quickly add-up to a tidy sum for families travelling together, or perturbed about the possibility of being denied flight boarding and being stuck overseas should they test positive in the pre-departure test prior to returning to Malaysia,” observed analyst Raymond Yap in an aviation sector update.

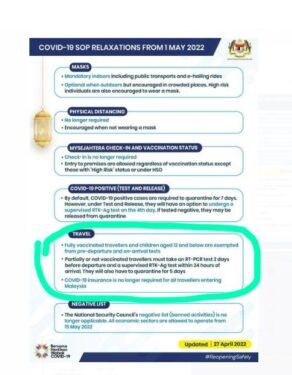

On Wednesday (April 27), the Health Ministry announced among others that effective May 1, (i) mask facial coverings will no longer be required in outdoor settings; (ii) pre-departure and on-arrival COVID-19 tests for fully-vaccinated air travellers will be abolished; and (iii) that COVID-19 insurance will no longer be required.

CGS-CIMB Research expects Malaysia Airports Holdings Bhd (MAHB) (“buy”; target price: RM7.60) to be key beneficiary of projected travel volume recovery.

“In March 2022, MAHB’s domestic pax traffic recovered to 59% of the March 2019 level but international traffic only recovered to 9.4%; we expect both to rise sharply from April onwards,” projected the research house. “We have pencilled in recovery to average 85% and 40% of the 2019 level respectively for FY2022F.”

Apart from benefiting from the re-opening of Malaysia’s borders since April 1, CGS-CIMB Research also expects MAHB to benefit from the planned start-up of a new airline called MYAirline in August and a potential new operating agreement in 2H 2022F.

On the contrary, the research house remained pessimistic about Capital A Bhd’s (formerly AirAsia Group Bhd) prospects.

“Despite the re-opening of Malaysia’s borders, Capital A’s airline may come under pressure from high fuel costs and price competition from incumbents and new entrants,” noted CGS-CIMB Research while reiterating its “reduce” rating with an unchanged target price of 19 sen.

Meanwhile PublicInvest Research is also wary of Capital A’s prospects despite its 1Q FY2022 operating statistics showing continued recoveries with passenger volume for the consolidated aircraft operating certificate (AOC) operations (Malaysia, Indonesia and the Philippines) increasing by 37.6% quarter-on-quarter to 3.7 million.

“While demand is expected to continue to improve, we remain wary over the Group’s PN17 (Practice Note 17) status and its ability to turn around its financial position within the next 12 months,” reckoned analyst Danny Oh.

“We maintain our earnings estimates and ‘neutral’ call on Capital A with an unchanged target price of 69 sen”. – April 29, 2022