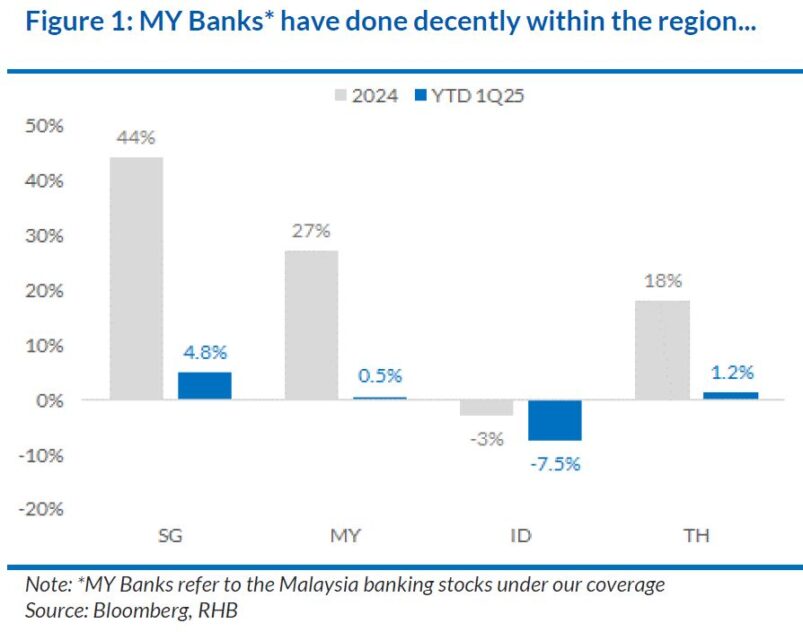

AMID geopolitical uncertainties and market volatility, the Malaysia banks under our coverage (MY Banks) have provided a shelter for investors, on their solid earnings delivery and attractive dividend yields, in RHB’s view. Such factors still underpin our sector thesis and weighting.

As expected, sector net profit dipped 3% quarter-on-quarter (QoQ) due to seasonal effects on net interest margin (NIM), non-Interest income and operating expenses, among others.

“Full-year sector earnings ticked up by a commendable 10%, powered by robust income growth, neutral JAWs, and moderating credit cost, a reflection of a general improvement in asset quality,” said RHB in the recent Malaysia Sector Update Report.

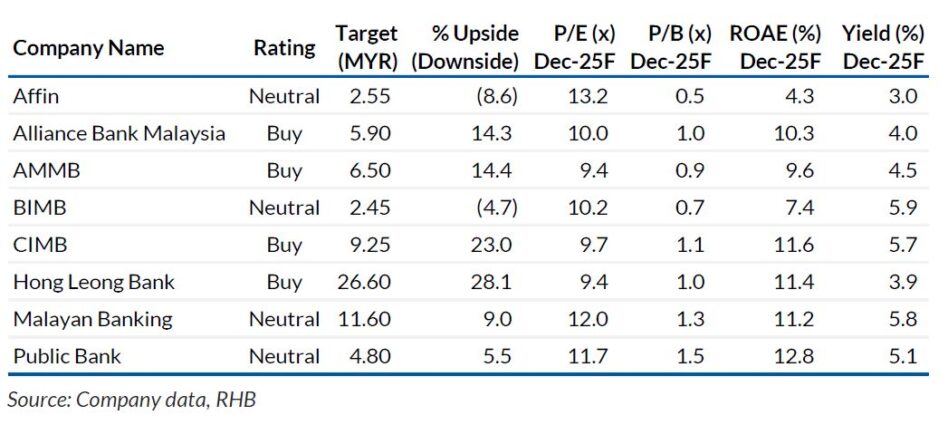

Of the eight banks RHB covered, six posted results that were within their forecast and consensus forecasts, while Affin and BIMB beat on stronger-than-expected net loan impairment writebacks in quarter four 2024 (4Q24).

“Also worth noting is Public Bank, which posted a core profit before tax that was 3% ahead of our numbers due to higher-than-expected overlay reversals, whereas its headline net profit was in line,” said RHB.

“Also worth noting is Public Bank, which posted a core profit before tax that was 3% ahead of our numbers due to higher-than-expected overlay reversals, whereas its headline net profit was in line,” said RHB.

Guidance for 2025 points towards a modest and stable year, as banks remain watchful over geopolitical developments. Domestically, a resilient Gross Domestic Product (GDP) and the ongoing execution of various development plans should be positive for loan demand.

“However, deposit growth continues to trail loan growth, and we will be keeping an eye out on whether deposit competition heats up to support the banks’ funding needs,” said RHB.

Banks with overseas operations were also wary of rate cuts and less favourable liquidity conditions putting potential pressure on NIM.

On asset quality, the banks continue to monitor any pockets of softness, although these appear confined to certain segments and portfolios.

On NIM, the banks maintained a cautious stance, especially with respect to potentially tightening liquidity domestically and overseas, guidance was mostly for flat-to-a-slight squeeze in NIM.

During the reporting season, AMMB toned its guidance down slightly to account for certain short-term, high-cost deposits that had entered its books.

Credit costs performed well in 2024, and banks are expecting some moderation back to more “normalised” levels in 2025.

While the banks maintain a watchful eye over certain potential hotspots, they have not noted any significant increase in systemic risk across the portfolios.

“So we would not be too surprised should credit costs once again come in below guidance,” said RHB. —Mar 10, 2025