NEGOTIATE not retaliate, that’s Malaysia’s official response to Trump tariffs, namely the “Reciprocal Tariff” of 24% on Malaysia which the country disagrees with.

The 24% reciprocal tariff on Malaysia is currently suspended for 90 days from 9 Apr 2025, thus the imposition of the minimum or baseline 10% reciprocal tariff for now.

The suspension is to allow time for negotiations between the US and its trading partners.

According to news reports, there are around 75 countries lining up to negotiate with the US with 15 countries already in active negotiations.

“Recent remarks by Stephen Miran, the Chair of President Trump’s Council of Economic Advisors is worth noting,” said Maybank in a recent report.

In essence, US trading partners should accept US tariffs, do not retaliate, and boost defense spending and procurement from US, that is to buy more US-made goods.

They should stop unfair and harmful trading practices by opening their markets and buying more from the US, and invest in, and install factories in the US. Also, zero or reduce tariffs on imports from the US.

This is a “natural” offer in negotiation with the US over all things trade and tariffs.

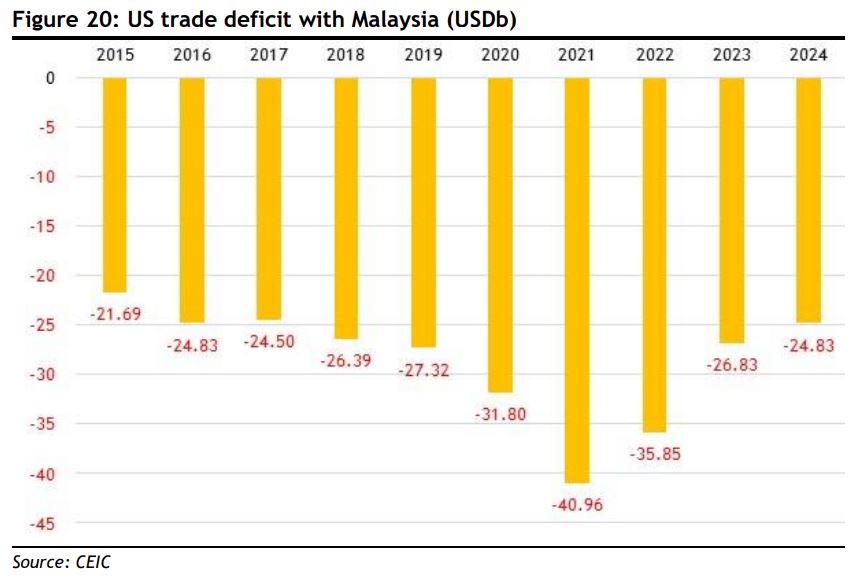

Malaysia could buy more US products via corporate capital expenditure and government procurements as a show of commitment to build on the progress of narrowing US trade deficit over the past few years.

Ideally this can, and should, come with a “win-win” outcome as per Malaysia Aviation Group’s orders of 30 Boeing 737 Max airplanes, with options for another 30, for Malaysia Airlines’ fleet modernisation.

“This is win-win in our view as Malaysia is also in Boeing’s global supply chain via Boeing Composites Manufacture (BCM),” said Maybank.

It is a wholly-owned subsidiary of Boeing Company, located in Bukit Kayu Hitam in the northern state of Kedah, plus furthering the national agenda of developing Aerospace industry as one of the high-growth, high-value sector as per the National Industrial Master Plan (NIMP) 2030.

In addition, Malaysia can offer to purchase more US defense products as the country is modernising and upgrading the armed forces with state-of-the-art equipment totaling MYR12 bil for this year alone, as per the Minister of Defence’s remark earlier this year.

Further, there is scope for Malaysia to undertake energy imports from US, especially natural gas given the recent statement by the Economy Minister that Malaysia needs to import more liquefied natural gas due to declining gas production especially in Peninsula Malaysia.

The National Gas Roadmap is being finalised and scheduled for release this year is aimed at boosting the domestic gas value chain, and this will also involve attracting new investments into the downstream gas industry, which should be of interest.

The government also provides incentives for local production, that is, three-year procurement contracts to companies that shift production of imported pharmaceutical products to Malaysia.

This is with the potential for a two year extension if those locally-produced products are exported.

Malaysia to participate in re-building US manufacturing? At the outset, many will wonder how Malaysia can take part in re-building US manufacturing, especially in terms of direct investment there.

US is not a key destination for Malaysia’s direct investment abroad although US is a key source of foreign direct investment into Malaysia.

“One possibility, and this is purely suggestive, even speculative on our part, is perhaps for Malaysia’s government-linked investment funds to look into investment opportunities in US manufacturing sector,” said Maybank.

This can be done via the real estate and infrastructure portfolio of their overseas investments, that is, co-investing with US or global partners in industrial real estate and infrastructure and manufacturing construction in the US.

To note, in the case of the Employees Provident Fund, its Global Investment Asset has much larger allocation for “Real Estate & Infrastructure” compared with Domestic Investment Asset.

At the same time, in the negotiation process with US, Malaysia will no doubt want to manage and mitigate the risk of “semiconductor” tariff.

To note, MITI highlighted that Malaysia will tighten the monitoring of semiconductors shipments to prevent the country being involved in the illicit flows of advanced/AI chips that are subjected to US exports restrictions/sanctions.

Malaysia is also proposing “technology safeguard pact” with US government, possibly as a “carve out” or “exclusion” from any US tariff on technology, electronics and semiconductor products produced in Malaysia and exported to US by the significant presence of US companies. —Apr 21, 2025

Main image: Reuters