MALAYSIA’s exports increased by 12.1% year-on-year (y/y) in August 2024, reaching RM129.2bil. This growth exceeded expectations of 11.7%, although it was slightly lower than July’s 20-month peak of 12.3%, primarily due to declines in mining exports.

Manufacturing exports rose by 14.1% y/y, driven by a 16.5% y/y increase in electrical and electronic products. Imports jumped by 26.1% y/y, outpacing market expectations of 21.2% and followed a 25.4% increase in July.

Marking the 10th consecutive month of growth, this was the fastest rise since October 2022, driven by strong domestic demand.

“On another note, Malaysia’s government securities closed mixed yesterday. There were gains on the front of the curve which was aided by the Ringgit rally, but the rest of the curve showed profit taking activity especially after the United States Treasury posted losses the day before,” said AM Bank Group (AMB) in the recent Daily Market Snapshot Report.

“We have the RM5.5bil reopening today, the size which is larger than expected around RM4.5-5bil,” said AMB.

Corporate bond trading was mixed, to go alongside the sideways MGS trading yesterday.

AMB noted investors opting to buy up select AA papers instead of the usual higher grade papers, which was encouraging as it shows underlying demand for credits remains healthy.

Notable trades include AA1 Genting Cap 06/27 at 4.34% (unch) and AA- Johor Port 10/27 at 3.77% (-26 basis points).

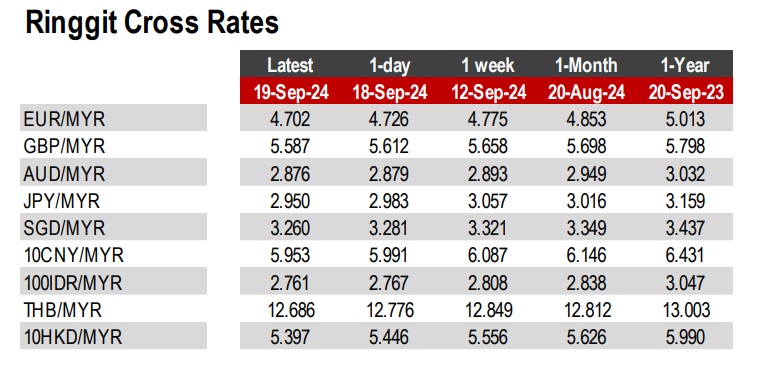

“On Thursday, ringgit gained further to 4.207, past our support range of 4.225-4.295 and around its highest level since June 2022, which effectively erased losses incurred when the Fed started its rate hike cycle. Our new support level is now pinned at around 4.173 – 4.187,” said AMB. – Sept 20, 2024

Main image: malaymail