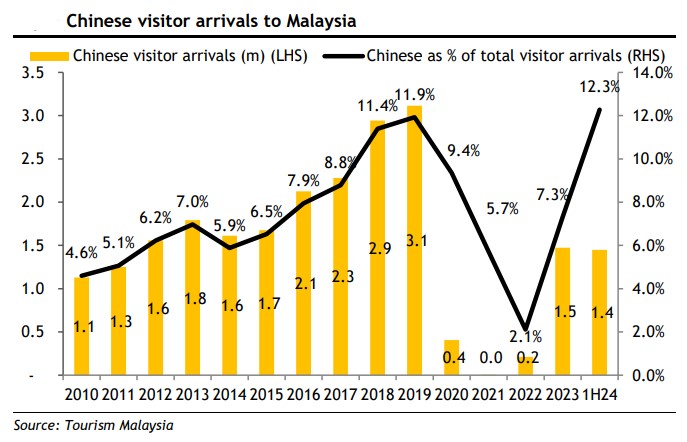

SUCH is the excitement shared by Maybank IB Research whose channel checks revealed that the recent summer holidays saw Chinese visitor arrivals exceeded even pre-COVID levels.

This has led to the research house expecting Chinese visitor arrivals in 2025 to surge to 5 million (60% more than 2019) while Chinese tourism expenditure may also surge to above RM30 bil (twice that of 2019).

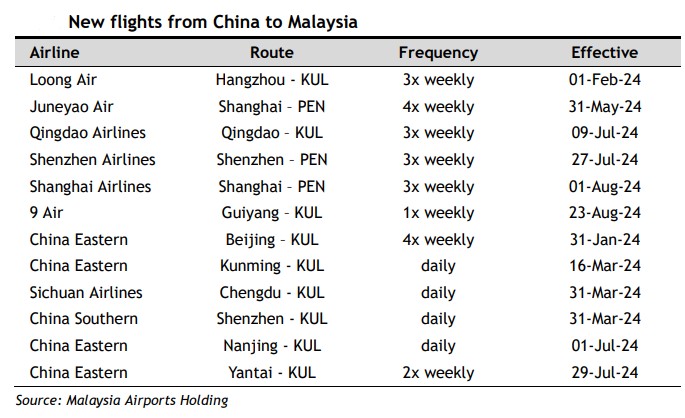

Deeming Malaysia as a “big winner in the Chinese tourism race”, Maybank IB Research observed that most of the growth in seat capacity from China to Malaysia was driven by Chinese carriers instead of Malaysian ones.

“Annualising September 2024 seat capacity from China to Malaysia of 419,153 and assuming 80% load factor, we gather that Malaysia may welcome 4 million Chinese visitors by air in 2025,” projected analyst Yin Shao Yang in a thematic review.

“Coupled with the 1.1 million Chinese visitors who entered Malaysia from Singapore by land in 2019, we believe it is probable that Chinese visitor arrivals to Malaysia could hit 5 million in 2025. Curiously, Tourism Malaysia is (also) targeting 5 million.”

As Chinese visitor arrivals to Malaysia could be lower this year (8M 2024: 2.3 million), the research house said if its projection were to materialise, Malaysia may welcome a whopping 60% more Chinese visitors in 2025 than it did in 2019 (Fig. 6).

As it is, Maybank IB Research further observed that Chinese visitors to Malaysia are already spending more vis-à-vis pre-COVID times. In 2H 2024, the average tourism expenditure per Chinese visitor was 27% higher than in 2019.

“Coupled with the potentially 60% more Chinese visitors in 2025, Chinese tourism expenditure in Malaysia could double to >RM30 bil in 2025 vis-à-vis 2019,” reckoned the research house.

Notable listed companies with quantifiable exposure to Chinese tourism, according to Maybank IB Research, are Genting Malaysia Bhd (GENM) (4% of 2019 visitor arrivals) and Genting Bhd viz GENM and Genting Singapore Ltd (20-%30% of 2019 gross gaming revenue).

Also deemed as potential beneficiaries include Capital A Bhd (14% of 2019 available seat kilometres) and AirAsia X Bhd (25% of 2019 available seat kilometres). Other listed companies but with non-quantifiable exposure to Chinese tourism are KLCC Property Holdings Bhd and Pavilion REIT. – Oct 18, 2024