THE International Monetary Fund (IMF) has warned of China’s overcapacity in its manufacturing sector amid improved economic outlook.

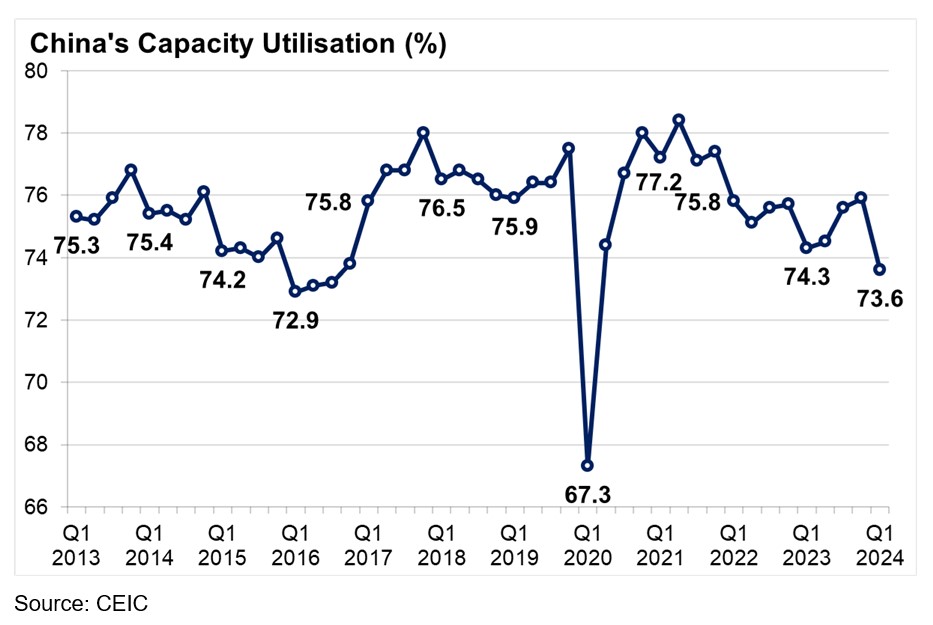

Ever have that feeling of déjà vu? China’s previous episode of overcapacity was last seen in 2014-2016. The recurrence of overcapacity problem in recent years was due to the imbalances in supply and demand aggravated by the COVID-19 global pandemic.

Chinese companies are producing far more than domestic consumption can absorb, resulting in domestic surplus with low factory utilisation rates.

Low-capacity utilisation rates were observed in machinery, food, textiles, chemicals and pharmaceuticals. The downturn in property sector further impacted the demand of downstream products such as furniture, iron/steel products and plastic as well as non-metallic minerals.

Massive investment and production in new emerging industries such as electric vehicles (EVs), and clean technology also resulted in domestic surplus.

Protectionism against Chinese goods which is usually the trade affairs of advanced economies is now spreading to some countries in Asia.

Citing China’s unfair trade practices regarding technology transfer, intellectual property and innovation, the US has increased tariffs ranging from 25% to 100% across strategic sectors such as steel and aluminum, semiconductors, batteries, battery components and parts, solar cells, rubber medical and surgical gloves in 2024-2025.

Additionally, the European Commission (EC) has imposed provisional duties on Chinese electric cars up to 37.6%.

ASEAN’S reaction

Surging Chinese goods are also exerting impact on her ASEAN trading partners. The Federation of Thai SMEs wants its Commerce Ministry to review import tax rate and also impose a value-added tax on imported Chinese products to protect Thai manufacturers from the flooding of cheap Chinese goods.

It also requests the Board of Investment to review the privileges granted to Chinese companies whose investments do not really benefit Thailand and Thai SMEs.

Indonesia will soon impose import tariffs ranging between 100% and 200% on Chinese goods to mitigate effects of the on-going trade war between China and the US.

A regulation is being drafted to address concerns raised by stakeholders about the inadequacies of earlier regulations regarding protecting local industries from the influx of Chinese-made products.

Back home, Malaysian domestic businesses, especially SMEs, have expressed concerns about the impact of Chinese businesses in low value and tech goods, retail, trading services and restaurants as well as sub-contracting of construction and property development.

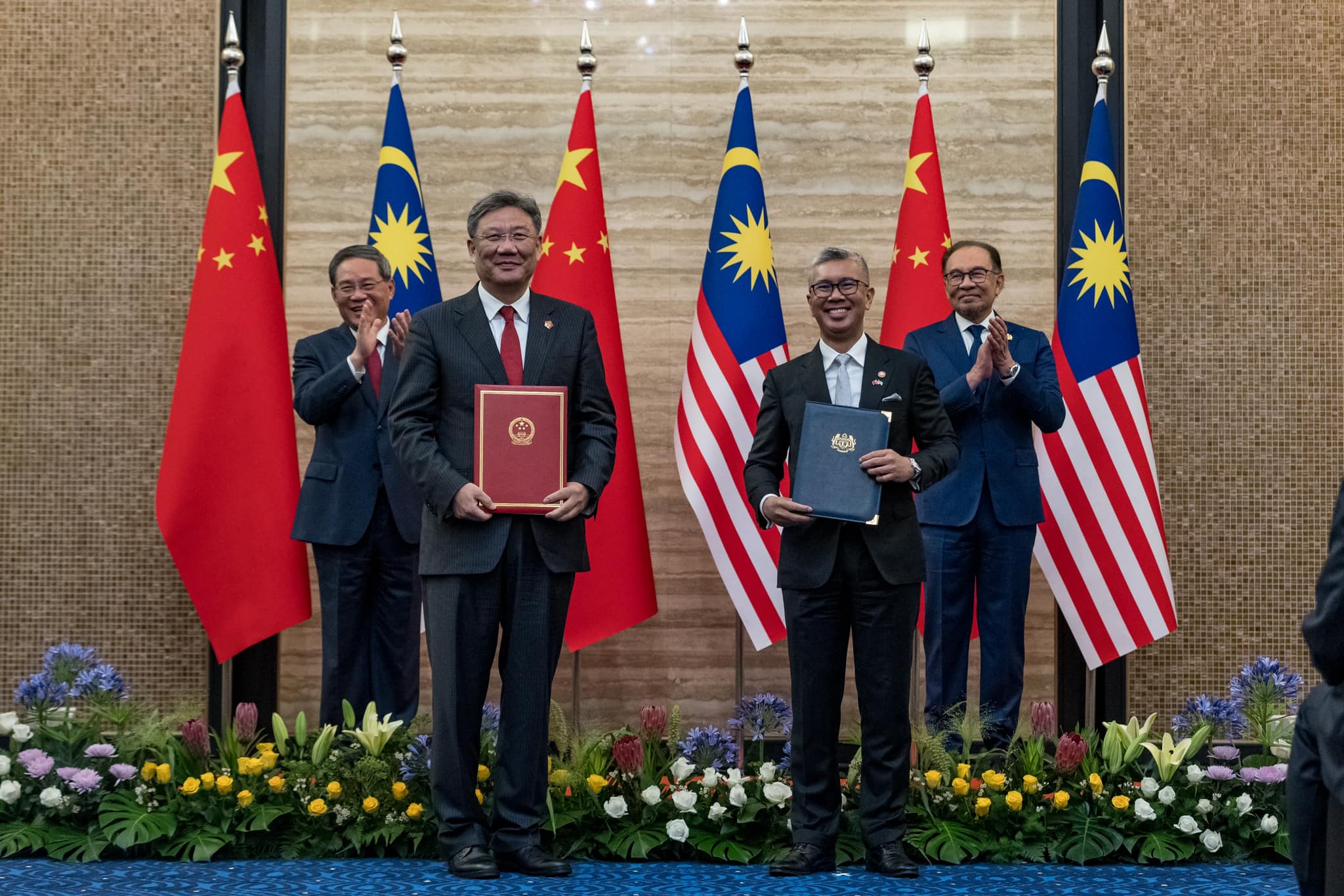

China has been Malaysia’s largest trading partner of Malaysia for 15 consecutive years since 2009, boasting a 17.1% market share of Malaysia’s total external trade in 2023.

Malaysia has incurred a widening trade deficit with China for 12 consecutive years (an average of RM33.1 bil per year) since 2012.

Since 1980, China’s accumulated realised investments in the manufacturing sector amounted to RM74.2 bil as of December 2023. Malaysia has nevertheless indirectly benefited from China+1 strategy and the US-China trade war due to the re-location and re-configuration of supply chains in the semiconductor industry, rubber products, solar panels, LNG, plastics, petroleum and palm oil.

China enterprises and businesses (either wholly-owned or joint-ventures with Malaysians) are investing and doing business in a variety of sectors such as manufacturing, information technology, construction, education, restaurants, eateries, cafes, and milk tea shops.

Flexing financial muscles

The debate over the impact of Chinese investment and companies on domestic businesses and investors is highly contentious, complex and has become politically charged.

The investment and businesses opportunities generated by China comes with competition challenges faced by Malaysian MSMEs (micro small medium enterprises) in the domestic market.

Given China’s technological advancement which also supports its quest towards high technology industries and renewable energy for net zero emission, Malaysia welcomes high value creation investments from China that can contribute to the development of its high technology, green, AI, digitalisation and EVs industries as well as smart agriculture and food processing for food security.

The debate over the competition inflicted on local firms comes from a “competitive pricing and low unit cost structure” of Chinese traders, wholesalers, retailers, suppliers and contractors as well as builders in sectors that they are participating in.

Chinese firms’ competitive edge rest on their balance sheet capacity to take on many business ventures and opportunities, and in some cases, Chinese contractors can take on multiple and large projects. Chinese firms have financial muscle.

How then can Asian policymakers navigate the challenges of protecting their domestic manufacturing and services sectors?

There is no doubt that China’s outward investments in regional countries, including shifted production abroad have generated various benefits such as employment, knowledge and technology transfer, industrial and infrastructure development.

However, there is a question of how much net impact of these Chinese investments on domestic industries, especially SMEs in low-tech and low-priced consumer goods via e-commerce platforms and domestic businesses are found to be not cost competitive. Some have claimed that the investment may be driven more by political rather than economic factors.

Potential solutions

Below are six policy options that are capable of managing the impact of China’s overcapacity while protecting domestic industries and encouraging domestic production as well as the utilisation of local raw materials.

- Erection of tariff barriers on imported Chinese products: But this would lead to retaliation, having inflationary effect on consumers, besides not in conformity of free trade practices as China and ASEAN member countries are signatories of multi-lateral trade agreements such as the ASEAN and China Free Trade Agreement (ACFTA) and the Regional Comprehensive Economic Partnership (RCEP).

Moreover, it requires cost and efforts to conduct formal anti-dumping investigations and the use of countervailing duties (CVDs).

- Employing local content requirements (LCRs): This is an ideal way to promote domestic industry and employment or encourage domestic innovation. It could also bring about a win-win solution by ensuring that Chinese firms provide opportunities to local SMEs for manufacturing activities, supply chain integration and downstream services.

- Striking balance between economic and geopolitical priorities: While Chinese high-tech industries such as semiconductor, automation, artificial intelligence (AI) and digitalisation as well as EVs are needed to help support high-value tech-up industrial development, low-tech industries and products that domestic SMEs are capable to manufacture should be discouraged.

- Review a Negative List which “prohibits” or “restricts” certain industries for foreign investment purposes: Other measures include a review of capital requirements and licensing requirements for foreign firms entering into or expanding in economic sectors such as trading, retail and selected services. Limit the number of foreign firms’ producing goods that can be sold in domestic market or ensure that the products must be 100% for export.

- Promoting import substitutions policy: This is to reduce over-reliance on Chinese imported intermediate and final goods through fiscal incentives and local content expenses deductions. Switching towards domestic sourcing encourages the growth of domestically produced intermediate and capital goods.

- Continue to forge smart partnerships between domestic and Chinese enterprises: The ultimate aim of this initiative is to achieve a win-win business cooperation for the sharing of economic prosperity. – July 15, 2024

Lee Heng Guie is the executive director at Socio-Economic Research Centre (SERC) Malaysia.

The views expressed are solely of the author and do not necessarily reflect those of Focus Malaysia.

Main image credit: Anwar Ibrahim/Facebook