“EXPECT more economic fluidity and market volatility under Donald Trump’s presidency given his rather confrontational “shoot from the hip” style.”

Such is the market view of Hong Leong Investment Bank (HLIB) Research which nevertheless reckoned that “this isn’t entirely a bad thing” given that Malaysia did benefit from the on-going US-China trade war.

“However, the key risk this time around is if he drags the entire world into it as well with his proposed blanket 10%-20% tariff – US was Malaysia’s third largest export destination in 2023 at 11.3%,” cautioned the research house in a strategy note on Trump’s return to the White House for the second time ss the 47th US president.

“Our investment themes on tourism recovery, energy transition, Johor’s developmental re-invigoration and disposable income boosting measures would fairly insulate the US election outcome – while trade war beneficiaries could see revived interest.”

For now, HLIB Research has maintained its end-2024 FBM KLCI target at 1,700 based on 15.5 times price-to-earnings ratio (PE) on CY2024’s earnings per share (EPS).

Elaborating on the subject of trade diversion, the research house recalled that when Trump implemented his barrage of tariffs on Chinese goods during his first presidency (2017-2021), US imports from Malaysia grew at an annual CAGR (compound annual growth rate) of 3.7% during that period while their purchases from China declined at an annual pace of -2.6%.

“The trade diversion benefitting Malaysia is more apparent from the China side. From 2017 to 2023, China’s imports from Malaysia grew at a commendable CAGR of 11.2% vs 5.6% from the world and 1.2% from US.

“From a trade diversion angle (alongside near-term ringgit weakness), we believe that selected export driven sectors in Malaysia would benefit.”

Ringgit to take a beating

The beneficiaries include (i) furniture (US clamping down on “masked” Chinese furniture); (ii) gloves (recent acceleration of tariff hike on China from 7.5% to 50% (2025) and 100% (2026); and (iii) technology (higher tariffs on China’s semiconductors (25% to 50% in 2025) as well as steel & aluminium products (0%-7.5% to 25% this year).

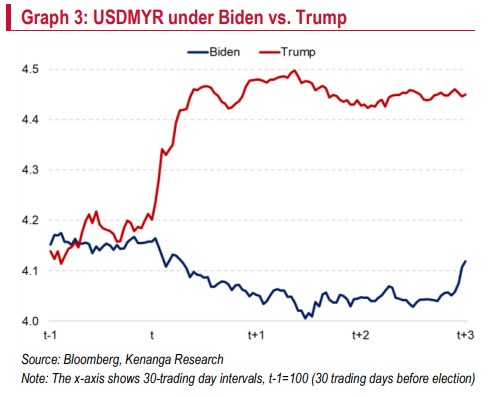

Trade and stock market aside, Kenanga Research expects the second Trump term to likely enhance the strength of greenback as the US Federal Reserve is expected to respond cautiously by limiting rate cuts due to the fiscal expansion that Trump would likely pursue.

“With national debt anticipated to rise by over US$7.75 tril by 2035, pressure for a higher US term premium would likely push the DXY (US Dollar Index) up,” projected the research house.

“For Malaysia, this could see the ringgit depreciate to around RM4.57/US$ by end-2024 with potential recovery to RM4.45/US$ in 2025 if market tensions ease.

“US dollar strength would also reflect heightened investor demand for US assets amid global uncertainty, potentially weighing on emerging market currencies as capital flows to the safe-haven greenback.”

Although many of Trump policies may only be enacted by 2H 2025, Kenanga Research expects markets to respond pre-emptively by positioning early for anticipated impacts on trade, fiscal expansion and interest rates.

“Note that, even with a clean Republican sweep, fiscal hawks could oppose unchecked spending, potentially complicating Trump’s agenda,” opined the research house.

“Nonetheless, investors may brace for rising yields and global capital shifts which set the stage for potential volatility across assets as market adjusts to the likelihood of a more assertive fiscal direction.” – Nov 7, 2024